Italian Residential Mortage Backed Securities (RMBS) notes issued by Berica ABS 5 srl have been listed yesterday on the Luxembourg Stock Exchange.

Italian Residential Mortage Backed Securities (RMBS) notes issued by Berica ABS 5 srl have been listed yesterday on the Luxembourg Stock Exchange.

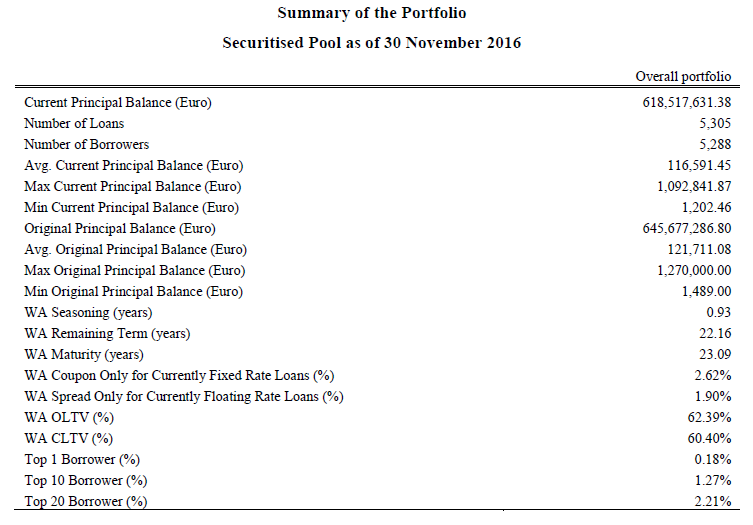

These are notes coming from a new r securitization of a 618.5 million euros residential mortgages portfolio made of 5,305 loans issued to 5,288 counterparts from Banca Popolare di Vicenza and its subsidiary Banca Nuova, the Issue prospectus explains.

Listed RMBS notes have been issued in three tranches all maturing in 2067: a 507.2 million euro Class A tranche which euro con Moody’s assigned definitive Aa2 rating, a 39.2 million euros Class B tranche having rating A1 and a 20.6 million euros Class C tranche with rating A3. There is also a 51.5 million euros junior tranchewith no rating. Arranges for the deal are Banca Popolare di Vicenzaitself together with JP Morgan while Zenith Service is the master servicer.

This is securitization numer 17th for Banca Popolare di Vicenza and the deal replicates the structure of the previous residential securitizations, the last one being Berica ABS 4 srl, listed in 2015.