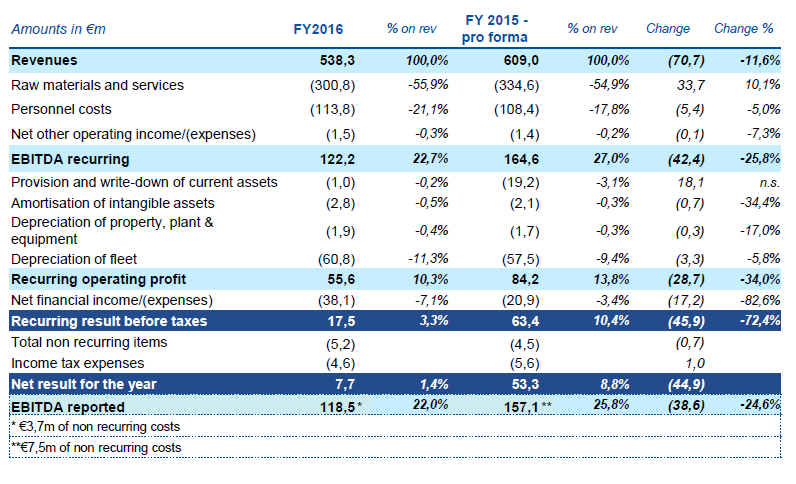

Moby group, owner of Moby and Tirrenia-Cin ferry companies, closed FY 2016 with 538.3 million euros in revenues down from 609 millions in 2015 and with a 122.2 million euros ebitda down from 164.6 million the year before, MF Milano Finanza, writes today, telling about contents of yesterday’s conference call with bond investors on FY 2016 results.

Moby group, owner of Moby and Tirrenia-Cin ferry companies, closed FY 2016 with 538.3 million euros in revenues down from 609 millions in 2015 and with a 122.2 million euros ebitda down from 164.6 million the year before, MF Milano Finanza, writes today, telling about contents of yesterday’s conference call with bond investors on FY 2016 results.

Ebitda margin however was sufficiently high to meet financial covenants as net debt leverage was about 4.15x versus a maximum of 4.5x fixed by financial covenants as stated in the 300 million euros bond offering circular. And that was even if net financial debt was actually 507.9 million euros on Dec 31st 2016 up from 460.5 million euros on Sept. 30th.

That’s why bond investors showed appreciation yesterday with quotes reaching a 102 price, following a positive trend started some months ago after the bond had touched a miminum around 90 cents last November on disappointing H1 results. A very good Q3 2016, instead, with a 100.2 ebitda in nine months, made investors happy sometime later.

Third quarter of each year is actually the best performing period for Moby as it includes revenues from Summer tourism. On the contrary, forth quarter is the wrost performing period for Moby and that’s why its managers had previously stressed their investors that Q4 ebtida would have been negative so that whole year’s ebitda would have been arund 120 million euros, down from 129.4 millions recorded for the nine months. Q4 ebtida was actually negative for 7.3 million euros, pushing down FY 2016 ebitda to 22.7% of group revenues down from 27% in 2015.

Margins were kept high mainly thanks to a better management of payables (59 million euros): debts versus suppliers were raised actually to 129 million euros at the end of 2016 from about 70 milions at the end of 2015.