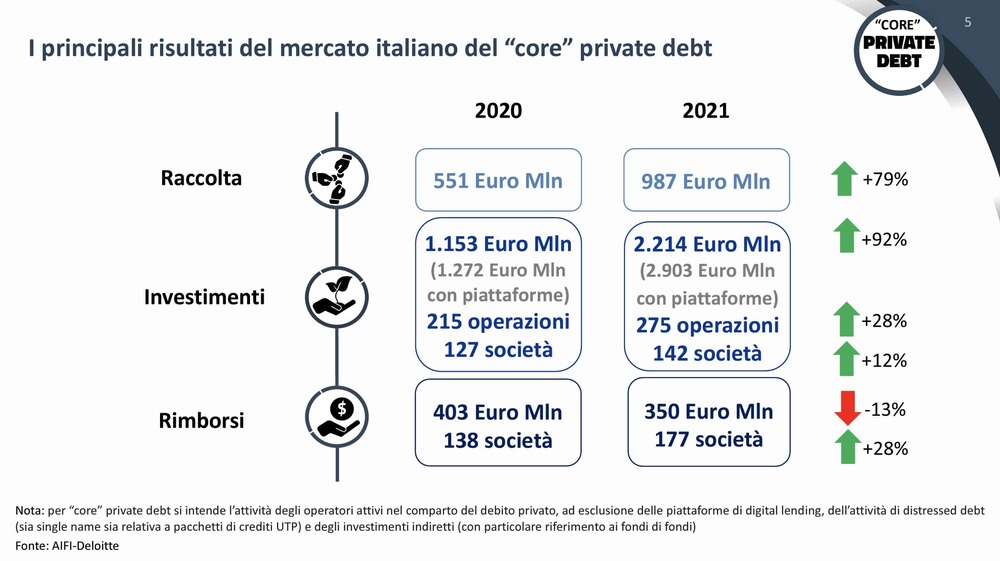

In 2021, the Italian market attracted investments of private debt and direct lending funds for 2.214 billion euros (1.153 billions in 2020) for 275 subscriptions (215, +28%) spread over 142 companies (127, +12%), said a report of AIFI and Deloitte (see here a previous post by BeBeez). Italian private debt funds raised 987 million (551 million, +79%). However, the Italian private debt market is much wider as you consider all kind of investors in all kind of private debt instruments, including securitizations and fintech platforms. Ad for BeBeez data, in fact in 2021 the private debt investments in the Italian market have been worth more than 26 billion euro (13.1 billion) or above 29 billion including the UTP deals (see here BeBeez Private Debt Report 2021, BeBeez Fintech Platforms Report 2021, BeBeez NPL Report 2021 available for the subscribers to BeBeez News Premium and BeBeez Private Data, the Database that BeBeez developed with FSI).

In 2021, the Italian market attracted investments of private debt and direct lending funds for 2.214 billion euros (1.153 billions in 2020) for 275 subscriptions (215, +28%) spread over 142 companies (127, +12%), said a report of AIFI and Deloitte (see here a previous post by BeBeez). Italian private debt funds raised 987 million (551 million, +79%). However, the Italian private debt market is much wider as you consider all kind of investors in all kind of private debt instruments, including securitizations and fintech platforms. Ad for BeBeez data, in fact in 2021 the private debt investments in the Italian market have been worth more than 26 billion euro (13.1 billion) or above 29 billion including the UTP deals (see here BeBeez Private Debt Report 2021, BeBeez Fintech Platforms Report 2021, BeBeez NPL Report 2021 available for the subscribers to BeBeez News Premium and BeBeez Private Data, the Database that BeBeez developed with FSI).

A news issue of the Viveracqua Hydrobond basket bond programme has been structured by Banca Finint for supporting the investment plans of members of the emonymous Italian consortia for the water management. This time a 148.5 million euros issue has been placed having bonds issued by 6 members of the consortium as collateral (see here a previous post by BeBeez). The issuance will support investments of 350 million of utilities based in the Veneto Region. The spv Viveracqua Hydrobond 2022 carried on a private placement of abs and subscribed the issuances of the utilities Acque del Chiampo, Acque Veronesi, BIM Gestione Servizi Pubblici, ETRA, Livenza Tagliamento Acque, and Piave Servizi. The first tranche is due to mature on 21 February 2046 and pays a biannual coupon of 3.55%, while the other tranche pays a 3.46% coupon and will mature on 21 February 2038. The European Investment Bank, Cassa Depositi e Prestiti (CDP) and Kommunalkredit Austria subscribed the tranches.

The European Investment Fund (EIF), Milan-listed Mutui Online (MOL) and corporate credit broker NSA created IGLOO (Italian Guaranteed Loan Origination Platform), a platform for issuing 170 million euros worth ESG loans to at least 800 Italian companies (see here a previous post by BeBeez). EIF will invest 50 million in the abs notes that Igloo will issue. NSA, MOL and foreign investors will subscribe the remaining portion. Every loan of the securitization portfolio will get the warranty of Fondo di Garanzia Pmi.

Unicredit is close to launching a new multi-sector ESG basket bond programme for the Italian MSMEs (see here a previous post by BeBeez). The programme will allow Italian firms to issue 6-years or longer minibonds of 2 – 25 million euros for financing the implementation of ESG strategies.

UBS Asset Management refinanced a portfolio of Italian renewable energy plants after having borrowed 46 million euros from Intesa Sanpaolo and Unicredit (see here a previous post by BeBeez). The facility also allowed UBS to refinancing a portfolio of 13 photovoltaic plants with a power of 14MW and 4 biogas plants with a power of 4MW.

EuroGroup Laminations, an Italian manufacturer of industrial components of which Tikehau Capital owns a stake, attracted two loans of 15 million euros each from BNL Gruppo BNP Paribas and Crédit Agricole Italia with the green warranty of SACE (See here a previous post by BeBeez). The company will invest the proceeds in increasing its production with a sustainable approach. Marco Arduini is the ceo of Euro Group. The company has sales of 424.3 million and aims to invest 150 million in the 2021-2025 period.

CTIP Blu, the developer of an Abruzzo-based biomethane gas out of urban waste, raised 25 million euro in equity and above all in credit lines (see here a previous post by BeBeez). IES-Biogas (Gruppo Snam) is acting as EPC Contractor. CTIP Blu sold a 6.75% to Sustainable Securities Fund (SSF), an impact investing vehicle of Alternative Capital Partners, who subscribed subordinated debt instruments. SSF raised 80 million ahead of a 200 million target. Belenergia owns 51% of CTIP Blu and belongs to Mid Infra SLP, a French infrastructures investor that Schroders Capital manages, while the founders Vincent Bartin and Jacques-Edouard Lévy have 49%. Further shareholders of CTIP Blu are Ciclo Blu (20%), CTIP srl (15%) and Energy.com (7.25%).

Ecopol, an Italian producer of sustainable firms of which Tikehau Capital owns 33%, received a 35 million euros financing facility from Crédit Agricole Italia, Banco BPM and Intesa SanPaolo (see here a previous post by BeBeez). Ecopol will invest these proceeds in its international expansion and the construction of a plant in USA. Ecopol has sales of 14 million, an ebitda of 4.5 million and a net financial debt of 3.8 million.

Florian, an Italian company active in the field of wood processing and marketing, issued a 7-years 25 million euros bond that Banca Finint structured and placed, while SACE provided a warranty (See here a previous post by BeBeez). Cassa Depositi e Prestiti, Mediocredito Centrale, Banca Popolare dell’Alto Adige, Veneto Sviluppo, Friulia, Finest, Banca Valsabbina, and Mediocredito Trentino Alto Adige subscribed the bond. The company will invest the raised proceeds in the investments planned for 2022-2024. Florian belongs to the eponymous family and received a rating of A3.1 from Cerved Rating Agency. The company has sales of above 160 million (+35% yoy), an ebitda in the region of 34.1 million (15.2 million), an ebitda margin of 21%, and a net financial debt of 53.8 million.

Sublitex, a producer of special papers and films that belongs to the Italian fashion firm Gruppo Miroglio, received from Unicredit a green loan of 3 million euros for which SACE provided its Garanzia Italia warranty facility (see here a previous post by BeBeez). The loan is part of Unicredit’s Finanziamento Futuro Sostenibile programme. Sublitex has sales of 21.1 million, an ebitda of 1.1 million and a net debt of 1.2 million and will invest the proceeds of the facility in reducing the waste of materials for its production cycle.

Art Cosmetics received from Unicredit a 2 million euros loan with a tenure of 58 months with the Garanzia Italia warranty of SACE (see here a previous post by BeBeez). The facility is part of the bank’s ESG programme Futuro Sostenibile. Unicredit will charge the company with a lower interest rate upon the achievement of ESG targets. Art Cosmetics has sales of 64.4 million and an ebitda of minus 0.18 million.

Gabriele Casati and Alberto Arrotta launched private debt asset manager and investor Merito sgr of which own even stakes (see here a previous post by BeBeez). The vehicle started its fundraising and attracted the commitment of Fondo Italiano d’Investimento sgr and of the European Investment Fund. Azimut Libera Impresa sgr appointed Merito for managing its private debt fund Antares AZ 1, launched in 2016. Antares AZ had been jointly launched by Azimut and Antares Advisory, led by Stefano Romiti, who has been now also appointed a manager of Antares AZ 1 Fund. The fund had raised 127 million euros from Fondo Italiano d’Investimento, the European Investment Fund, Confidi, family offices and other financial services firms.