Flying taxi startup Lilium faces insolvency if it doesn’t raise more capital. Talks with the German government for a €100m loan are reportedly off the table, leaving the country’s tech ecosystem abuzz with discussion over who the company’s white knight should be.

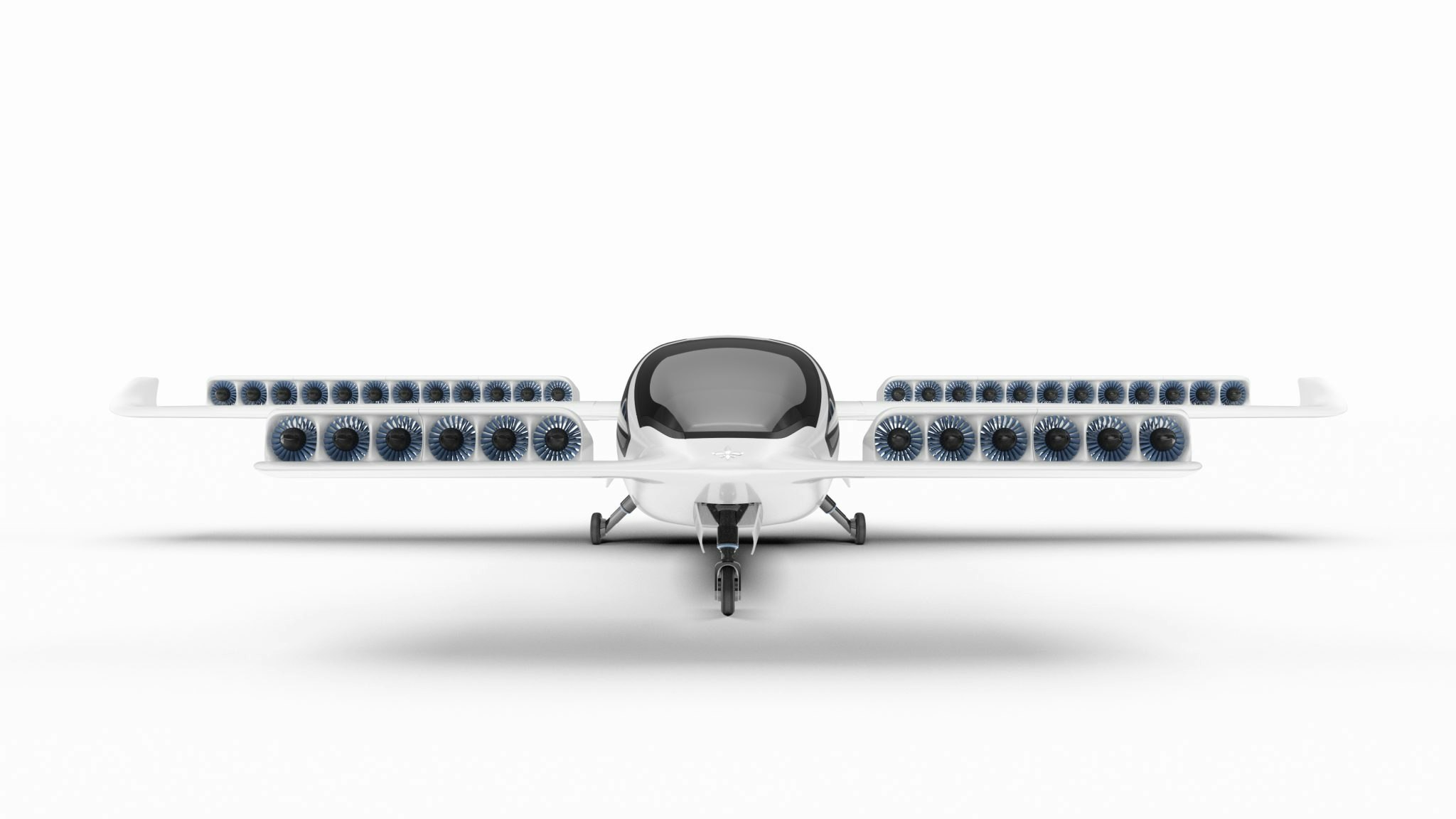

Lilium was founded in 2015 and secured early backing from Atomico, Earlybird and Tencent, all convinced by the company’s promise of zero-emission electric aviation. In 2021, as SPAC-fervour gripped European tech, Lilium joined the trend, listing on the Nasdaq via a merger with Qell Acquisition Corp.

Since that listing, Lilium’s share price has decreased by 93% and it has failed to meet the milestones it set out at IPO: for example, it projected to achieve revenue of €240m by the end of 2024 and reach profitability by the end of 2025.

A spokesperson for Lilium said its shareprice has performed “similar to other US-listed pre-revenue companies over the last few years” and that increased interest rates had hit those companies particularly hard.

Lilium’s woes are echoed elsewhere in Europe’s climate tech world. Swedish gigafactory Northvolt is also on the hunt for cash — and the Swedish government has ruled out help.

Volocopter, another electric aviation company, was also previously on the brink of insolvency and sought guarantees from two German state governments and the federal government but was unsuccessful. The company told Sifted it has an ongoing funding round, but declined to say the amount or the investors.

A CEO’s plea

In May, Lilium announced that state bank KfW was conducting due diligence on the €100m loan, from the state of Bavaria. Last week, German media Der Spiegel reported the Bavarian state government had approved the plan in September, but that Germany’s federal government had then declined to approve the loan.

Lilium told Sifted that it could not comment on ongoing conversations.

The company’s CEO, Klaus Roewe, took to LinkedIn on Monday to make the case for the loan.

“Our private investors — mostly from the USA and China — have already financed Lilium with $1.5 billion,” he wrote. “They would like to continue investing. But they also want a signal that investing in a German company is not a disadvantage.”

Roewe pointed out that Lilium’s competitors in other countries have enjoyed more state support – American electric aviation startup Joby has received $600m in state aid from the US government, he said. “If the funding situation in Germany deviates too much from this, Germany will not be competitive as an investment location.”

Adding to Roewe’s comments, a Lilium spokesperson told Sifted that “countries of innovation don’t occur accidentally” and that public policy is needed to spur innovation and job creation.

One EU member state may be more likely than Germany to offer help to Lilium. France is luring the air taxi startup in with a state subsidy of €220m, according to a report by the Süddeutsche Zeitung. The condition is that the company would have to move a significant part of its production to the country, while maintaining its location in Munich.

The company has been in ongoing talks with the French government; it announced in May this year that it was assessing possible locations in France where it could expand its industrial footprint.

An open letter

On Wednesday, a flurry of founders and investors came out in support of Lilium receiving a federal guarantee; over 650 signed an initiative called ‘Enable loans for Lilium, strengthening Germany as a deep tech location.’

Many also took to LinkedIn to pledge their support, arguing that if Germany wants to compete globally, it needs to support startups working on innovative deeptech technologies.

The naysayers

Others are not too thrilled about the possibility of Lilium receiving state support.

“Lilium made big promises via a SPAC deal that it couldn’t keep. Now a small state guarantee is supposed to send a big signal for international investment?,” questioned Steffen Heinrich, founder of Peregrine, a Berlin-based startup building AI-powered computer vision for cameras, in a LinkedIn post.

“If we as a tech community call for the state in this particular case, we are jeopardising our credibility.”

In response, a Liliium spokesperson said that Lilium had modified its projections in 2021. “As most entrepreneurs are aware, early days in a technology field are ripe with uncertainty,” the spokesperson said, adding that updates on its strategy and financial situation are regularly updated in its SEC filings.

Others in the tech ecosystem took a stab at investors who publicly came out in support of Lilium, and questioned why the state should step in if private investors aren’t.

“It’s at least questionable that venture investors, typically known for preferring clean cap tables with purely financially incentivised investors, are now forming alliances to lobby for credit from the German government,” wrote Nico Schonenberger, early stage investor at 10x Founders, in a LinkedIn post.

“Yes, we need to position Germany as a leading deep tech hub to remain internationally competitive, but it’s outside-in hard to believe that a €50m taxpayer check is a decisive argument for future equity investors — particularly for a company that has raised north of €1.5bn in private means already.”

Christoph Gerber, founder of German delivery company Lieferando, echoed that sentiment. “If €100m or even €150m could realistically push them toward a breakthrough, private investors would be all over it,” he said. “The fact that the private market refuses to back Lilium sends a clear message: Lilium has no shot at hitting the next milestone with that money.”

In response, a Lilium spokesperson said that Lilium had been flying its demonstrator for five years. “When the Lilium Jet’s first piloted flight occurs in early 2025, it will be the world’s first and only certification compliant eVTOL flying in the world, thanks to the work of nearly 1,100 highly skilled and talented employees and engineers.”

“We have built up an industrial footprint for electric aircraft manufacturing: an aircraft final assembly line, battery pack production line and propulsion assembly facilities,” they added.

Lilium’s woes come a month after the publication of the Draghi report, which called on the European Union to raise investments by €800bn a year to stop the union falling behind the US and China. Germany’s startup scene is waiting to see if that will come to fruition in this case.

Read the orginal article: https://sifted.eu/articles/lilium-taxi-startup-save-germany/