B2B SaaS — defined by Sifted as proprietary software (excluding financial, healthcare and climate software) developed and sold by one business to another — was the most represented vertical on the recent Sifted 250, a ranking of the 250 fastest-growing startups in Europe by revenue.

It led with 75 of the 250 companies featured, and was followed by fintech (64) and climate tech (41). B2B SaaS did, however, have the lowest average three-year compound annual growth rate (CAGR) of all the verticals at 178.7%.

Only one B2B SaaS startup ranked in the top 10: Paris-based mobile app publisher Kovalee (#7), which achieved a CAGR of 626%. It finished top of the Sifted 50: France Leaderboard published in November.

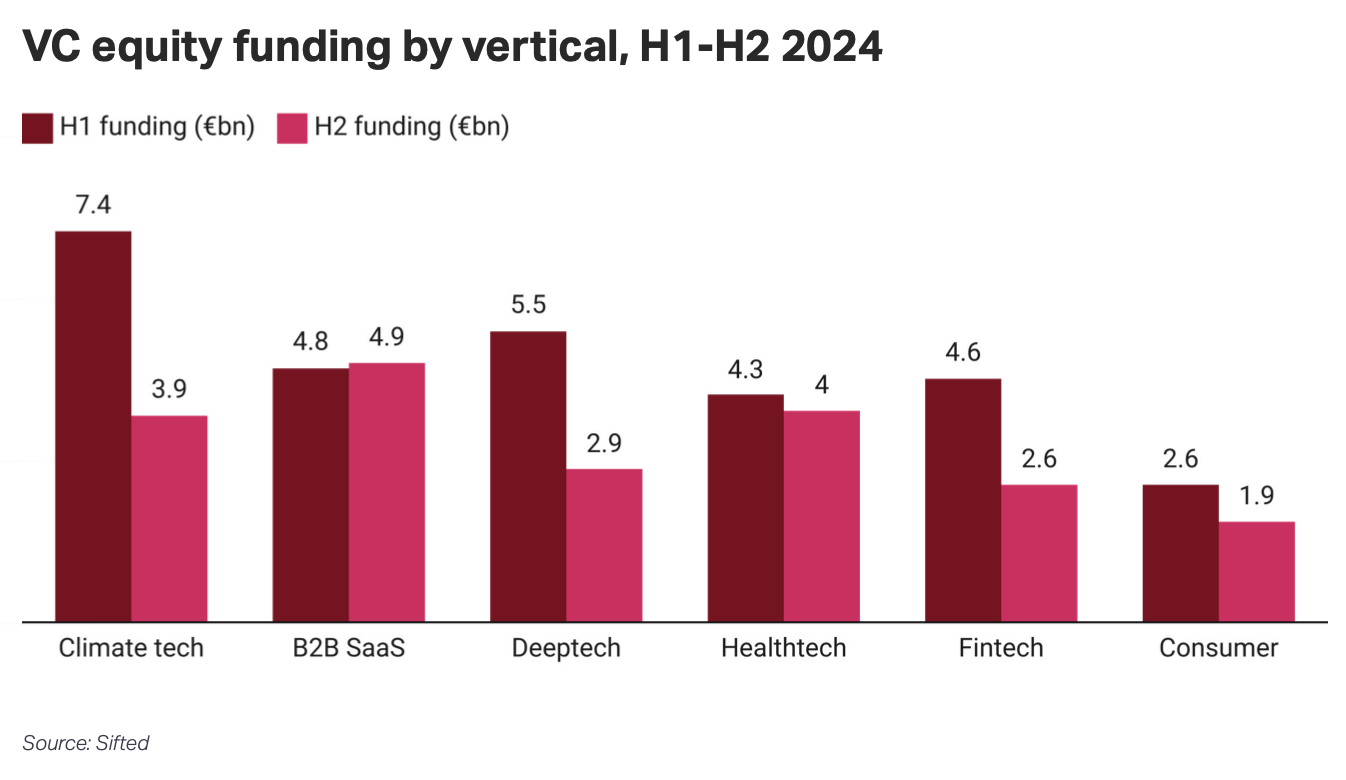

The B2B SaaS industry has had somewhat of a resurgence in Europe in H2. It was the only vertical tracked by Sifted that saw equity funding levels increase, from €4.8bn to €4.9bn, putting it top of the tree ahead of healthtech and climate tech according to Sifted data published in its H2 report.

10 fastest-growing B2B SaaS startups by revenue growth

1. Kovalee

HQ: Paris, France

CAGR: 626%

What it does: Kovalee is an app publisher that partners with developers to help their consumer apps climb the download charts. Cofounded in 2020 by Vincent Hart de Keating and Damien Soulard, who leads the company as CEO, it secured a €8m Series A in July 2022, led by IRIS, with participation from Bpifrance, Sequoia Capital and Breega.

2. Charles

HQ: Berlin, Germany

CAGR: 506.4%

What it does: Launched in 2019 by cofounders Artjem Weissbeck and former associate partner at McKinsey Andreas Tussing, Charles is a Berlin-based WhatsApp marketing platform that enables brands to build personalised, conversational experiences for their customers in creative ways. The company is an official Meta partner and secured a €20m Series A in July 2022, led by Salesforce Ventures alongside Accel and HV Capital.

3. Yoti

HQ: London, UK

CAGR: 468.1%

What it does: London-based Yoti was cofounded in 2014 by Robin Tombs (CEO) and Noel Hayden, and provides digital identity tools for businesses and individuals, including a free digital ID app that allows people to verify their identities on their phones without needing additional documents or personal data. The company achieved revenues of £3.2m in the financial year to March 2022, up from £100k two years prior according to company filings. In January 2024, Yoti announced that it had raised £12.5m in debt funding from HSBC and a further £7.5m convertible from existing investors, which include Lloyds Banking Group.

4. Hofy

HQ: London, UK

CAGR: 443.8%

What it does: Launched in 2020 by Sami Bouremoum (CEO) and Michael Ginzo (CPO), two founders with a background in consulting and software development, Hofy is a London-based startup that delivers office equipment to remote hires. The company achieved revenues of £17.3m in the financial year to January 2024, up from £586k two years prior according to information submitted to Sifted. Investors include CNP, Stride, 20VC, Day One Ventures, Kindred Capital, Activum and TrueSight. Hofy was acquired by global HR and payroll platform Deel in July this year.

5. Done

HQ: Stockholm, Sweden

CAGR: 396.1%

What it does: Founded in 2019, Done connects customers with home repair contractors via an app and virtual consultations. The company is led by Malin Granlund and Alek Åström, and secured a €400k seed round in January 2024 with support from Almi Invest, Antler, RadCap Ventures, Bling Capital, Yeos Ventures and angels. Done achieved revenues of €1.6m for the financial year ending December 2023, growing from €65k two years prior, according to information submitted to Sifted.

6. N8n

HQ: Berlin, Germany

CAGR: 378%

What it does: N8n is an AI-led, low-code workflow automation platform based in Berlin. It was founded in 2019 by Jan Oberhauser, who is also the CEO (and got its title because Oberhauser couldn’t find a good free domain name). It recently raised a €5m Series A round in February 2024, which was an extension to its Series A that kicked off in 2021.

7. Veremark

HQ: London, UK

CAGR: 353.4%

What it does: London-based Varemark was founded in 2018 by Daniel Callaghan (CEO) and Daniel Braithwaite (CPO), and offers a HR tool for background checks and screening. The company achieved revenues of £2m in the financial year to December 2022, growing from £95k two years prior according to information submitted to Sifted. Its latest round of equity funding was an £8m Series A in July 2022 from investors including SOV Ventures, Triple Point Ventures, ACF Investors and Samaipata.

8. Clone

HQ: Paris, France

CAGR: 350%

What it does: Clement Benoit (CEO) and Alexandre Haggai cofounded Paris-based Clone, a foodtech startup specialising in virtual restaurant franchises, in 2020. The company helps restaurants generate income from existing kitchens. In June 2022, it raised a €80m Series B round, with support from Verlinvest, Convivialité Ventures and Kharis Capital.

9. Anybill

HQ: Munich, Germany

CAGR: 328.2%

What it does: Launched in 2019 by CTO Tobias Gubo and CEO Lea Frank, Munich-based Anybill’s technology and partner network enables retailers of all sizes in the retail industry to issue receipts digitally, directly at checkout. It raised a €3m seed funding round in July 2022 from High-Tech Gründerfonds, Ilavska Vuillermoz Capital and business angels including Payone founders Jan Kaniess and Carl Frederic Zitscher.

10. Aily Labs

HQ: Munich, Germany

CAGR: 316.3%

What it does: Munich-based Aily Labs helps businesses realise the power of AI in everyday tasks. Former global head of digital finance at Novartis Bianca Anghelina launched the company in 2020 and bootstrapped it for the first three years. It then secured a €19m Series A led by Insight Partners in August 2023. Aily Labs’s customer portfolio includes Fortune 500 companies, and it opened a new office in New York City in June 2024, adding to its existing locations in Munich, Madrid, Barcelona and Romania.

The full, downloadable list of B2B SaaS startups on the Sifted 250:

Read the orginal article: https://sifted.eu/articles/europes-10-fastest-growing-b2b-saas-startups-by-revenue/