First Citizens BancShares of Raleigh has agreed to buy the commercial banking business of Silicon Valley Bridge Bank, National Association, the bridge bank to which all of the deposits (both insured and uninsured by the Federal Deposit Insurance Corporation) and substantially all assets and all qualified financial contracts of Silicon Valley Bank (SVB) were transferred last March 13th as SVB collapsed and was seized by the U.S. government (see here the press release at the time). SVB bridge bank’s 17 branches reopened yesterday under the First Citizens brand and all SVB depositors have become depositors of First Citizens, according to a Federal Deposit Insurance Corporation (FDIC) press release published last Sunday March 26.

First Citizens BancShares of Raleigh has agreed to buy the commercial banking business of Silicon Valley Bridge Bank, National Association, the bridge bank to which all of the deposits (both insured and uninsured by the Federal Deposit Insurance Corporation) and substantially all assets and all qualified financial contracts of Silicon Valley Bank (SVB) were transferred last March 13th as SVB collapsed and was seized by the U.S. government (see here the press release at the time). SVB bridge bank’s 17 branches reopened yesterday under the First Citizens brand and all SVB depositors have become depositors of First Citizens, according to a Federal Deposit Insurance Corporation (FDIC) press release published last Sunday March 26.

As of March 10, 2023, the bridge bank had approximately $167 billion in total assets and about $119 billion in total deposits. Transaction with First Citizens included the purchase of about $72 billion of SVB’s assets at a discount of $16.5 billion.

Approximately $90 billion in securities and other assets will instead remain in the receivership for disposition by the FDIC. In addition, the FDIC received equity appreciation rights in First Citizens BancShares common stock with a potential value of up to $500 million.

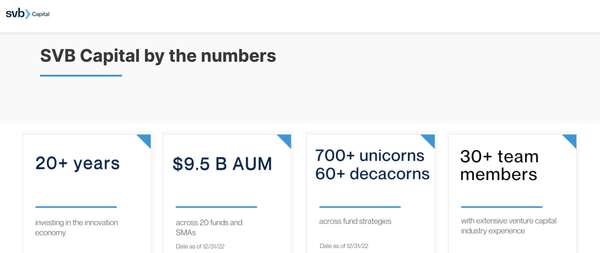

What is not included in the transaction with First Citizens is also SVB’s securities business and its venture capital investment portfolio. The latter is said to be valued around $9.5 billion and includes stakes in major venture capital funds such as Sequoia Capital, Ribbit Capital and Andreessen Horowitz (see here the Information).

As MarketWatch wrote, Silicon Valley Bank may have started out in the 1980s as a bank that mostly supported small businesses and tech startups, but that changed over the last decade as the bank rode the boom in venture capital and technology investing. Its chief business was making loans through fund subscription lines to venture capital firms that, in turn, used the rock-solid capital commitments of their investors as collateral. A decade ago, SVB held $1.7 billion of fund subscription line loans, representing 19% of its total loan portfolio, Securities & Exchange Commission filings show. By the end of 2022, the bank was holding $41.3 billion of these loans on its books, making up 56% of its total book. SVB created a new business segment, global fund banking, to manage its subscription lines. By contrast, debt financing the bank extended directly to startups, tech companies and biotechs amounted to just $15.3 million, SEC filings show, only a fifth of SVB’s loans at the end of 2022.

However, MarketWatch wrote, while all this activity helped boost SVB’s deposits from $62 billion at the end of 2019 to $189 billion at the end of 2021, the bank did not earn all that much income from it. Acutally those loans only added up to $2 billion at the end of 2022, SEC filing shows, a mere 2.6% of SVB’s loan book.

That’s why the bank, which had been plowing the excess money into its investment portfolio, started to buy long-dated mortgage bonds with fixed yields to boost the bank’s income. But when rates on bonds spiked last year, value of those bonds SVB held dropped. As by the start of this year, venture capital investment had dropped off too and many venture-backed companies were drawing down cash on their bank accounts. So when deposits fell, SVB sold a big chunk of its long-dated bonds, realizing a $1.8 billion loss. With SVB’s balance sheet shaky, the bank’s venture capital clients started directing their portfolio companies to move their cash out of the bank, causing a run and then the default of the bank.

Previously Bloomberg wrote that SVB’s book of venture loans had caught attention by some big private capital firms such as Apollo, Ares, Blackstone, Carlyle and KKR. Now even if they actually didn’t end in buying SVB’s loans books are in the first line to fill the gap that SVB left in the venture debt market as banks such as Deutsche Bank, Credit Suisse and smaller regional banks as First Republic Bank all have been shaken by the sense of unease that has drifted into the banking sector. That sense of instability will hurt banks’ ability to fill the gap left open by SVB’s fall.

It’s true that globally, venture debt underperformed in 2022 along with the global macro conditions such as raised interest rates, tarnished IPOs, and the Ukraine-Russia war. Historically, the low interest rate benefited the venture debt as it made companies cheaper to take venture debt and venture debt could generate strong returns due to the low interest rates and the spread passed on to borrowers. However, at the end of 2022, rates were rather higher everywhere.

As for the US, the Wall Street Journal prime rate rose to around 7.5% and the twelve months LIBOR rate rose to around 5.4%. Such rates were the highest rate since 2007. This led to direct impacts on lenders, which would charge a higher rate to borrowers. Hence, it made the venture debt more expensive. In addition, a strong IPO market is a release valve of return for venture capital-backed companies. However, the IPO market in 2022 underperformed.

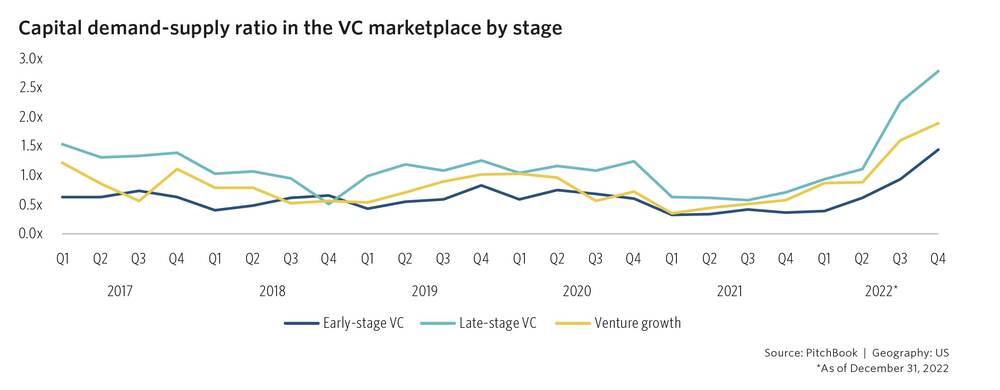

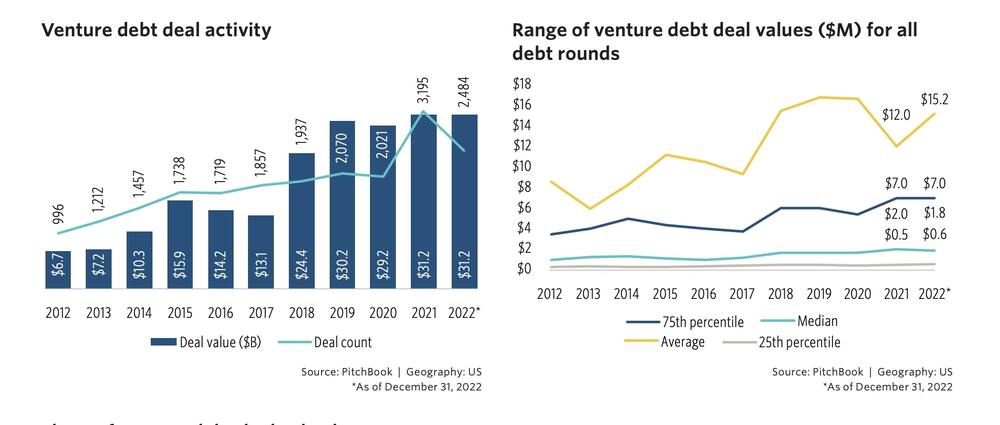

At the same time venture capital activities experienced significant declines in 2022, and the valuation multiples also had some drops. Currently, the US venture market is dealing with a staggering lack of capital as nontraditional investors pull back from venture capital and record amounts of dry powder stay on the sidelines. Moreover, Pitchbook research posits that 2.1x the amount of capital is being demanded by VC-backed companies than is actually being supplied at the moment. Much of this gap can be attributed to the swift retreat of nontraditional investors, especially large institutions that have played a role in the extension of the late stage over the past few years. Meanwhile as for the US venture debt in 2022, it counted 2484 deals worth $31.2 billion compared to 31.2 billion for 3195 deals in 2021, Pitchbook said in its recent report and added that it is reasonable to think this robustness to continue expanding, as the private credit asset class keeps evolving and more VC-backed startups have started to explore debt financing options during a time when equity capital has become more costly and elusive for founders.

The most apparent advantage of venture debt are that it provides minimal dilution. It allows startups to maintain ownership and control when it comes to decision-making. Also, debt issuance does not depend on valuation reset. Using debt for financing helps companies avoid resetting their valuation yet continue to pursue growth and profitability. Moreover, venture debt provides more flexibility to startups, as the environment is more lender friendly and makes more traditional debt lenders pickier and less willing to offer high-flexibility loans. Also, the drawback is obvious, venture debt needs to be eventually paid back and it typically has shorter terms. It may foreclose a business if a covenant breaches.

The most apparent advantage of venture debt are that it provides minimal dilution. It allows startups to maintain ownership and control when it comes to decision-making. Also, debt issuance does not depend on valuation reset. Using debt for financing helps companies avoid resetting their valuation yet continue to pursue growth and profitability. Moreover, venture debt provides more flexibility to startups, as the environment is more lender friendly and makes more traditional debt lenders pickier and less willing to offer high-flexibility loans. Also, the drawback is obvious, venture debt needs to be eventually paid back and it typically has shorter terms. It may foreclose a business if a covenant breaches.

Venture debt also has some advantages for investors. As an increasing number of high-quality companies consider venture debt as a financing option, venture debt investors can have a wider scope of selections. Also, venture debt lenders can place a cash runway preservation requirement to filter out companies that run out of cash. In addition, the draw period shifted toward pushing borrowers to use the capital raised more efficiently. Furthermore, most venture debt has a floating interest rate, this ensures investors’ benefit in the event of significant change in interest rates

Yuyang Sun contributed to this article