Journalists go into listicle overdrive this time of year — and I’m powerless to resist adding a few of my own.

Sifted has tracked over 5,000 fundraises in Europe in 2024 and, for my money, these are the strangest companies — the ‘wait, this is something you can get VC money for??’ category — to receive backing.

And as bonus material, I’ve listed the best startup names and most over-used tech-speak of 2024.

Weirdest deals

5) Valpas, Finland

VC-backed pest tech is a new one for me. Valpas raised €4m this year for its “smart bed legs” which attract and capture bed bugs. The company has also developed an app that alerts users — hotels, mainly — to the potential arrival of these itchy intruders. My friend recently had bed bugs and instead of steadily losing his mind — he chucked a lot of his possessions out on the street — he could’ve been using an app to solve the problem (silly man!).

4) Loop Biotech, the Netherlands

This Dutch company raised €2m in April for what it claims is the world’s first “living coffin”, which is made of mushrooms that naturally degrade, freeing corpses to decompose in the soil more quickly. “You’re withholding your nutrients from the environment,” if you (selfishly!) opt for a wooden coffin after you die, the cofounder told Sifted. Best of all is the company’s gift shop where you can buy a tote bag that reads: “I am a lovely bag of compost.”

3) Depet, Spain

The company — which organises funerals for pets, including wakes and cremations — raised €5m in October from investors Garós Partners, Transition Capital and private equity firm Actyus. Deals like this are transforming pet care and not everyone welcomes what an investor influx means for vet bills.

2) Smell Made Digital, UK

The startup raised $2.2m in August for its “digital smell solutions”, which is the kind of thing you read just before saying “okay that’s enough internet for today”. The company has academic heft behind it, including a CEO with a PhD in the “Psychology of Smell Perception”, and wants to improve sleep quality through “curated scents”. Here’s the digital bit: all these smells will be logged in a “scent database”.

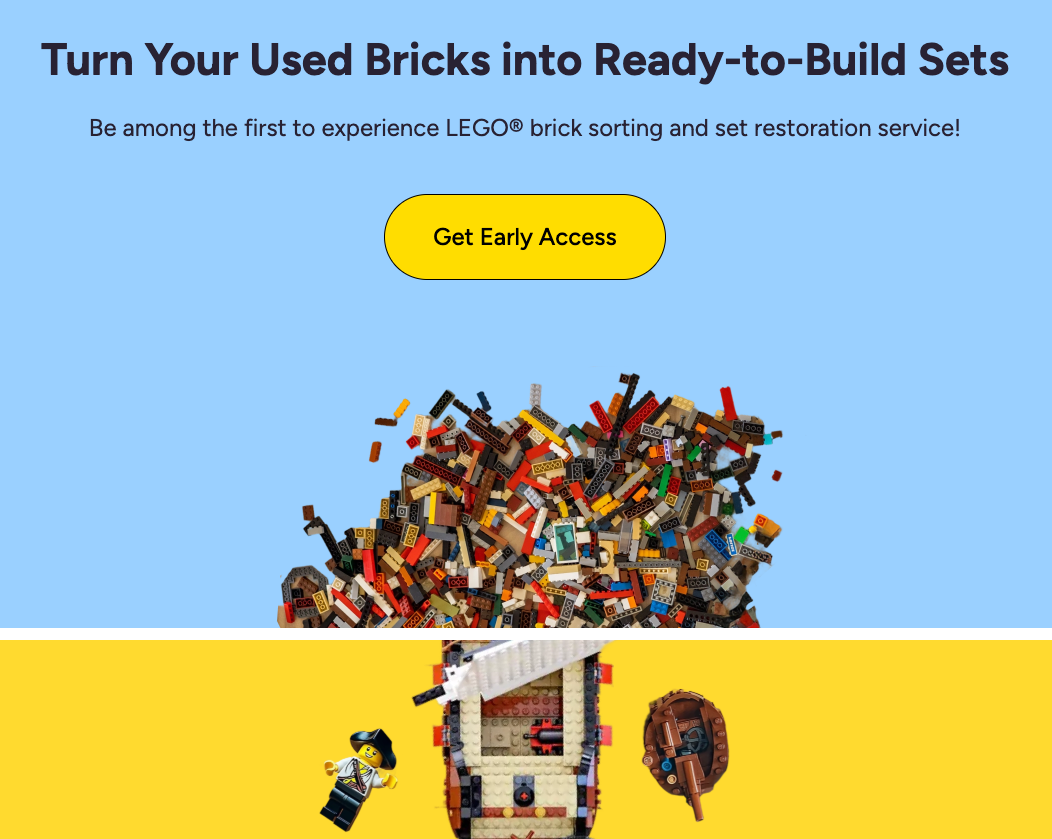

1) Sort A Brick, Lithuania

The weird deals crown goes to a Lithuanian startup, which raised €1.15m in October “to expand its AI-powered Lego sorting service”. Its what, now? The company cleans, sorts, and repackages old Lego bricks to reduce waste. So it’s a circular economy concept — which is nice — but I’m surprised this needs to be so hi-tech. “We are simultaneously developing computer vision models and optical systems that will work together to deliver precise brick recognition,” the company’s cofounder explains. Fine, if that’s what they want to do, I’m not going to get in their way. And I do like Lego.

Honourable mention

Resting Reef, UK

This company, which plans to raise early next year, deserves recognition for its memorial service that turns pet ashes into ocean reefs in Bali.

Most over-used tech jargon

You do see repetitions — you might even say insecurities — in the tech world, whether it’s companies calling their product “pioneering”, even if it’s not, or adding “.ai” to the end of the company name (even if they’re not really all that AI-y).

Some over-played tech-talk this year:

5) The IPO window is shut — Someone open that thing and air the place out.

4) It’s time to build — I know this coinage is years old but it remains prevalent on LinkedIn.

3) AI native/AI-first/AI-enabled — or “companies designed with AI at their core.” These get an automatic eyeroll from me. Mildest here is AI-enabled. AI native is a bit naff.

2) AI agents/co-pilots/assistants — I don’t doubt some of these tools are good and useful timesavers. But I also don’t think many are so clever that they’ve become sidekicks capable of doing your work for you. There’s too much chatbot dressing-up. If Microsoft’s Clippy — aka ChatGPT’s great great grandfather — were around today, he/she/they would inevitably be hailed as “a powerful AI agent”.

1) AI-powered — What else could be number one? “Leveraging AI” has become a favourite pastime of so many companies. Everything is AI-powered now (your gran is AI-powered).

2024’s best startup names

Finally, the best names I’ve encountered this year. Kudos to Lithuania, which also wins this category.

5) Willy Anti-Gaspi, Paris — mouthful.

4) Donkey Republic, Copenhagen — you probably couldn’t guess what this company does.

3) Meet my mama, Paris — lovely.

2) Eyeball.Club, Prague — chilling.

1) Broswarm, Vilnius — a new collective noun for crypto conference attendees?

Read the orginal article: https://sifted.eu/articles/weirdest-vc-deals-2025/