A reform of Fondo Centrale di Garanzia delle pmi (Italy’s Government fund issuing guarantees for SME financing) is on its way. The reform will enlarge fund’s activity to SMEs with lower credit ratings. MF Milano Finanza wrote last Saturday October 30th.

The news was announced last October 27th in Rome by Stefano Firpo, managing director for industrial policy, competition and SMEs at the Italian Economic Development Ministry, during a meeting at the Ministry’s headquarter where about 20 reperesentatives of the Italian private debt industry attended. Both MF-Milano Finanza and BeBeez were invited to the meeting where an update of data about the Italian private debt sector have been presented by Giancarlo Giudici, head of the Private Debt Observatory at the Milan Politecnico University.

Mr. Firpo explained: “We are perparing a reform of the Central Guarantee Fund for SMEs in a way to modify its approach. It has been right to enlarge its activity to so-called minibond issues (as before the fund’s guarantee was just for loans, editor’s note), but it is a nonsense to guarantee financing to SMEs which are perfectly able to find credit by themselves. What is really needed instead is helping SMEs which find it har to access credit because they have a lower credit rating”.

So Mr. Firpo added that “the idea is equipping the Fund of an internal credit rating model as the one developed by banks so that the Fund can calculate and provide guarantees in line with the correpondent riskiness of SMEs asking for a guarantee”. Till now “the Central Guarantee Fund has been used for many uses. But now it is crucial to focus its activity on beating the credit crunch for SMEs. Finance for helping the best SMEs to growth is instead a market issue. The healtiest companies can easily find credit and there is open competition between banks and private debt funds”, Mr. Firpo said.

The majority of Italian SMEs has a lower credit rating so the Fund’s reform is expected to speed up minibonds issues and create a larger market. Many more investors might then been involved thanks to a lower risk attached to minibonds. Moreover, ” thanks to a larger market it would be possible to finance also entire supply chains in various industries in order to help the digitalization of the manufacturing sector”, Mr. Firpo added thinking of the Industry 4.0 theme.

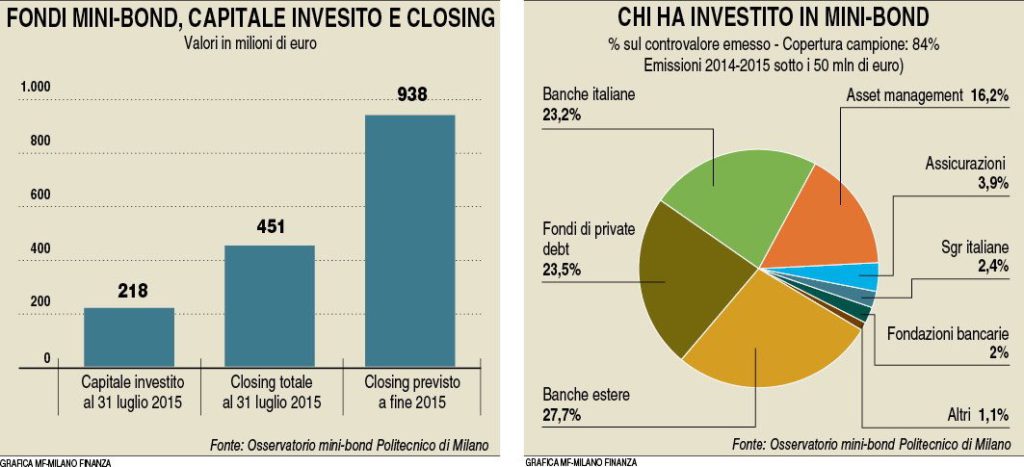

As far as investors are concerned now, investments by private debt funds represent just a 23.5% stake of total minibonds issues in Italy, Mr. Giudici said, adding that banks had been the mahor investors instead. More in detail, italian banks invested for a 23.2% stake while foreign banks invested for a 27.7% stake.

Insurance companies are still almost out of this market having subscribed just 3.9% of all outstanding minibonds value, while pension funds are completely absent, even if the Italian Government provided a tax credit to pension funds related to direct an indirect investments in private equity, venture capital, private debt and infrastructures.

Private debt firms also find it difficult to convince insurance companies and pension funds to subscribe stakes in their funds so fundriasing is rather hard. By the end of last July private debt funds focus to Italian SMEs announced closings for 451 million euros while a total of 938 millions euros of total closings are expected to be raised by the end of the year. This is a poor result if you think that all 29 private debt funds launched in Italy have a total target of 5.2 billion euros, Mr. giudici said.

Last but not least is the distressed debt issue. “Italian banks are not actively working of this issues”, Mr. FIrpo said, adding that “We need to think of handling these special situations and there is a wide room for specialized turnaroung operators. On this issue the capital markets might offer very good solutions”. Mr. Firpo referred to a rumored proposal to with the Minsitery of Economic Development had been working for months to give birth to a secondary market of SMEs distressed debt issues, the so-called development bonds.