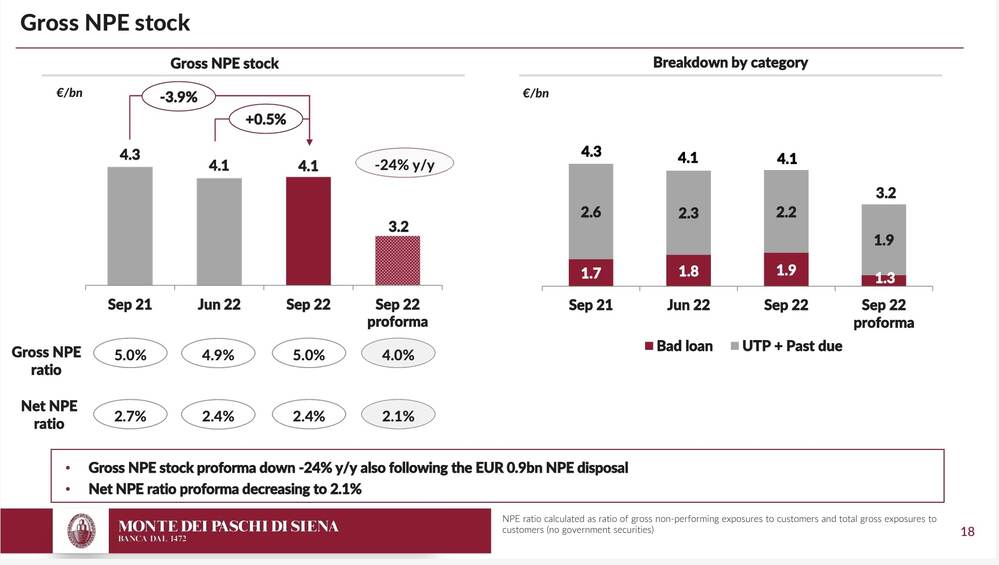

Monte dei Paschi, the troubled Italian bank, is no longer facing a bail-in risk as it successfully completed a 2.5 billion euros capital increase on 4 November 2022 at 2 euros per share (See here a previous post by BeBeez). The bank’s expected Net NPE ratio for 2024 amounts to 1.9% and to 1.4% for 2026 from 2.6% at the end of 2021.

Monte dei Paschi, the troubled Italian bank, is no longer facing a bail-in risk as it successfully completed a 2.5 billion euros capital increase on 4 November 2022 at 2 euros per share (See here a previous post by BeBeez). The bank’s expected Net NPE ratio for 2024 amounts to 1.9% and to 1.4% for 2026 from 2.6% at the end of 2021.

Intrum Italy, a joint venture of Stockholm-listed Intrum (51%) and Intesa Sanpaolo (49%), signed a servicing agreement with AMCO for the management of a 500 million euros of distressed leasing credits (See here a previous post by BeBeez). Intrum also announced the closing of the acquisition of a portfolio of NPLs leasing of 570 million from Intesa Sanpaolo.

The basket bond programme that BPER and CDP launched in September currently amounts to 112 million euros ahead of a 250 million target (See here a previous post by BeBeez). The basket bond involves 15 Italian SMEs. Four Italian companies issued 4-6 year minibonds for a total of 33 million. BPER and CDP acquired from Mortirolo BB spv notes linked to 3M Euribor rate at zero floor and a spread. Grimet, an Italian producer of industrial components, issued a 4 million minibond. The company has sales of 56.5 million, an ebitda of 8.2 million and a net debt of 19.6 million. Bayker Italia, a distributor of tyles, issued a 4 million bond and has sales of 128.7 million with an ebitda of 4.4 million and a net debt of 26.9 million. WIIT, a Milan-listed Italian IT, issued a minibond of 20 million. The firm has a turnover of 102.9 million and an ebitda of 36.7 million. OSAI Automation System, a Milan-listed industrial company, made a 5 million issuance. In 1H22, the company generated sales of 16.6 million, an ebitda of 1.8 million and a net financial debt of 13.1 million. CM spa, CMB – Cooperativa Muratori, Braccianti di Carpi, Zanutta spa, Cipriani Profilati SB srl, Weightpack, Co.ge.fa, Centro di Medicina, Maps, Massucco T joined the previous rounds of issuance of the programme.

Planet Farms Holding, an Italian vertical farming company, received from Unicredit a financing facility of 17.5 million euros with the warranty Garanzia Green SACE (See here a previous post by BeBeez). The company will invest such resources in the development of a new farm. Planet Farms has sales of 2 million, an ebitda of minus 6.2 million, a net financial debt of 6.7 million, and equity of 3.5 million.

Generalfinance, a provider of factoring facilities to companies in special situation, generated a turnover of 2.01 billion euros in 2022 (up 43% from 1.4 billion in 2021) (See here a previous post by BeBeez). Generalfinance outperformed the Italian factoring sector that grew by 16%.

Fondazione Enpam, the pendion fund of Italian doctors and dentists started a selection of private equity, venture capital and private debt with a focus on Italy in which to invest (See here a previous post by BeBeez). Enpam aims to allocate 190 million euros in buyout/growth private equity investors with a fundraising target of above 150 million that invest 70% of their portfolio in Italian companies; 50 million in private debt funds with a fundraising target of 150 million and 70% of investments in Italy. The deadline for applying is 15 January, Sunday.

Eurolls, an Italian producer of industrial components, received a direct lending facility of 3 million euros in support of the working capital that Azimut Direct brokered (See here a previous post by BeBeez). An undisclosed institutional investor subscribed the financing that has a 4-year tenure and a pre-amortising period of three months with the warranty of Garanzia SupportItalia SACE. The company will invest such resources in its organic growth.

Luigi Luzzatti concluded a multioriginator securitization of NPLs with a face value of 545 million euros (See here a previous post by BeBeez). The spv Luzzatti POP NPLS 2022 acquired the NPLs from 15 banks and issued asset-backed notes in three tranches: senior (118.25 million – Baa1/BBB+ rating from Moodys and ARC), mezzanine of 17.5 million and a 3 million junior tranche. Banca Popolare di Sondrio sold NPLs with a face value of 242.5 million. The other sellers are Banca di Piacenza, Banca Popolare di Fondi Società Cooperativa, Banca di Credito Popolare, Banca Popolare di Puglia e Basilicata, Banca Agricola Popolare di Ragusa, Cassa di Ravenna, Banca di Imola, Banca Popolare del Frusinate, Banca Popolare Sant’Angelo, Banca Sella, Cassa di Risparmio di Asti, Banca di Credito Peloritano, Cassa di Risparmio di Bolzano, and Banca di Cividale (Civibank).