After three consecutive years of growth and a record of 1.6 billion euros marked in 2017, in 2018 the value of investments in hotel properties in Italy fell by as much as 20% to 1.3 billion euros. At the same time, however, the number of transactions increased by 20%. The study “Italy Hotel Investment snapshot 2018” by EY.

After three consecutive years of growth and a record of 1.6 billion euros marked in 2017, in 2018 the value of investments in hotel properties in Italy fell by as much as 20% to 1.3 billion euros. At the same time, however, the number of transactions increased by 20%. The study “Italy Hotel Investment snapshot 2018” by EY.

According to Marco Zalamena, Head of Hospitality of EY, “the decline in total investment volume in 2018 is due essentially to the lack of significant value deals, but the Italian hotel market remains solid, lively and attractive, especially in large cities such as Rome, Milan, Venice and Florence, where almost 80% of transactions were concentrated “. Specifically, Rome has catalysed 40% of investments, Milan 17%, Venice 11% and Florence 10%. The highest investment volume per room is found in Venice (500k euros), followed by Milan (245k euros).

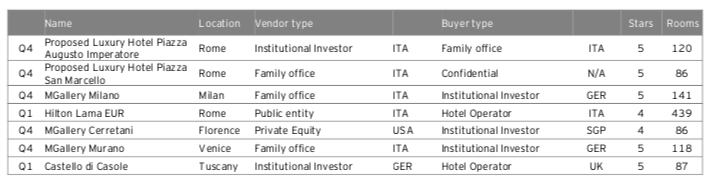

The biggest deal of 2018 was the development project by a family office of a luxury hotel in Rome, in Piazza Augusto Imperatore. There is nothing official, but on the market it is said the building, until now owned by the Fondo Immobili Pubblici managed by InvestiRe sgr has been sold to the Italian luxury group Bulgari, which will bring back to life the old monumental building of Italian pension institution Inps between 2020 and 2022 (see here La Repubblica and Gugsto), in partnership with Marriott International,

The main investors in the sector were mainly institutional (40%), followed by hotel operators (25%) and hotel operators (23%). 44% of investors are Italian and 42% are European.

For 2019, the outlook is positive, despite macroeconomic indicators. Zalamena says: “Based on our analysis, we estimate that, by the end of 2019, the total volume of investments may exceed 2 billion euros, a figure that contributes both to the conclusion of the purchase of Belmond Hotels and Resorts by LVMH (see here a previous post by BeBeez) and the sale, already underway, of a significant number of hotels and accommodation facilities in the main Italian cities and tourist destinations”.

Institutional investors will probably become even more active in the Italian hotel property market, especially institutional and private equity funds. Oaktree is for example in these days in exclusive negotiation with Castello sgr to take over the portfolio of hotels owned by the Cosimo I and Augusto funds (see here a previous post by BeBeez). The NPLs segment should in turn lead to auction sales of medium-small size assets, especially in secondary locations (see here a previous post by BeBeez for Premium readers, see here how to subscribe for only 20 euros a month).

A recent CBRE analysis also predicts strong growth and investment from international investors in the hotel sector in Italy (see here a previous post by BeBeez).