When you dream of launching a VC fund, you imagine a frustration-free world where you invest in the companies you choose and work with founders on your terms.

What you don’t anticipate is how challenging it will be to run it. You are essentially running a small startup, with customers (founders), shareholders (LPs) and a host of operational (legal, accounting, HR) and regulatory complexities. On top of that, if your fund is small, you’re operating a company with high fixed costs and a very limited budget.

Management fees are typically 2% of a fund’s size per year over its lifespan (usually 10 years). Hence, the smaller the fund, the lower the fees, making it essential for small funds to run a lean operation.

In Part I, I shared the process and costs of setting up a fund. Part II focuses on the costs of running a small first fund and how to make it viable — to hopefully save other new managers some sweat, scares and tears.

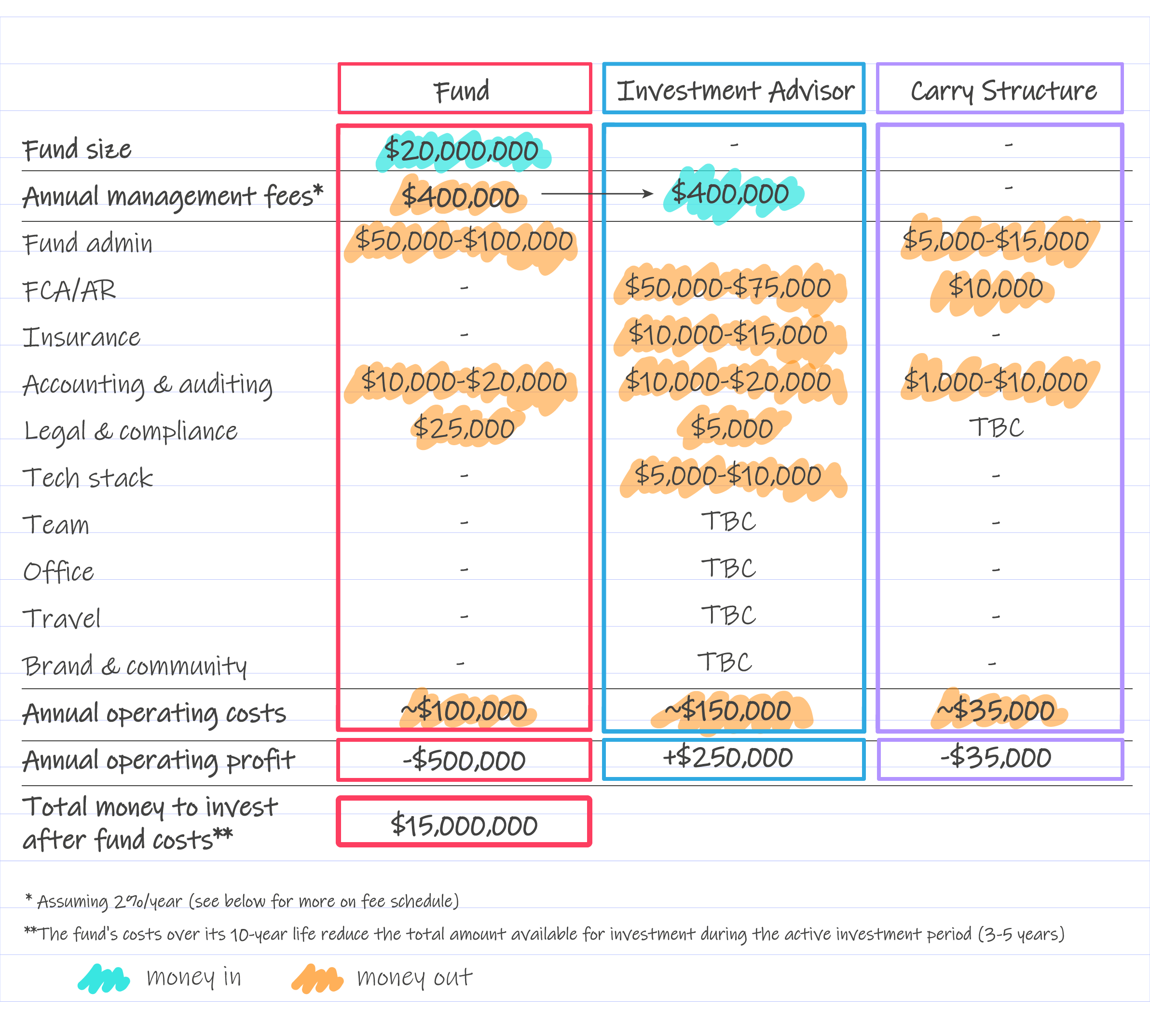

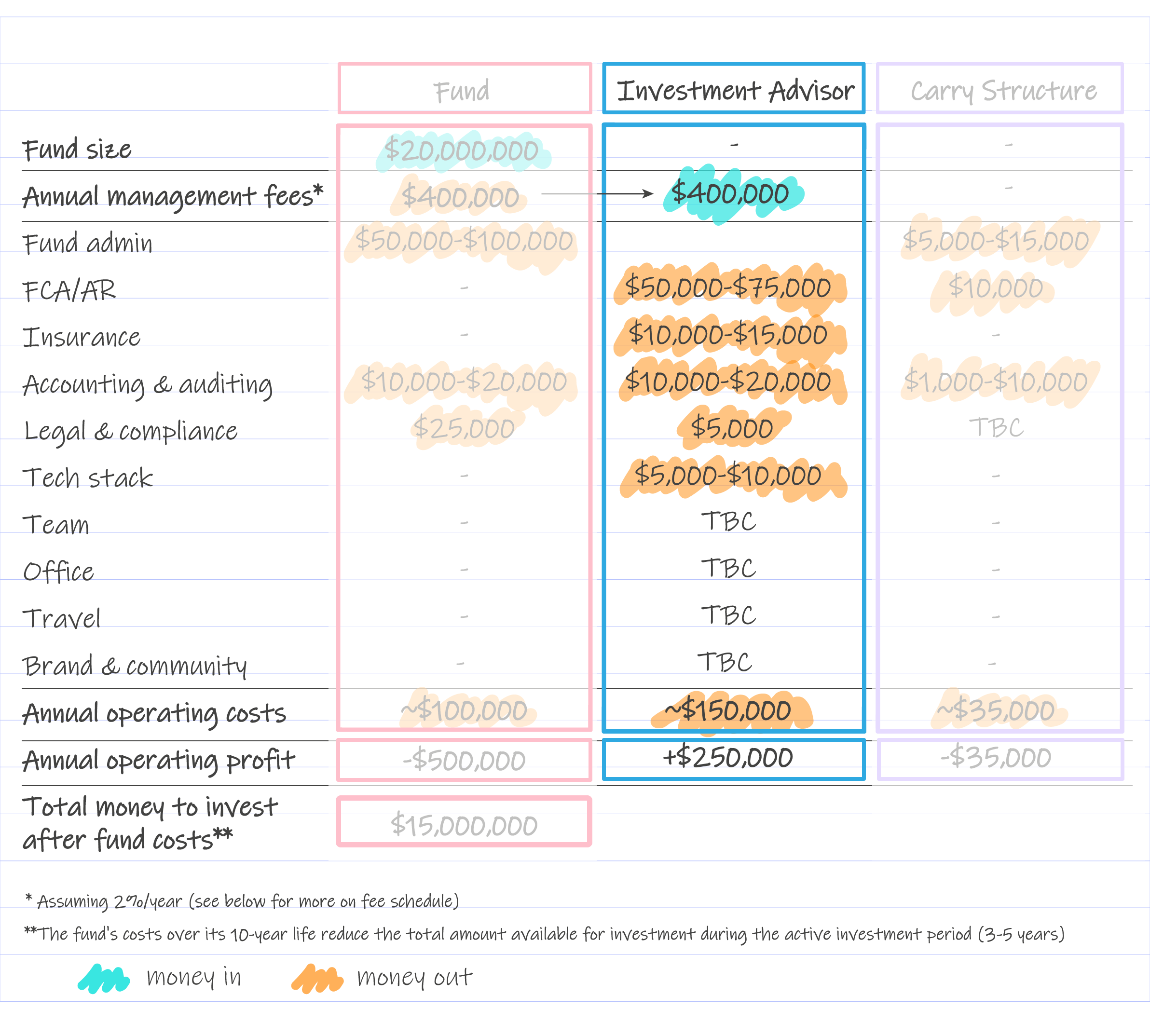

Example for a $20m fund

Disclaimer: The costs provided are estimates tailored to small funds. While they are indicative, the range is wide, so I recommend doing your own research (and negotiating!). The provider recommendations are based solely on Cocoa’s experience and are not meant to be exhaustive — there are undoubtedly many other excellent options available. None of the providers mentioned are aware they’re being included, and Cocoa is not receiving any benefit from mentioning them. The sole purpose of mentioning them is to offer helpful insights to new managers.

The Fund: $50-$200k/year

In the UK, funds are typically set up as English Limited Partnerships (LP). Managed by a General Partner (GP), they receive capital from investors (Limited Partners, or LPs) to be invested in portfolio companies.

Key costs: what, why & providers

Fund Administrator: $50k-$100k/year fixed cost

A fund administrator handles back-office functions, including:

- LP-related tasks like KYC/AML compliance, capital calls and distributions.

- Investment-related tasks like KYC/AML for founders and companies, and custodian services (managing and safeguarding the assets of a fund, including transferring funds).

- General tasks like accounting, financial reporting and tax filings.

Costs range from $50k to $100k/year, depending on the jurisdiction, provider and assets under management (AUM). You’ll need a fund administrator in your fund’s jurisdiction. Cocoa, as a US fund, works with AngelList — they allow us to operate like a top-tier fund with microfund resources. In the UK and offshore, reputable administrators include Ocorian and Langham Hall. And if you’re looking for a tech-enabled platform in the UK/Europe, we know lots of managers work with Carta, Fundrbird and Bunch Capital.

Accounting and auditing: $10k-20k/year fixed cost

Most fund administrators cover accounting functions, but funds often require an annual audit at the request of LPs. Audit costs can reach $20k/year.

Legal & compliance: $25k/year buffer

As a VC, you will spend a lot of time with lawyers, on new investments and portfolio management in particular, and you should always budget for their services.

Generally, the Lead in an investment round drafts the legal documents. But even if your fund is not leading, it’s essential to ensure that all your investor rights — both economic and governance — are fully secured, i.e. legal docs for any new investments or follow-on round should be carefully reviewed.

Beyond an investment round, and as a shareholder, the fund also has obligations to review and often approve a range of portfolio documents — AGM and Board resolutions, Management Accounts, Employee Stock Option Plan (ESOP) issuance, and more. Additionally, when things don’t go as planned, having sound legal counsel is critical to navigate those challenges.

As a lawyer myself, my bar here is high. The advice I give founders applies to Cocoa as well: a good lawyer isn’t just someone who tells you what to do. They’re someone you trust to outline key risks and help you make informed, commercial decisions. Above all, they’re problem-solvers.

A strong legal team is essential to operate a fund, and I couldn’t be luckier to be building Cocoa with the most brilliant and dedicated team. Since the start of Cocoa, we’ve been lucky to work with exceptional corporate lawyers (note: investment legal work requires corporate lawyers, not fund lawyers) at Latham & Watkins, Slaughter & May and Keystone Law. In the US, we always work with Reitler.

After three years of managing it myself, we recently welcomed Iwona Biernat to Cocoa, as our part-time in-house legal expert to lead on everything legal ops and compliance and keep us safe. I can confirm such an add-on to the team is definitely something to consider and budget for at the right time.

Total legal costs will vary across time, but having a buffer of $25k/year minimum is essential, especially as the fund scales and the number of portfolio companies and potential risks grow.

Overall fund costs can range from $50k to $200k, depending on AUM and the providers. Over the fund lifetime, that is $500k-$2m.

How to pay for it: fund costs

Most Limited Partnership Agreements (LPAs) allow fund-related costs to be charged to the fund, meaning these expenses are covered by the Fund itself rather than by management fees (Investment Advisor). However, it’s important to remember that money spent as a fund cost reduces the capital available for investment, which ultimately impacts returns. This is important in two key ways:

- For LPs: LPs closely monitor fund costs, as they reduce the investment base. Therefore, cost allocations should be clearly documented in the LPA — being transparent with investors about which costs are charged, or will be charged, to the fund is crucial. LPs are generally comfortable with $50k–$100k per year, depending on AUM.

- For managers: covering costs with fund money may seem like a relief, especially with small management fees. However, in small funds, the real money is in the carry, not the fees. Once operating costs and the manager’s remuneration are covered, the incentive is to maximise investable capital to boost potential returns — and, ultimately, carry.

Looking at the numbers in the example from our illustration, for a $20m fund with a 10-year life, we have the following fund costs:

i) $400k/year in management fees ($4m over the life of the fund)

ii) $100k/year in fund expenses ($1m in total)

This means $5m goes to cover expenses, leaving $15m to invest and multiply. In other words, only 75% of the raised capital is invested, meaning only 75% of the raised capital can generate returns for investors and carry for the GPs.

The Investment Advisor: $75k-$200k/year

Typically, the GP delegates the fund’s business operations and investment decisions to another entity — the Investment Advisor — which must be regulated, either directly or via the Appointed Representative (AR) Regime. Management fees flow from the fund or the GP to the Investment Advisor to cover operational costs like salaries, travel and office rent.

In the UK, an Investment Advisor can be structured as either a Limited company (Ltd) or a Limited Liability Partnership (LLP). Both offer limited liability for shareholders or members, but differ in their tax and membership structures. Consult a lawyer and tax advisor to determine which structure best suits your fund. See Part I for more on the structure of the Investment Advisor.

Key costs: what, why & providers

Mandatory costs: Due to its regulated nature, the Investment Advisor has certain regulatory costs that are non-negotiable — without them, it simply cannot operate. They include:

FCA/AR: $50k-$75k/year

In the UK a fund must be notified and registered with the Financial Conduct Authority (FCA) before it can admit investors and deploy capital, but it is not itself a regulated entity. However, it must be managed and operated by an FCA-regulated entity. Most funds start with the Appointed Representative structure and transition to Direct Authorisation for subsequent funds once they have more infrastructure and a larger team to handle the increased compliance and reporting requirements.

In the Appointed Representative regime, the Investment Advisor acts as an Appointed Representative of an FCA-authorised firm (known as AR Principal). The AR Principal manages the fund and is legally responsible for all investment decisions and regulated activities in the UK.

Fees for AR services range from $4k to $10k per month.

At Cocoa, we work with The Fund Incubator.

Insurance: $10k-$15k/year

Investment advisors in the UK need i) professional indemnity insurance (PII) as required by the FCA to cover claims for errors, negligence, omissions or misconduct that could arise while providing financial advice (~$10k-$15k); and ii) Employment liability insurance (~$1k).

Cocoa works with Berns Brett Insurance Brokers to renew our insurance policies every year.

Accounting and auditing: $10k-$20k/year

As an LLP or Limited Company, the Investment Advisor must work with accountants to comply with tax regulations, financial reporting and statutory filings, including the preparation and submission of annual accounts. The same accounting firm often manages secretarial services, liaises with HMRC and oversees payroll if the firm employs staff. They ensure that all financial obligations are met efficiently and in line with UK regulations.

Under the Appointed Representative Regime, the Investment Advisor of a small fund will very rarely be required to undergo an audit (it only happens if it meets two of the following three thresholds: annual turnover: +£10.2m; balance sheet total: +£5.1m; number of employees: +50). If regulated by the FCA directly, the Investment Advisor will generally be required to have an audit.

At Cocoa, we work with accounting and tax advisory firm WSM. Other well-known providers include BDO.

Given that we are a USD-denominated fund, but our cost base is mostly in GBP, we also work with Ballinger to manage our FX risk.

Other legal and compliance costs: $5k/year

Policy maintenance: this includes periodic training and reviews of internal and external policies such as data privacy, GDPR compliance, cybersecurity, etc.

HR costs: maintaining compliance with employment laws is critical. This includes everything from contracts for services to employee handbooks. For our HR compliance needs, we collaborate with Cajun.

Non-mandatory costs: The following costs are important to operate a fund but not essential.

Tech Stack: $5k-$10k

As a small resource-constrained fund, you need a tech stack that supercharges you: powerful but agile, flexible and cost-efficient.

- We built in-house our own CRM and operating system on Notion — it’s our system of record and single source of truth. Cost is around $25/month per user. In another life, we’ve also used attio, affinity and salesforce.

- We use tactyc.io (recently acquired by Carta) for portfolio and fund performance tracking. Notion isn’t great with numbers, but Tactyc is fantastic. Pricing depends on AUM, but for a small fund, it’s about $5k/year.

Team: TBC

You might decide to hire a team to support you, especially as you scale. If so, you’ll need to factor in their salaries, as well as other employment costs like National Insurance, pension, payroll, etc.

Office: TBC

CocoaHQ is at Huckletree, and we love having a space where we can host founders and fellow investors. We’re based in the middle of Soho, so feel free to visit anytime — CocoaHQ is always full of chocolate!

Travel: TBC

We’re in a people business, which means travel is often necessary — whether to meet founders, build relationships with other VCs or attend industry events. The specific amount will depend on each fund and manager, but be sure to budget for this cost as it can be significant.

Brand and community: TBC

Branding is more than just a logo or tagline — it’s the core identity of your fund. You want founders, LPs, and investors to connect with that identity, to feel like they’re part of a community they want to belong to. One LP once told me, “You’re not just building a fund, you’re building a movement.” That’s exactly the goal.

At Cocoa, we do all our branding in-house — it’s my guilty pleasure. And if we ever want to/have to deal with the press, Harper Gray is always there for us.

Chocolate

Probably not a cost for most managers but absolutely essential at Cocoa.

Chocolate aside, the total mandatory regulatory-required costs of operating an Investment Advisor can range from $75k–$150k+/year. If you add business operating costs like team, office and/or travel and brand to it, you could be looking at more in the $200k-$250k/year range — not including the remuneration of the manager(s).

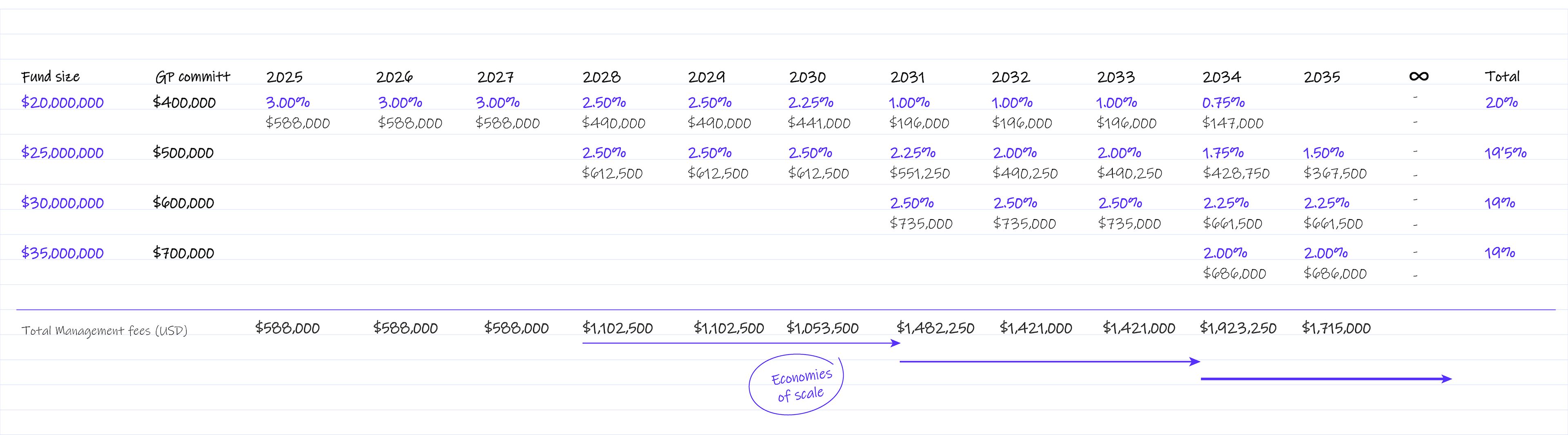

How to pay for it: management fees and how to build a sustainable business model

Typical management fees are around 2% per year over a fund’s lifetime of 10 years (equating to 20% of the total fund). For small funds, this can be particularly challenging in Fund I, when fees from subsequent funds haven’t started to accumulate: a $10m fund charging 2% generates $200k/year, which may not be enough to cover all costs outlined above.

First and foremost, it’s crucial to ensure the fund size is sufficient to cover all operating costs, including your remuneration (see more on this below).

Then, you need to optimize the fee schedule. A potential temporary solution to low fees is to “frontload” fees, charging a higher percentage during the investment period and reducing it in later years, while keeping the total fees at 20% over 10 years.

The fee schedule should serve as the foundation for a sustainable business model, balancing income and costs from future funds. Optimise it for:

- Financial independence during the investment period: Ensure enough funds are available to operate the business (and pay yourself) during this period so that investments are driven by quality, not the need to raise a new fund.

- Coverage of costs throughout the fund’s life: Setting up a fund is a long-term commitment (10+ years). Regulatory obligations and costs persist throughout the fund’s life, so planning for these is essential.

- Overall sustainability of the business model: Aim to reduce the need for frontloading fees in future funds as soon as possible

With that in mind, here some constraints/targets to build your fee schedule around:

- Investment period (3-4 years): Keep fees under 3% per year, ideally around 2.5%. LPs tend to push back on anything above 3% in Fund I and above 2.5% in Fund II and beyond, as this raises concerns about the sustainability of the business model.

- Rest of the fund life (6-7 years): Gradually step down fees, dropping 0.25% each year, ensuring that ongoing regulatory and operational costs are well covered beyond the investment period and throughout the full life of the fund.

There’s also the option of charging higher fees (2.5% per year on average, up to a total of 25%), but I’m not a fan of this approach as it reduces the investable capital, which in turn lowers returns for both LPs and the manager.

Finally, the good news is that economies of scale are your friend when it comes to building a sustainable firm while maximising potential returns. Fees accumulate as more funds are raised, but costs like FCA/AR fees, legal expenses, or team don’t grow proportionally. Once operational costs (and your remuneration) are fully covered, you can maximise investable capital by:

- Lowering total fees if operational costs are well-managed (as shown in the fee schedule example above).

- Recycling management fees: reinvesting them back into the fund if not needed to cover costs.

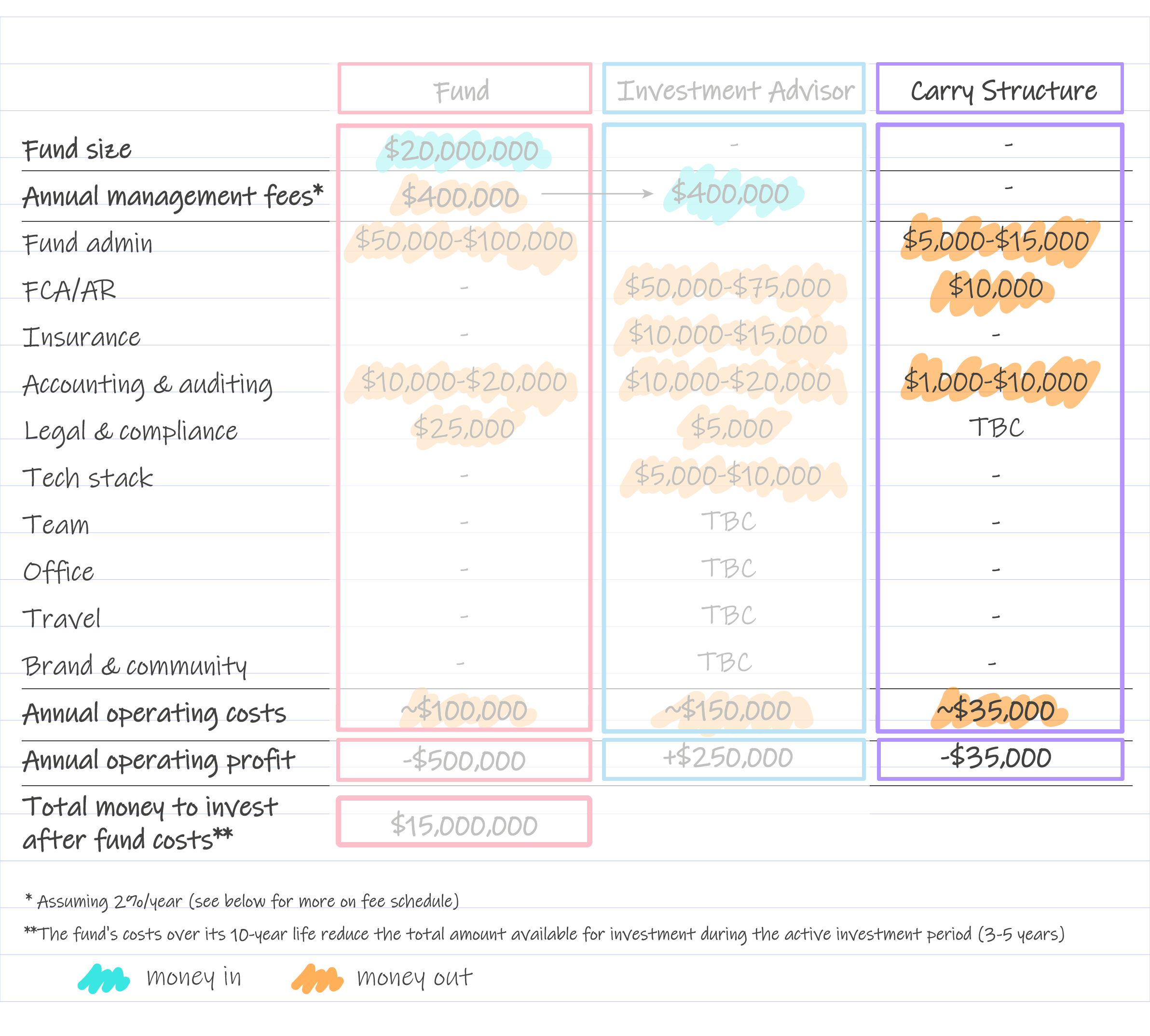

Carry Structure: $15k-$35k/year

Carried interest, typically 20%-30% of the Fund’s net returns, is how VC firms reward and motivate investment partners, employees and others who contribute value by sourcing deals and supporting due diligence and/or portfolio companies. The Carry LP is the entity that receives the carried interest. The Carry LP is often also structured as a Limited Partnership, like the underlying Fund. As a Limited Partnership, the Carry LP will require a GP to manage it.

Key costs: what, why & providers

The cost structure of a Carry LP mirrors that of the Fund, but with i) lower absolute costs; and ii) minimal costs in the early years when no carried interest is being distributed.

Fund Administrator: $5k-$15k/year

Similar to the Fund, the Carry LP needs a fund administrator for KCY/AML compliance, distributions, financial reporting, accounting and tax filings. However, given the smaller scale and reduced activity in the early years, the costs are typically lower.

FCA/AR: $10k/year

The Carry LP is likely to be non-regulated and operated by the Investment Advisor (either directly or through the FCA-regulated AR Principal). If the Investment Advisor operates under the AR regime, you might need to pay additional fees to the FCA-regulated AR Principal to cover the management of this additional entity. Regulatory requirements may differ for offshore structures.

Accounting and auditing: $1k/year at the beginning, $10k+/year after

In the beginning, accounting and auditing costs are minimal since there’s little to no financial activity in the Carry LP. As the fund matures and carried distributions begin, these costs can increase significantly.

Legal and administrative costs: TBC

Legal costs for any compliance or structural changes needed as carried interest begins to flow. These can be minimal in the early stages and increase as carry distributions come into play. Costs will depend on the carry structure and the number of carry holders. Overall, they can remain very minimal, provided there are no issues among carry holders.

Overall carry structure costs can range from around $15k to potentially very high, depending on the stage of the fund’s life (distribution timing), the number of carry recipients, and any potential conflicts.

How to pay for it: fund costs vs. management fees

The Carry LP is a cost centre with no immediate income until carried interest is realised (and this takes years). In the meantime, these costs can either be covered by the Fund (fund costs) or by the Investment Advisor (management fees). Considering some of these costs fund costs is common practice, though it should be outlined clearly in the LPA to ensure transparency with LPs. And the same considerations outlined above regarding investable capital apply when deciding between covering costs through fund expenses or management fees — if considered fund costs, carry costs will reduce the investable amount.

Elephant in the room: what about you?

Once you’ve accounted for all the operating costs of the Fund, the Investment Advisor and the Carry Structure, there’s your own compensation as manager to be considered. There’s carry of course but that will take time. So, until then, you will get paid from the Investment Advisor. How this happens depends on the structure of the Investment Advisor. In the UK:

- If structured as a Limited Company (GPs are shareholders), GPs can pay themselves as employees (salary, taxed as income tax), as shareholders (dividends from the net profit) or a combination of both.

- If structured as an LLP (GPs are partners), any operating profit left after covering costs flows through to the GPs as their share of the partnership’s profits. This income is then subject to income tax at the individual’s marginal rate.

The tax rate and obligations vary in each case, so I recommend seeking expert advice to determine what works best for you.

Additionally, it’s worth noting that the GP commitment can sometimes be structured via salary sacrifice.

TL;DR: No magic formula, just key fundamentals to keep in mind

A small fund is a long-term commitment that requires a long-term view on returns. If you launch a small fund, you are playing the long game.

Small funds mean lower fees. Personally, I appreciate the alignment of incentives that comes with this — since I’m not collecting substantial fees, I only earn carry if I first make money for LPs. But operational costs are high, and fund life is lengthy. So, planning your fee schedule and operational costs carefully becomes essential to ensure long-term sustainability for the fund and financial stability for yourself as a manager.

For that, there’s no magic formula, but there are some core principles to live by:

- Always, make sure the size of the fund is enough to cover all the costs of running it, including your remuneration.

- In the medium term, ensure that fees support a sustainable business model.

- For the long term, leverage economies of scale to maximise investable capital and, in turn, potential returns and carry.

Thank you Charlotte from Integra, Jamie from WSM and Flora from TFI for kindly reading this post and making sure I didn’t get you/or myself in any trouble.

And on that note, a reminder that nothing in this article should be taken as legal, tax and/or financial advice. The examples, costs and provider names shared are simply for general information and by no means an exhaustive list. It’s always a good idea to do your own research and consult with professionals what works best for your specific needs.

Cocoa Advisor LLP is an Appointed Representative of The Fund Incubator Limited which is authorised and regulated by the Financial Conduct Authority – FRN 208716

Read the orginal article: https://sifted.eu/articles/ops-costs-launching-vc-fund/