Insurance firms and satellite operators still face challenges to keep both parties happy.

Insurers and risk experts of the space market convened this week on the second day of the Space-Comm Expo in London to talk seriously about better understanding a widely untapped market as part of the Space Insurance Symposium.

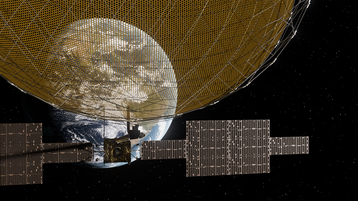

There are thousands of satellites in orbit today, but only hundreds of them are insured. The number of satellites launching every year is booming; yet most are now too small to warrant insurance, while the value of the largest machines is on par with what the entire insurance market can afford. Recent years have seen losses mount for insurers amid a number of high-profile satellite failures, increasing costs for the few operators who want or can get cover.

A stubborn market

“Let’s stop thinking about insurance as an afterthought, and instead as the infrastructure behind space going forward,” said Joseph Ziolkowski, co-founder and CEO of RELM, opening the symposium. RELM is an insurer specializing in risks in cyber attacks and space operations, both of which uniquely target satellites.

Several major banks and insurance groups have had difficulty quantifying the risks involved in the space industry beyond launch, which is one of the simplest products, being both transparent to assessors prior to liftoff and the moment at which satellites are most at risk. The majority of satellite loss occurs at launch or during orbital insertion as key systems come online – or don’t, as the case may be.

“With space markets normalizing, we’re seeing more specialists like [Seraphim] prepared to engage with space, as traditional companies have trouble doing,” said Alexander Holt, managing director at Seraphim Space Enterprise.

Another provider in attendance was Atrium Space Insurance Consortium, a band of eight Lloyd’s of London insurance syndicates underwriting launch and in-orbit risks.

“We need lots of underwriting information,” David Wade, space underwriter at Atrium Space Insurance Consortium. “We cannot rely on pure statistics for space insurance. Out of the 10,000 active satellites in orbit today, 300 are insured, 250 in geosynchronous orbits, 50 in low-Earth orbit. We’re always looking for flight heritage, but based on the lack of numbers we have to rely on an engineering-led approach for assurance.”

Presently around 30 insurance providers offer policies covering space assets, with only $420 million of capacity available. While this has worked well enough for launches, more complex risks, and more importantly human spaceflight risks, are challenging to insure for.

This difficulty in securing insurance is especially true of smaller operators.

“The common refrain I hear is that smaller operators do want insurers, but they need the insurance market to meet them in the middle,” said Dave Pearah, CEO of SpiderOak, a cybersecurity provider specializing in protecting Edge operations. “Startups with simple remits like Earth Observation and nature monitoring can’t find insurers who can find the time for them. Whether that’s because the profit margin isn’t enough, or the risk is too high, I couldn’t say, but it’s a real obstacle for innovation that these disruptors can’t find insurance safeguards.”

Multiplying risks

While issues defining insurance products persevere, our understanding of the risks to satellites are expanding too.

In February of 2022, SpaceX saw the loss of 40 satellites to a geomagnetic storm, the same loss scientists predict occurring of solar flares and gradual damage to flimsier satellites due to chronic exposure to cosmic radiation.

This is to say nothing of debris effects, the breach of environmental law following Earth atmospheric pollution as a result of destructive re-entry, or the compromise of satellites via cyber-attack, a capability long thought to be dominated by Russian and Chinese cells of state-backed prodigious hackers.

“In space and other Edge economies, their cyber approach is a joke,” said SpiderOak’s Pearah. “At best, they may be encrypting the link. There’s a lot of old tech in Newspace. We see 20-year-old chips and out-of-date and unsupported operating systems. In space, there’s either nothing done in cyber, or will do minor box-ticking, which leaves the door wide open to risk.”

The cyber insurance market has uncertainties of its own, many of which are addressed by the assurances of experts who can extensively examine and alter systems personally, a contingency that becomes all but impossible once such a system is placed into orbit where it remains inaccessible for years, sometimes decades.

Flashback

It has been two years since Viasat-3’s reflector deployment incident during launch insertion, which led to its $420 million claim against the loss, the greatest in history, and the crowning obstacle that has led to many groups reassessing their appetite for satellite coverage.

It was one of 16 insurance claim events that year, two of which added up to $950m, against $600m in premiums brought in.

“This line of insurance is naturally volatile and as a result, some companies have already pulled out of the business, Chris Kundstadler said in 2023, then the global head of space at insurance company AXA XL. “Still more are reducing the capital they’re providing to this market. When availability of capital in the insurance market decreases, prices go up. Higher prices mean we see more differentiation of risks. New space technologies will see more of an increase in insurance premiums than established technologies and operators.”

Traditionally, high-value and long-lived geosynchronous satellites have been insured, and not the heavily proliferated LEO satellites in 1000-strong constellations. Very few of these satellites are insured, since the sheer volume of satellites is a contingency in and of itself. By fronting the costs for more satellites than are needed, constellations can keep running in the face of individual nodes break.

Read the orginal article: https://www.datacenterdynamics.com/en/news/further-market-uncertainty-predicted-for-satellite-coverage-policies/