Italy’s eyewear maker Marcolin is launching an international roadshow starting today for issuing a new 250 million euros bond with a 6 years’ maturity non callable for 1 year aiming at refinancing the existing debt and repaying a vendor loan.

Marcolin had been delisted from the Italian Stock Exchange in 2012 following a tender offer by funds managed by Pai Partners.

The new bond has expected B2/B ratings by Moody’s and S&P’s, will pay a floating rate coupon and will be sold by joint bookrunners Credit Suisse, Deutsche Bank and Unicredit.

The deal is part of a more complex agreement including the announced joint venture with French luxury giant Lvmh, who is buying a 10% stake in Marcolin’s capital and is actually founding a new company that could eventually absorb all of Lvmh’s eyewear licenseses.

In a press release published yesterday Marcolin said that refinancement will be completed by additional loans for a total of 40 million euros and by a 21.9 million euros capital increase to be subscribed by Lvmh.

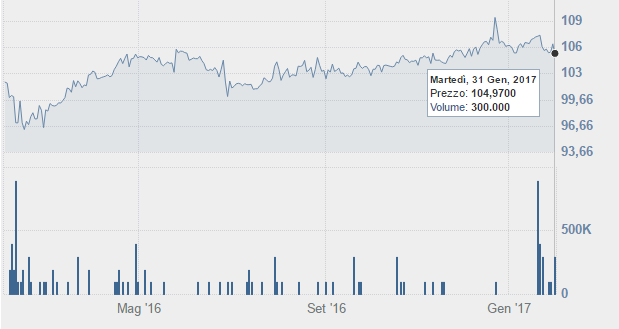

Marcolin listed a 200 million euros bond on the ExtraMot Pro market in 2013, maturing in November 2019 and paying an 8.5% fixed coupon. That bond will be repaying in advance by February 13th.

The Italian glasses maker sold about 15 million glasses in 2105 reaching 434.8 million euros in revenues (from 382.1 millions in 2014), with a 50.2 million euros djusted ebitda (from 43.8 millions) and a 213.9 million euros net financial debt (from 196.1 millions). In the 9 months closing on Sept. 30th 2016 the company reached 335.1 million euros in revenues and a 35 million euros ebitda with 215 million euros of net financial debt.