Italian online financial advisory service MoneyFarm looks for new investors among foregin venture capitalists, MF-Milano Finanaza wrote last Saturday Jully 19th.

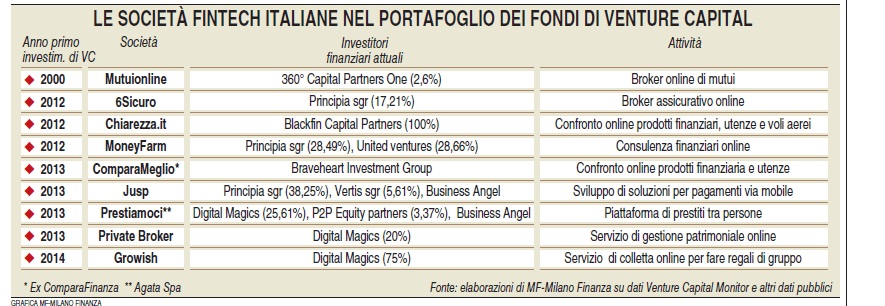

Founded by chairman Paolo Galvani and ceo Giovanni Daprà in February 2011, the company is specialized iin building and managing portfolios in ETFs for retail investors and it is one of the few Italian fintech companies having venture capital operators among its shareholders (see the table in this page).

“Massimiliano Magrini’s Annapurna Ventures and Paolo Gesses’s JV Capital hgave as 300k euros as seed money while as founders we invested 400k euros”, Galvani said to MF-Milano Finanza. “That money was used to set up the company, prepare the project and ask the compelling authorizations to Bank of Italy in order to be active on the Italian market as a financial advisor. It took 9 months to have the authorizations and the company has been active since Spring 2012. In Summer 2012 then we received a financing round of a total of 2.6 million euros by Principia sgr’s venture fund (for a 28.49pct stake) and by United Ventures (28.66pct), which is the new investment veichle by Magrini and Gesses together”. Finally last December also Vittorio Terzi, a senior director of McKinsey, invested in MoneyFarm capital.

Fintech setors is starting to be in the Italian banking system’s radar as some banks have launched fintech accelerators (as Start Lab by Unicredit and GranPrix Fin Startup Program by CheBanca! – Mediobanca group) while other banks have strict contacts with companies’ accelerators in order to make contact with the most interesting startuppers in the sector as Intesa Sanpaolo did last February when it partecipated to the H-ack Bank initiative realized by H-Farm accelerator, together with Unicredit and CheBanca!

Abroad bank giants as Credit Suisse, Goldman Sachs, Barclays and Ubs developed their own accelerators or signed agreements with existing accelerators, while Santander sponsored a private equity fund focusing on fintech investments.

As for Schroder, the asset managment firm invested last June in the last financing round of NutMeg, a British startup founded in 2012 specialized in creating and managing portfolios in ETFs for retail investors as well as MoneyFarm. In the last round MoneyFarm obtained 32 million euros by new investors reaching a total of 50 millions invested by venture capitalists since its foundation.

Schroder beated Aberdeen in taking a stake in MoneyFarm’s shareholders capital and it is now an investor together with Balderton venture capital fund and a with Micheal Spencer (Icap broker’s ceo). Investment in NutMeg is seen as quite important by Schroder as in NutMeg’s board it is now sitting Schroder’s vice chairman Massimo Tosato.

NutMeg is not the only one fintech company having obtained such an interest from international investors in the last few months. In the US for example WealthFront obtained a total og 65.5 million dollars by venture capitalists while Betterment raised 45 millions.

In this scenario MoneyFarm might find it easier than before looking for new investors. Chairman Galvani said: ” We might choose to enlarge our activity abroad. In Italy you cannot find venture capital funds able to invest 5 million euros or more in a single deal so it is necessay to look for foreign investorsi. The latter however won’t invest in a company focusing just on Italian clients and this is why I think we need to change and opern new markets even if we want to keep on growing in Italy too”.

A good hand to build international prestige for the company might be given by the new MoneyFarm’s advisory board which will include well-known people such as Michael Spence, Nobel award for Economy in 2001, and Meir Statman, Glenn Kilmek Professor at Santa Clara University.