European tech is at the best of times a rollercoaster, and the data for 2024 doesn’t say otherwise.

For the first time, Sifted has a full year of funding data at its fingertips, so it’s only right that we share the best bits as we approach the end of the year. Hold on to your hats, folks — it was a bumpy ride in H2.

The data in this article only includes deals completed by December 3, 2024, as per Sifted’s H2 2024 report.

A year of two halves

The ecosystem was in a much better place at the end of H1 following a difficult 18-month period referred to around the industry as the “VC slowdown”.

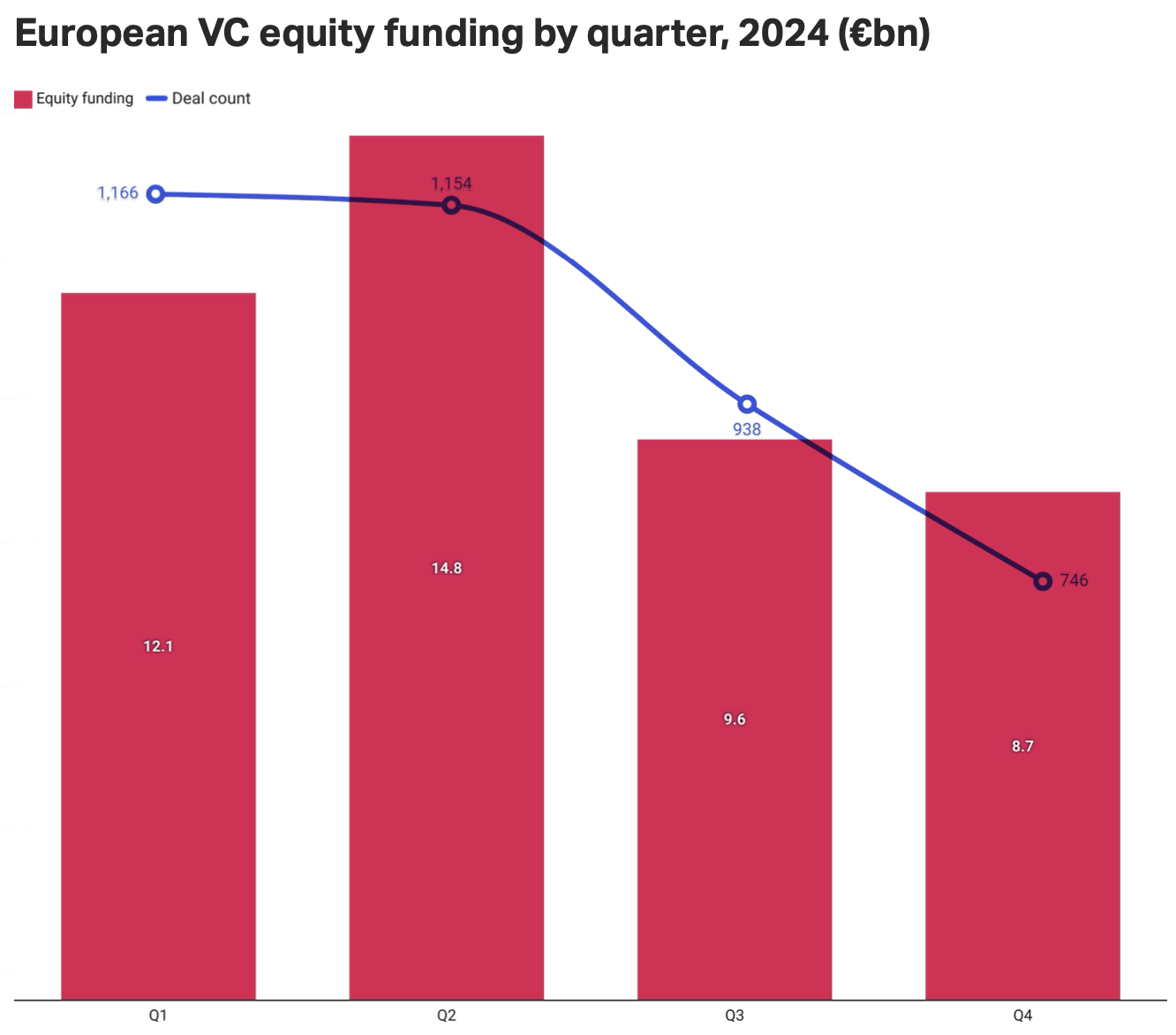

In H1, €49.9bn was injected — including debt and grants — into Europe’s startups across 3,118 deals. Six months on, the comparable figure was a mere €22.4bn — a 55% drop — and the number of deals (2,221) completed was the lowest reported since H2 2012. Solely looking at equity funding, the decrease was 32%.

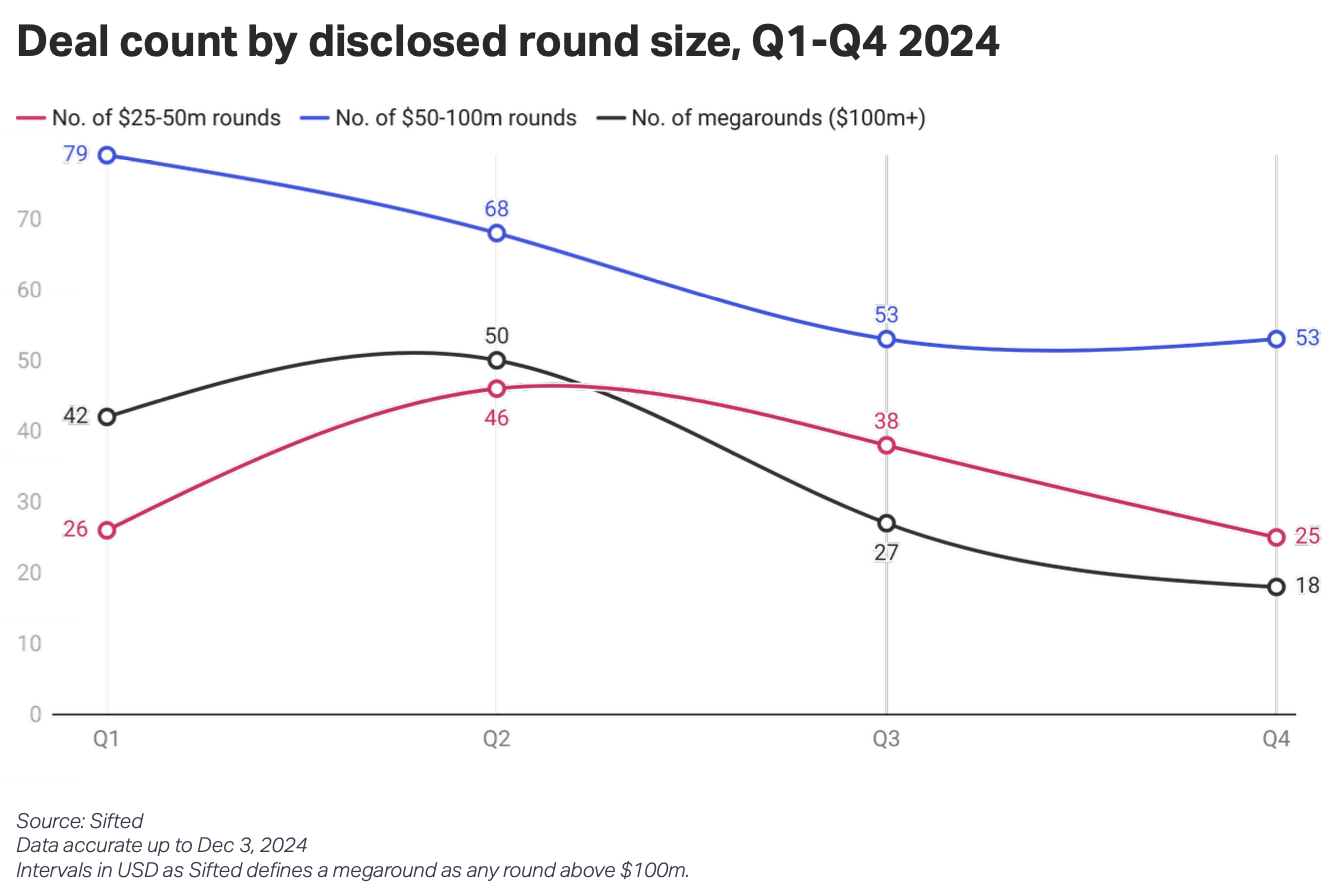

48 megarounds of $100m+ were announced in H2 compared to a resurgence (94) in H1, and late-stage capital dropped by 56%. The unicorn count only marginally fell from 7 to 6; yet the 13 across the year beating the 10 minted last year feels like a small victory.

VCs seemed to change tact in the second half of the year. 29% fewer startups received investment and equity funding was down by 32%, but median deal sizes at most round types actually rose. The median pre-seed grew 15.7% to €870k, while seed (+0.9%), Series A (+1.5%) and C (+4.3%) saw modest increases.

Might the ‘flight to quality’ be a good thing for the industry?

Germany beats France for the first time since 2021

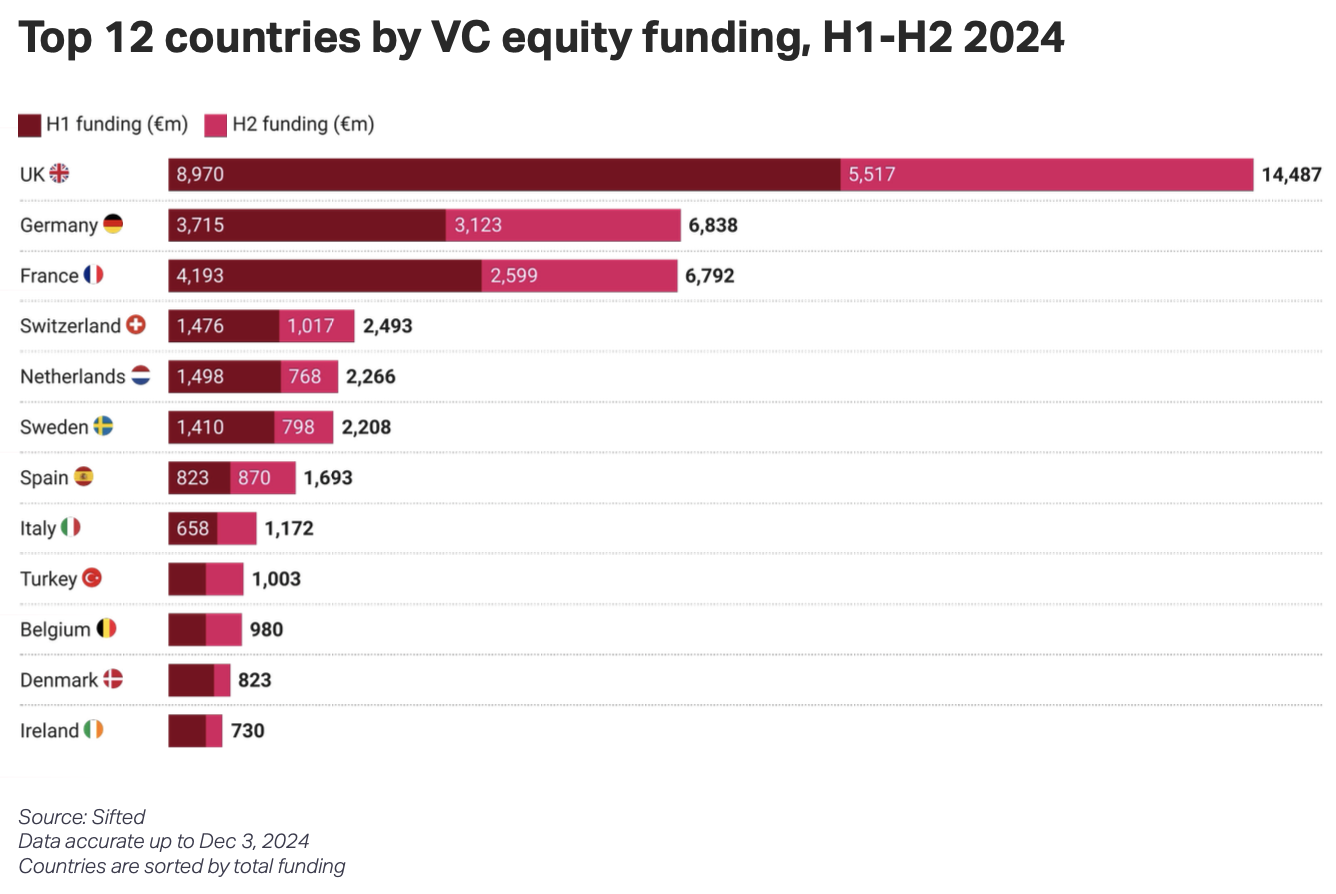

It’s no surprise to see the UK top this list but there was far more intrigue in the fight for second place. In the heavyweight matchup Germany narrowly edged France this year for the first time since 2021.

France had an incredibly quiet July and August — distracted by political instability and the Olympics — during which only 38 funding rounds were announced, amounting to just €248m. Germany in comparison brought in £1.4bn from 71 deals.

Germany had such a stable year (the state of its government and economy might say otherwise) that its average and median deal sizes were higher than UK’s (and anyone else for that matter among other countries with 10+ rounds) despite its biggest round being less than half the size. Autonomous driving company Wayve’s $1.05bn Series C from SoftBank, Microsoft and Nvidia — Europe’s biggest equity funding round and a landmark moment for UK tech — trumped Germany’s best offering: Munich-based defence tech startup Helsing’s €450m Series C in July led by General Catalyst.

Of the leading 12 countries for funding, only Spain received more investment in H2 than H1 — an increase of 6% from €823m to €870m, enough to place it fourth ahead of the Netherlands (€768m) and Sweden, which were the worst affected by the H2 cooldown; funding in those two countries dropped 49% and 43% respectively.

Finland bucked the trend of Nordic struggles in H2 — the region saw funding drop by 42% — and ended up being one of only a handful of countries with a year-on-year increase in investment. Belgium was another of these countries, becoming a hub for drug discovery startups. Mol-based Pantera’s €93m was the second biggest Series A this year. Belgium also minted its third unicorn and its first since 2022 following Team.blue’s secondary sale in July, which valued the Ghent-based app developer at €4.8bn.

Capital city ≠ leading tech hub

2024 was a breakout year for Munich. The city established itself as a top European hub for deeptech — so much so that Bavarian minister president Markus Söder branded it as the “California of Europe”.

Alongside Helsing, 2024 sports tech unicorn EGYM, HR tech unicorn Personio, mobility company Flix and process-mining scaleup Celonis — Germany’s most valuable startup ($13bn) — call the city home. They of course pale in size to local giants Siemens, BMW, SAP and Allianz, whose deep pockets provide a ready customer base for young companies. The city’s famous Technical University of Munich continues to churn out talent, and topped the Financial Times’s ranking of leading European startup hubs in March.

One of its spinouts, Orbem, a profitable deeptech startup developing accessible and fast AI-powered imaging solutions, finished second on the Sifted 75: Germany Leaderboard of the country’s fastest-growing startups, behind another Munich company — Finn, which offers an all-inclusive, monthly vehicle subscription service.

Munich and Berlin were neck-and-neck for equity funding this year: just €83.9m split the two as of December 3 (Berlin leads right now). Deal activity was 42% higher in the German capital — historically more startups have set up shop there — but it trailed Munich by average deal size. Munich had an average deal size of €24.2m, compared to €13.5m in Berlin. London recorded €17.1m and Paris €17.3m.

Over in Spain, however, there’s no doubt which city is the leading tech hub. Madrid only mustered €377m from 78 deals over the year, which left it outside the top 15 cities in Europe (as seen in the chart) while Barcelona brought in €983m from 116 rounds. You have to go as low as #24 on the Sifted 50: Southern Europe Leaderboard of fastest-growing startups by compound annual revenue growth (CAGR) to find the first Madrid startup — neobank Myinvestor — whereas the top-ranked company was from Barcelona: beauty tech startup Olistic.

Climate tech clings on to top spot despite a rockier H2

Climate tech was the most funded vertical in 2024 but it didn’t have all its own way this year. In H1, €7.4bn was invested, but six months on the figure was 47% lower at €3.9bn — totalling €11.3bn up to December 3. Both B2B SaaS (€4.9bn) and healthtech (€4bn) received more funding in H2.

Sifted tracked 1,013 funding rounds in climate tech, second to B2B SaaS’s 1,414. Investors spread their capital more evenly too — the median deal size was €3.7m, the highest of any vertical.

There was only one climate tech round in the top 10 biggest deals: Parisian EV-charging startup Electra’s €304m Series B led by Dutch pension fund PGGM. Not far behind was Stockholm-based steel maker Stegra’s €300m (ranked 11th) from investors including Microsoft Climate Innovation Fund, Mubea and Siemens Financial Services, alongside its €4.2bn debt funding. Both deals were announced in January.

Debt financing had a record half in H1; then the cheque books disappeared

Europe’s climate tech startups actually raised more in debt than equity this year.

In total, €25.2bn was disclosed in debt funding over the past 12 months and a whopping €16.5bn of that went to climate techs. Eight of the ten biggest sums raised by European startups in 2024 were debt-based, headlined by Swedish battery maker Northvolt, which raised a $5bn loan amidst the climate tech funding frenzy in January, before announcing Chapter 11 bankruptcy in November.

UK growth and late-stage fintechs were also popular with banks — European and international — and investment firms, receiving €4.6bn of the €6.6bn (70%) in debt financing across the vertical. Payments unicorn SumUp raised the most with a €1.5bn package led by Goldman Sachs.

In July, Sifted predicted that debt was on for a record year based on the H1 results. Debt funding hit €22.1bn — smashing the record for most raised in a half — and looked to be comfortably on course to surpass the 2022 record of €28.1bn, according to PitchBook.

It’s no coincidence that Northvolt’s troubles coincide with debt funding becoming scarce. €4bn was loaned in H2, leaving Europe just short of the record at €26.1bn. Investors haven’t been completely spooked — deal count only dropped by 37% — but are acting more conservatively around riskier bets.

Secondaries provide an alternative route to liquidity for an ailing exit landscape

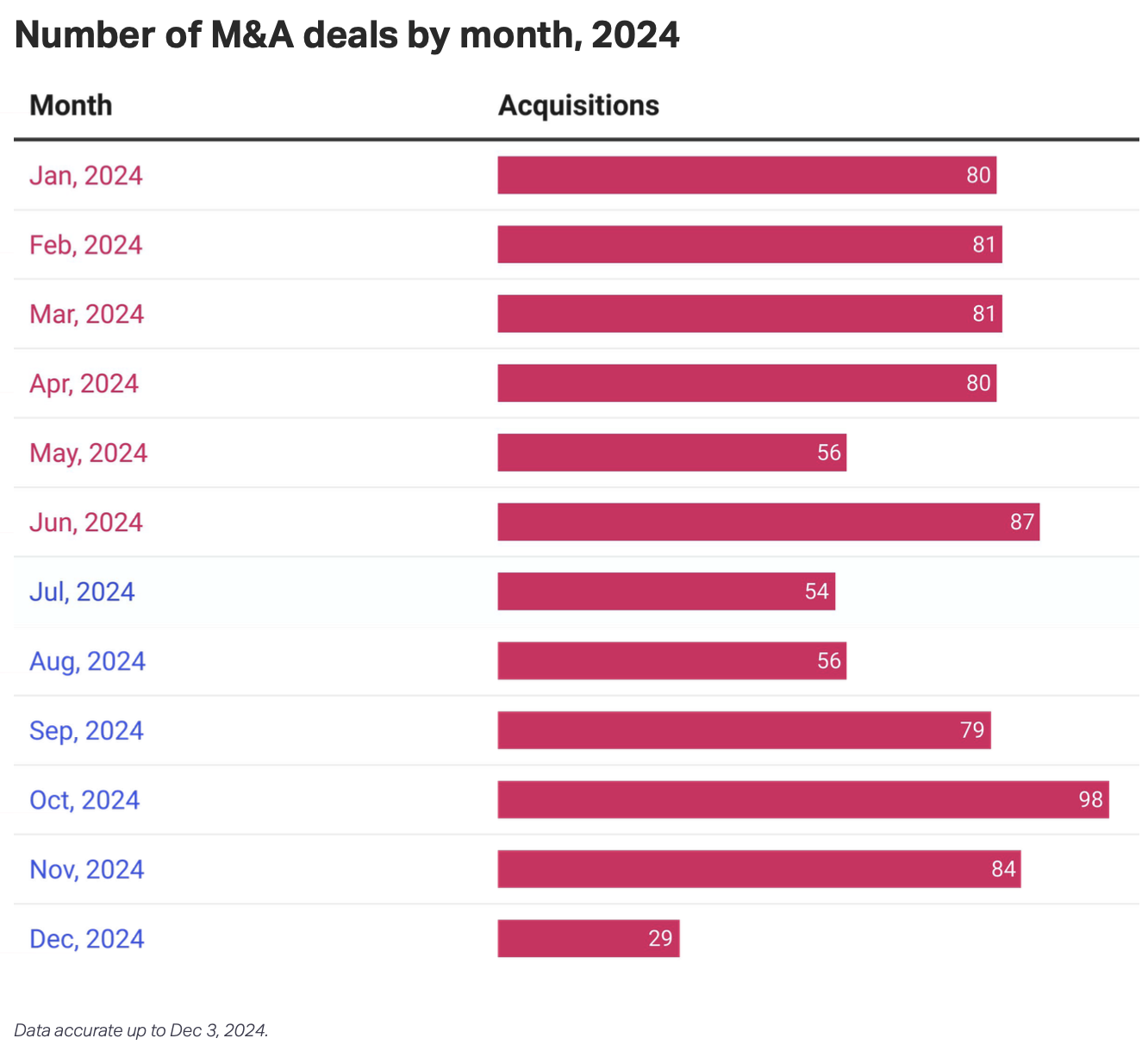

With European public markets virtually frozen, there were high expectations this year of the M&A landscape to deliver the exits that some shareholders badly need. The market, however, had other ideas, especially in H2.

Despite a slight recovery between the end of Q3 and Q4, H2’s M&A activity left a €15bn gap compared to H1 and no deal was priced above €1bn — against five for H1. Some good deals still happened: AMD’s $665m cash deal for Silo AI is Europe’s largest AI acquisition to date.

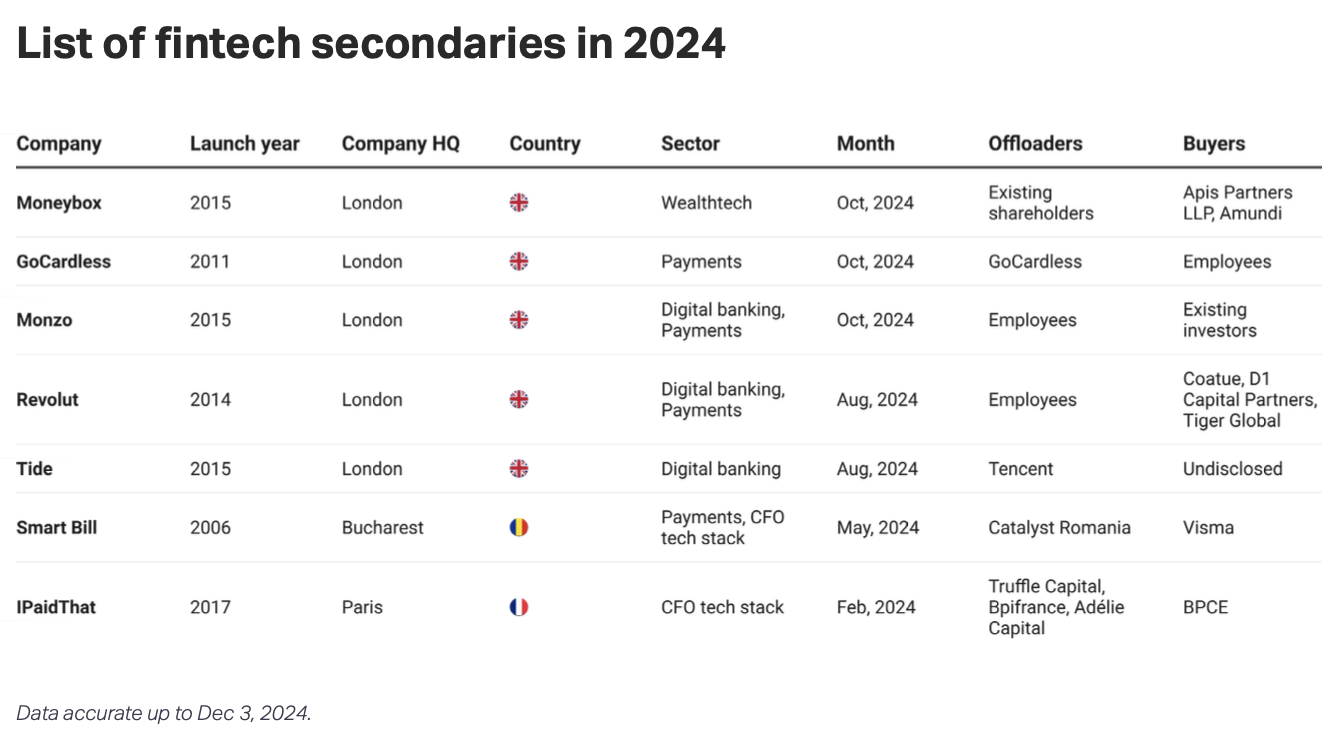

There was some joy for investors and employees patiently waiting for a return on their investment — be it money or time — in the form of secondaries. Sifted has tracked 45 secondary transactions this year, including several from the continent’s most closely followed scaleups, such as digital banks Revolut and Monzo, as well as secondhand clothes marketplace Vinted.

For access to Sifted’s proprietary data, become a Pro subscriber.

Read the orginal article: https://sifted.eu/articles/european-techs-2024-in-data/