HSBC Innovation Banking has made an application on behalf of London-based fintech Stenn to appoint administrators, according to documents accessed via Caseboard.

HSBC uses Stenn’s technology to provide financing options to SMEs involved in the global trade space. An April 2022 TechCrunch report said that the banking giant is supplying the capital behind its loans.

The application consists of two filings, which were both submitted yesterday, relating to two companies under the wider company umbrella of the Stenn group including Stenn International and Stenn Assets UK LTD. In each filing HSBC Innovation Bank is listed as an applicant for Stenn.

Companies typically appoint administrators when in financial distress and to avoid liquidation. But a Stenn spokesperson attributed the filings to a “sudden action by an investor” and are “actively defending” against the measure.

“We are committed to resolving this matter promptly,” they said. “While legal proceedings are ongoing, we are not commenting further.”

HSBC Innovation Banking UK declined to speak on client relationships when reached for comment.

Founded in 2015, Stenn offers invoice financing services for ecommerce, international trade and SaaS companies. The fintech has raised more than $50m in funding from investors including US private equity firm Centerbridge Partners, Barclays Bank and Crayhill Capital Management according to Dealroom.

After hitting a $900m valuation in 2022, Stenn appeared to be on a speedy growth trajectory. The company was named as one of Europe’s fastest growing businesses by the Financial Times in March. CNBC also listed Stenn as one of the world’s top fintech companies globally in July.

Global expansion

The company’s decision to expand globally was cited as one of the reasons behind its inclusion on both of these lists. In March, the company opened a technology hub in Barcelona and hired 25 employees in the city. And in, October, Stenn announced the establishment of its first overseas headquarters in the US state Atlanta as well as opening two new offices in the Chinese cities of Shanghai and Shenzhen.

But the international push came at a cost. Losses at the fintech more than doubled this year from $8.1m to $28.4m according to 2023 Companies House flings. Revenue at the fintech also fell by 5% year-on-year from $43.9m in 2022 to $41.9m in 2023.

Low interest in digital lending

Even though it appears Stenn wasn’t pulling the strings behind the application to appoint administrators, the London-based company isn’t the only fintech to befall a similar fate in the last year. Fintech infrastructure company Manigo entered administration in October. This summer also saw both HSBC-backed lending fintech Divido and Barclays-backed loyalty app Bink enter administration.

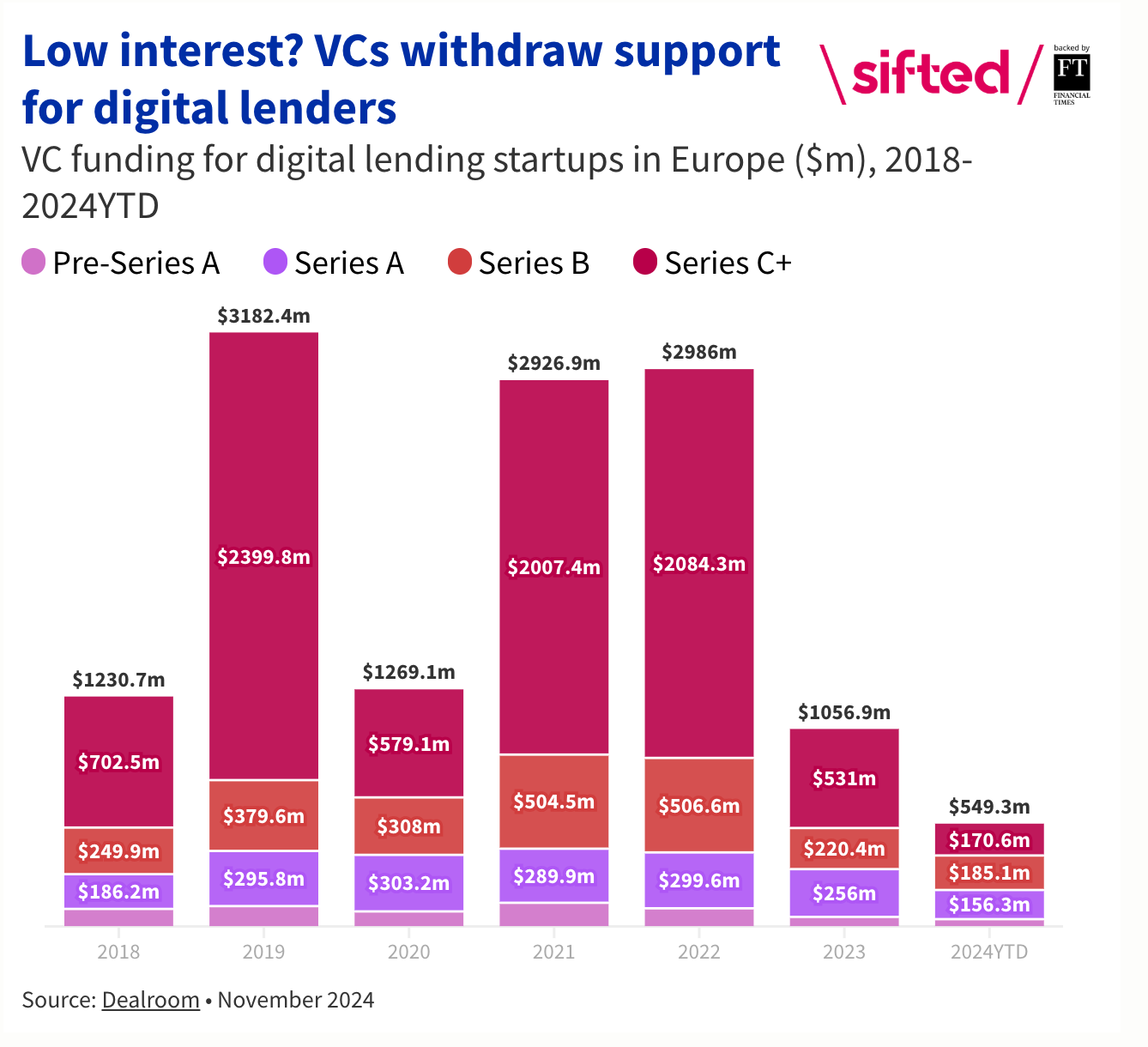

The application to appoint administrators also comes as VC investors pull back from allocating capital to the digital lending vertical.

According to data collected by Sifted, VCs have put $549.3m into the subsector so far this year, around half the $1.1bn they invested in 2023 and close to a sixth of the $3.1bn invested in in 2019.

Read the orginal article: https://sifted.eu/articles/stenn-administration-news/