Bad news for private capital funds’ performances: the one-year IRR by horizon as of June 30 2022 was down to 12% falling below the annualized 3-year, 5-year, and 10-

year IRRs, PitchBook’s Global Fund Performance Report writes.

This means that performance of investments made during the last year analysed was under the one made during the last 3, 5 and 10 years. regardless of whether they were divested or they are still in portfolio. All strategies’ performances were down with the exception of real estate, real assets and secondaries.

After extraordinary performances in 2021, private equity funds lived a wroste period in 2022. Their IRR in the first two quarters of 2022 was all negative. Venture capital also performed well in 2021, but it had negative returns for the first three quarters of 2022. The returns of private debts in 2022 were significantly lower than in 2021, this might be due to the raised interest rates in response to inflation. Funds of funds returns deteriorated dramatically in the first two quarters of 2022. It went from over 15% returns in Q2 2021 to a negative value in Q1 and Q2 of 2022. Secondaries funds returns also experienced declines as of the end of the 2nd quarter of 2022. The returns in the first two quarters of 2022 were significantly lower than the returns in 2021.

Private Equity Funds

Private Equity Funds

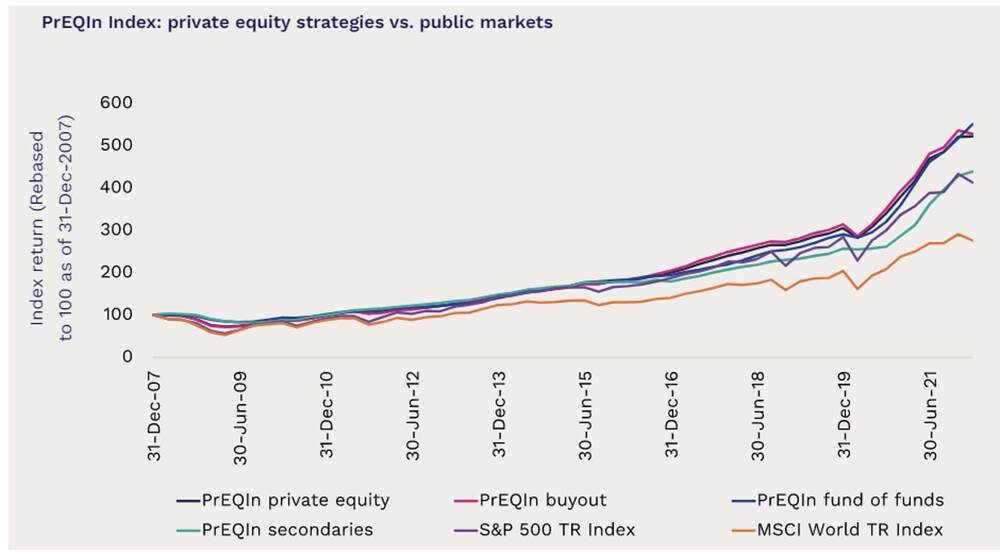

The performance of private equity funds reached a peak in 2021, the maximum quarterly IRR was around 15% in 2021. However, due to the deteriorating macroeconomic conditions, the performance of private equity funds declined in 2022. Till the 3rd quarter of 2022, private equity had two successive negative quarterly IRR, which were -2.5% and -0.5% in the second and third quarters. Such a significant decline was dramatic, and the last time such poor performance was in 2009. This was because private equity funds had certain difficulties. Nevertheless, other asset classes in 2022 also showed unfavorable performance. Figure 1 is a graph that shows Preqin’s index return for private equity. It reflects the performance of private equity, as well as public markets. As the graph displayed, after the dropped index in 2019, both private equity strategies and public markets increased aggressively. This aggressive increase slowed down or even turned into a decrease after June 2021. So, It was not hard to anticipate the underperformance of private equity in 2022 (see here Preqin Reports 2023).

The inflation, and the increased interest rates in response to the inflation, seem not temporary. Thus, the cost of LBOs increased and asset valuation dropped. Private equity funds hence need to confront the new situation. In addition, after the 2nd quarter of 2021, the rolling one-year horizon IRRs in Europe were lower than rolling one-year horizon IRRs in the United States by around 5%. This might be caused by the impact of the war between Ukraine and Russia. Investors should rethink their investments in Europe and North America. Moreover, opportunities may follow downturns, as Figure 1 showed, the overall performance after the downturn period in 2019 steadily increased. So, after the downturns in 2022, some might be looking to deploy some cash or cash equivalents into some depleted assets. Also, take-private was important in 2022 since the stock price of the public market decreased in 2022. It has a prospect to help private equity funds recover.

Venture Capital Funds

Year 2021 was also a peak year for the IRR of venture capital funds. The quarterly IRR in the first quarter of 2021 was the highest quarterly IRR since 2011. After the first quarter of 2021, the quarterly IRR of venture capital decreased persistently. In the 4th quarter of 2021, the quarterly IRR was around only 6%. After the peak year, the performance of venture capital funds was even worse than private equity funds in 2022. The IRR of it was negative for three consecutive quarters in 2022 as of the 3rd quarter of 2022. The quarterly IRR for the first three quarters of 2022 was around -5%, -8%, and -5%. Those figures are quite dramatic since they went from the summit to the abyss. Three successive negative quarter IRR was extremely unusual, it has not happened since 2011. Moreover, In both 2021 and 2022, venture capital funds smaller than 250 million in funds size had a slightly higher performance than those with funds size larger than 250 million. Such patterns did not show for the last five years. As of the 2nd quarter of 2022, the distance between funds sizes less than 250 million and greater than 250 million was around 15%.

In addition, due to the deteriorating macroeconomy, the number of public listings was significantly reduced in 2022. Investors were afraid of the swingeing market uncertainty, and thus they were incentivized to delay exits in order to avoid decreasing valuation. From Q1 to Q3 in 2022, venture capital funds generated the lowest IRR among all other asset classes. The delayed exits period derived some downward pressure on the returns of venture capital funds. The venture capital funds might remain as a long-term, yet illiquid asset class, as well as decreased valuations. In conjunction with a circumstance of the improvement of deal term, it incentives investors to deploy their capital over exits.

Real Estate Funds

Real estate funds were the most well-performed strategy among all other private equity market strategies. Unlike venture capital funds and private capital funds, the quarterly IRR of real estate funds remained positive for the first three quarters of 2022. Real estate funds performed well during 2021 and the first quarter of 2022. The quarterly IRR in the first quarter of 2022 was still high, which was around 6.5%. However, when came to the second and the third quarter in 2022, the quarterly IRR decreased to around 2.3% and 0.3%. Furthermore, its rolling one-year horizon in the first quarter of 2022 was around 27.3% and decreased to 24.2% in the second quarter of 2022.

With respect to vintage years, the distribution of its IRRs remained fairly tight through 2nd quarter of 2022 except for vintage years that were around the global financial crisis. Real estate funds had far less dramatic returns than other strategies like private equity and venture capital around the post-global financial crisis. Since the vintage year of 2010, even the bottom decile IRRs were consistently positive. Overall, on a year-to-year basis, it appears that the returns of real estate funds have less variability and more stability, and it showed perception countercyclical to some extent. Such features are attractive to investors in the context of a potential recession.

Compared with other funds like private equity and venture capital, real estate funds have much more relative advantages though such a rate of IRR was not favorable. The reason is foreseeable, the asset price and income from rentals were raised in response to inflation, as well as the increased cost of relocating. Though real estate funds outperformed other private equity strategies, it still significantly affected by the deteriorated overall economic condition. Due to inflation, the cost of construction and operation, along with the increased interest rate, eroded the returns from real estate funds.

Real Assets Funds

Most of the time IRRs of real assets funds are lower than the IRRs of some high yield funds like private equity or venture capital. However, during the first three quarters of 2022, the quarterly IRR of real asset funds was higher than the IRR of private equity and venture capital. Private equity and venture capital had some negative returns while returns of real assets were still positive. Compared to the historical norm of real asset funds, the quarterly IRR of real asset funds did not have weak performance in both 2021 and 2022. The IRR of real assets varied during the first three quarters of 2022 and was within the range of its typical variability. The quarter IRR was not unusual in 2022. The highest quarterly IRR in 2022 was around 5%, compared with the highest quarterly IRR in 2021, around 6%, which did not show signals of underperforming. Real asset funds also showed stability to some extent, since the vintage year of 2012, the bottom quartile IRRs were all positive.

In addition, the rolling one-year horizon of real assets funds had a quarter-to-quarter decrease since 2020. But the decreased amount was not significant, it decreased from the record high 23.4% returns to 18.5% in the first quarter of 2022. This decrease also showed in the infrastructure returns. Compared with historical infrastructure returns, we cannot conclude that such a rate of return was low. Infrastructure returns increased with returns from other strategies in 2020, but they did not have too many downward pressures as some other returns did in 2022. This might be because of the increased cost of capital, development, and operation.

Oil & gas rolling one-year horizon IRR also experience some decrease in the first two quarters of 2022. However, it was still high compared to its historical figures even though there is Ukraine Russian war. This might be caused by the 2021 rebound from the fierce abyss oil & gas market in 2020. Furthermore, with respect to the distribution of real assets funds IRRs by vintage years, most of the bottom decile IRRs are below zero. This gives managers’ selections a critical role when investing in real assets because it means it will generate negative or positive returns rather than higher or lower returns.

Private Debt Funds

The quarterly IRR in 2022 was not favorable, since there was a -2.5% IRR in the second quarter of 2022. But the IRR in the first quarter and the third quarter were positive, around 1.8% and 1.5%. Compared with the highest quarterly IRR in 2021, around 6.8%, the IRR in 2022 underperformed. In addition, The rolling one-year horizon IRR of private debt funds dropped to the negative in the 2nd quarter of 2022. This was the first time that private debt funds dropped to the negative since the Covid pandemic outbreak. The reason is easy to understand, which was the interest rate was raised in response to inflation and thus caused every fixed-income asset vulnerable. Though the performance of private debt in the second quarter of 2022 was unfavorable, it still was a good strategy in overall private market strategies. As in Figure 2, the historical data of private debt assets under management and some forward estimations provided by Preqin, it is obvious that private debt assets under management from 2010 to 2019 increased much slower than in years after 2022. We could assume an optimistic

However, there were significant constraints when trying to source debt through the public market, especially the syndicated loan market. The traditional market to originate these loans was almost replaced by private debt, and private debt takes some permanent market shares from banks. In a rising interest rate environment, direct lending funds appear to be attractive to investors because it provides loans in floating rate natures. However, due to decreased credit quality and increased loan defaults, the valuation may decline even if the interest rates drop. This should be a primary risk investors should consider within the private debt.

Funds Of Funds

The quarterly IRR of funds of funds in the second quarter of 2021 reached its highest record since 2011. After the second quarter of 2021, the quarterly IRR decreased on a quarter-to-quarter basis. But the quarterly IRR in the fourth quarter of 2022 was still acceptable, which was around 5%. However, in the first and second quarters of 2022, the quarterly IRR decreased dramatically. The IRRs became negative in those two quarters, which were around -1.3% and -1%. After those short periods of underperformance, the quarterly IRR recovered in the 3rd quarter of 2022. We would not expect such unfavorable performance occurs frequently since the IRR dispersion by the vintage year 2004-2017 was positive even in the bottom decile. The funds of funds are relatively stable compared with strategies like private equity and venture capital.

As of the 2nd quarter of 2022, the rolling one-year horizon IRR of funds of funds was around 11.5%, which was slightly below private capital’s 12%. Moreover, the one-year horizon of funds of funds was smaller than the 3-year, 5-year, and 10-year horizon, and this means that the performance of funds of funds was below its historical standards. In 2020 and 2021, funds of funds outperformed overall private capital, but this outperformance decreased when came to 2022. This was because funds of funds incline more proportion into venture capital, and venture capital was unstable over the past several years.

Secondaries Funds

Secondaries funds also experienced a bloom during 2021, and soon after the bloom, the performance of secondaries funds had a remarkable decrease in the first and second quarters of 2022. Its quarterly IRR dropped from the highest 13.5% since 2011 to around 2% and 1.5% in the first and second quarters of 2022. Shortly after, the quarter IRR recovered to around 8% in the third quarter of 2022. Secondaries funds still had strong advantages though they experienced a significant decrease in IRR.

The rolling one-year IRR of secondaries funds in the second quarter of 2022 was around 21.7%, and this outperformed many other private capital funds in the second quarter of 2022. However, under the deteriorating economic environment, the performance of secondaries funds significantly declined compared to the performance in 2021. With respect to quarterly returns, the returns in 2021 ranged from 7.3% to 13.8%, while the returns were 2.6% and 1.5% in the first two quarters of 2022.

The decrease in returns reflected lower net asset values across funds strategies in 2022, unfavorable exits conditions, and prolonged funds live. In addition, secondaries funds returns may suffer if the extension of exits occurred. However, there is a primary advantage to opt secondaries funds over primary funds. It could realize cash returns significantly faster than primary funds by purchasing mature portfolios.