Milione spa, the parent company of Save spa, the operator of the Venice and Treviso airports, in Italy, refinanced debt for the whole group by issuing a 300 million euros bond, which obtained a Baa3 rating by Moody’s with a stable outlook.

The deal happens one year after the tender offer that delisted Save from the Italian Stock Exchange at the end of October 2017 and brought the company under the control of DWS infrastructure funds managed by Deutsche Asset Management and of funds managed by InfraVia Capital, each owning a 44% stake in the company, while italian entrepreneur Enrico Marchi, through Finanziaria Internazionale, maintained a 12% stake. Mr. Marchi structured the deal on Save after the divorce from his business partner Andrea De Vido, who co-owned Finint Group (see here a previous post by BeBeez). The tender offer was then financed by Intesa Sanpaolo and Unicredit.

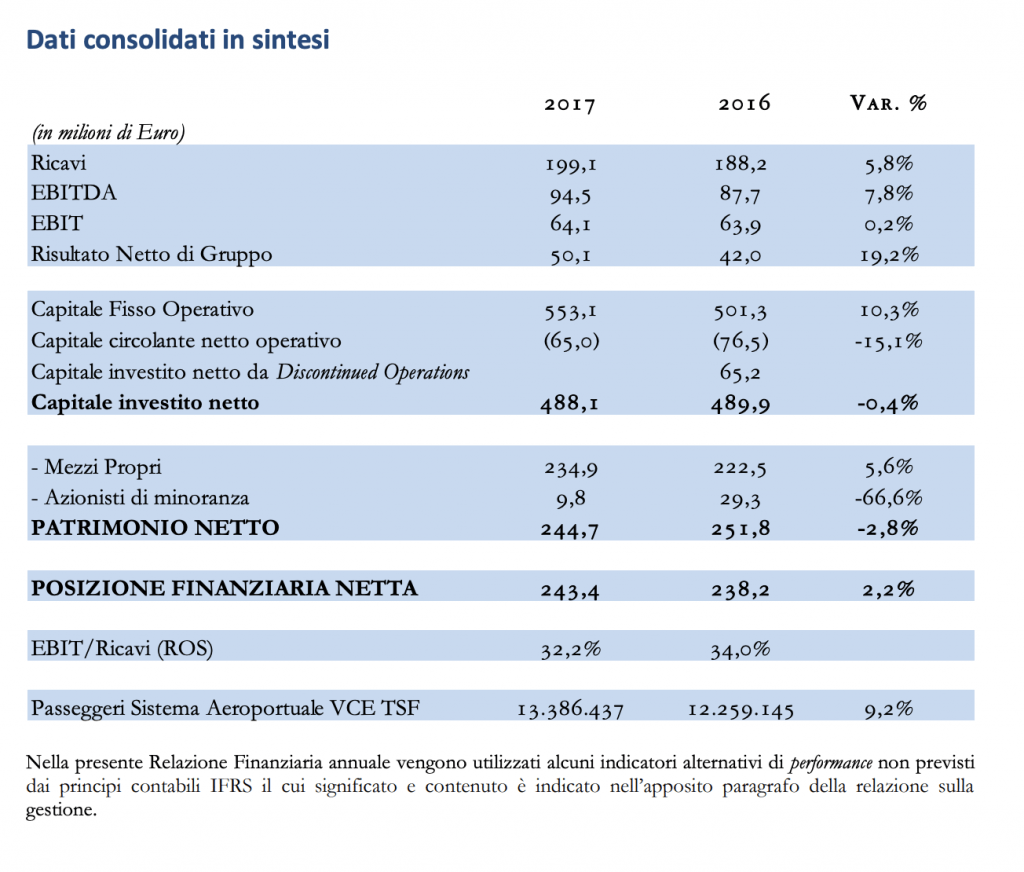

More in detail, Moody’s report explains that the bond is senior secured maturing in 2026 and paying a 2,47% fixed coupon. The bond is part of a refinancing package that brings the whole group’s debt at the Milione spa level, leaving Save with a maximum debt of 30 million euros. Save closed 2017 FY financial statement with 199.1 million euros in revenuews, 94.5 million euros in ebitda and a net financial debt of 243 millions, including a new loan package of 580 million euros which have been issued in order to refinance debt and to finance new investments planned for the 2018-2021 period. Moody’s report says that now Milione spa has a 515 million euros gross financial debt maturing in 4 years.