by Alessandro Albano

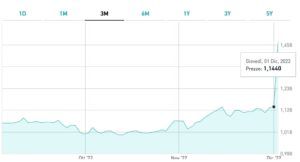

DeA Capital, Italy’s leading independent alternative asset management platform with aggregate assets under management of 26.4 billion euro at the end of September (see here a previous article by BeBeez), saw the stock to close its trading session last Friday with a 28.85 percent jump to 1.474 euros on Euronext Star Milan. This super-performance was due to the announcement by the parent company De Agostini Group that it intends to launch a voluntary takeover bid on shares representing the 32.156% of the capital it does not yet own, given that De Agostini already directly holds 67.062% of it, to which must be added the treasury shares held by the investment company. The takeover bid, which is aimed at delisting Dea Capital, will be launched through the vehicle Nova srl, which will pay a price per share of 1.5 euros, including dividend, for a total consideration, therefore, in the event of adhesion by the holders of all the shares subject to the takeover bid, of approximately 128.6 million euro, with an expected duration of the offer of between 15 and 40 days (see the press release here), the dates of which have not yet been set.

The Nova bidder has declared, in case the acceptances allow to exceed a share of the capital held by the De Agostini Group of more than 90 percent but less than 95 percent, its unwillingness to reconstitute a free float adequate for the proper unwinding of market exchanges, and to exercise the right to purchase the Dea Capital shares still on the market.

The transaction, which if successful will take the investment company off the Italian Stock Exchange, stems from the change in the structure of the business model that DeA Capital has made in recent years, progressively abandoning its strategy of being a direct operator as an investor in significant private equity transactions and becoming an alternative asset manager, and therefore a third-party fund manager, with a broad spectrum of managed products.

As explained in the note circulated on Friday, the current business model is “much less capital intensive,” as implicitly demonstrated by the significant extraordinary dividend distributions implemented in recent years including the most recent ex-dividend in May of 0.1 euro equal to a 10% pay-out and thus linked to inflationary trends. Because of this, the company also feels less need to resort to third-party capital for the development of the business itself, a need that, in the past, had been one of the fundamental reasons behind the listing.

According to the holding company, exiting Piazza Affari will ensure “greater management flexibility, as well as undoubted cost savings,” since, as a private company characterized by greater operational and organizational flexibility, DeA Capital will be able “to accelerate its investment and value creation strategy.”

Once off the list, the publishing and communications giant further explains, DeA Capital will be able to better pursue potential growth opportunities, benefiting from: a greater speed in making and implementing investment decisions; a more significant possibility of focusing on development projects that by the nature of the business present medium- and long-term horizons and possible investments with negative impacts on short-term economic results, the pursuit of which is less easy with the limitations arising from the need to obtain results subject to short-term audits typical of a listed company; direct access to a flexible source of capital, with the support of De Agostini; and finally a simplification of ownership structures with consequent alignment of the interests of the shareholding structure.

The listing has not prevented the investment company from increasing its assets under management and its net asset value in recent years even though, as shown in the latest financial statements for the nine months of 2022, some indicators have sent signs of a slowdown, partly as a result of the less than favorable macroeconomic environment. As of Sept. 30, DeA Capital had as mentioned 26.4 billion euro in assets under management, up 2% from 25.9 billion as of Sept. 30, 2021 (integrating what is attributable to Quaestio Capital sgr), but down slightly from 26.7 billion at the end of June 2022 (see here a previous article by BeBeez). In detail, the largest share of assets is represented by real estate, with 12.7 billion euros, up 8% to compared to 9 months 2021, however at the end of last June the figure was 12.9 billion.

Still on the real estate front, recall that the economic-financial instability has actually delayed plans to increase the capital of the former Nova Re, now Next Re Siiq spa, with which DeA Capital had committed to underwrite part of the new capital in exchange for a 4.99 percent stake in the new company, which changed its name precisely as a result of the agreement with DeA Capital. The increase, postponed to 2023, envisages new liquidity of 2 billion euros to be implemented in two tranches of 1 billion each by the date of the shareholders’ approval of the financial statements as of December 31, 2023 (see here a previous article by BeBeez).

Returning to the 9-month results, the income statement showed 77.6 million euros in revenues (up from 75 million in 9 months 2021), again the main contribution comes from real estate, with revenues of 31.5 million (up from 20.8 million), followed by the multi-manager segment with 22.4 million, the private equity segment with 12.7 million, and the credit segment with 11 million.

As for net operating income, that is, the net income of the three asset management companies in which the group holds an interest, before non-characteristic items and the effects of purchase price allocations, it is positive at 12.1 million, basically in line with the 9 months of 2021 (12.2 million). On the other hand, the group’s net income is negative by 2.2 million compared to the positive value of 21.1 million in 9 months 2021, as a result of the mark-to-market of funds in the portfolio, linked to the performance of financial markets. Finally, the consolidated net financial position is positive 94 million from 135.9 million at the end of 2021, as a result of portfolio investments and the distribution of the extraordinary dividend made in May 2022 (for about 26.5 million).