US giant pivate equity firm Blackstone aims at fonancing middle market italian companies and signes an agreement with italy’s second largest bank Intesa Intesa Sanpaolo (see here the press release).

US giant pivate equity firm Blackstone aims at fonancing middle market italian companies and signes an agreement with italy’s second largest bank Intesa Intesa Sanpaolo (see here the press release).

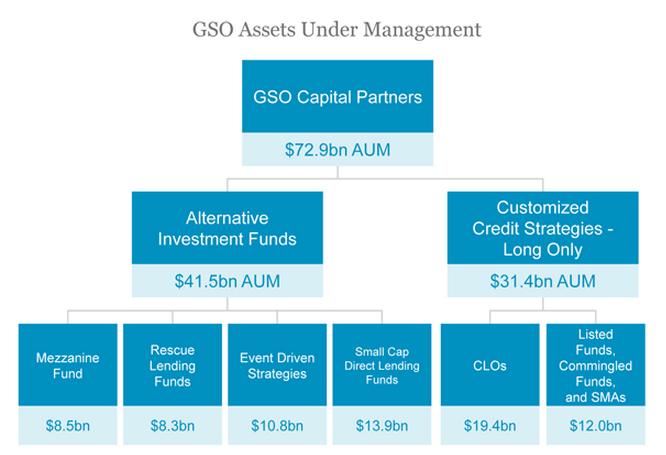

The strategic partnership has been signed by Blackstone through its credit investment arm GSO Capital Partners whih had about 73 billion dollars under management at the end of 2014.

The collaboration will have a focus on both existing corporate clients of Intesa Sanpaolo as well as the broader Italian middle market corporate universe. The private debt capital will be provided to sub-investment grade companies for a variety of purposes ranging from growth capital, acquisition financing, to opportunistic refinancings. The private debt capital offering via this partnership will serve to complement the existing offerings of the domestic banking system and expand financing options for the Italian middle market corporate, where applicable.

Giovanni Gilli, Head of Capital Light Bank, Intesa Sanpaolo, said: “Intesa Sanpaolo considers the partnership with GSO/Blackstone, an institution with a strong expertise and reputation in European private credit asset class, a significant opportunity to support its corporate clients. This brings an additional channel of long term specialized financing resources as a way to further enhance our dialogue with pre-existing and new corporate relationships”.

Tripp Smith, co-founder of GSO Capital Partners, said: “GSO is excited to partner with Intesa Sanpaolo, with its long heritage and successful long-term track record in Italian lending. It is a unique opportunity for us to access the Italian corporate mid-market given Intesa Sanpaolo’s incumbency and deep relationships across all sectors. Our ability to provide flexible and long-term private debt capital via this partnership will differentiate our two firms, and ultimately benefit the Italian corporate borrower.”

This is the first time that Blackston teams up with a local bank for such an objective, MF-Milano Finanza writes today, adding that the agreement is case-by-case meaning that GSO Capital will be free to decide to finance or not the companies proposed by Intesa Sanpaolo and that the two entities might decide to finance together or not any single company.

Blackstone’s interest for italian companies’ private debt is to be seen in a bigger picture lall big private debt operators are keen to finance SMEs around Europe.

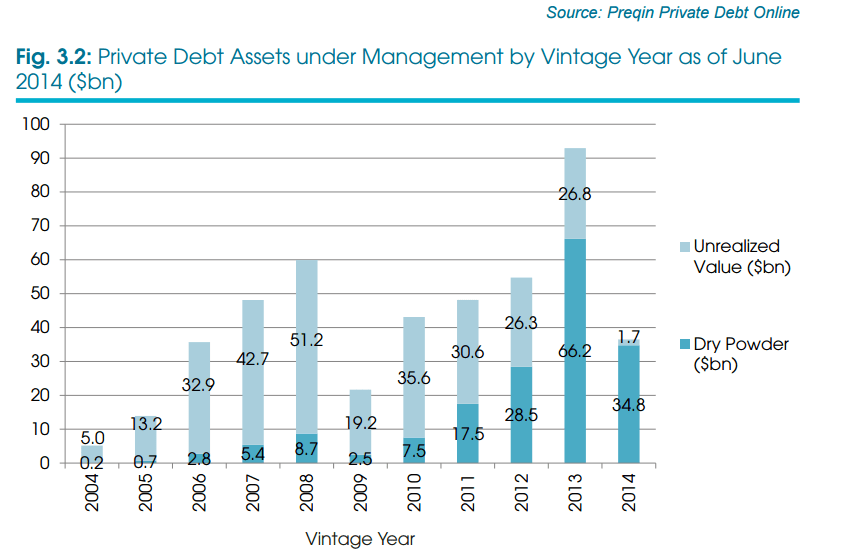

Uk’s alternative investment advisory company Preqin calculated that at the end of March 2015 the whole private debt industry had 154 billion dollars of dry powder available for new investments, up from 139 billions at the end of 2014, and that about one third of that figure (50.6 billions) are intended to direct lending investments (download here the press release and abstract of Preqin’s Private Debt Report). Moreover Preqin says that during 2014 direct lending activity was quite high as dry powder for those funds dropped by 26 billions out of a total drop of 40 billions from all strategise: dry powder for all strategise at the end of 2013 was 179 billion euros.

As for the fundraising, European private debt funds raised about 31% of the all European industry, up from 23% in 2013, with 19.6 billion dollars raised from 18.6 billions.

As for the fundraising, European private debt funds raised about 31% of the all European industry, up from 23% in 2013, with 19.6 billion dollars raised from 18.6 billions.

Investors are quite happy to invest in private debt funds as they result quite profitable with respect to other strategies while being not much volatile. Preqin calculates that on a global basis direct lending funds have median IRRs (net to investors, that is after fees and carried interest) of 8.9% versus a median IRRs for buyout funds of 11.9%, but volatility in their performance (standard deviation of median IRRs) is much more limited, that is 8.4% for direct lending funds versus a 17% for buyout funds (see altro articolo di BeBeez).

On the whole, private debt funds median net IRRs is about 12.5% for vintage 2011 while IRRs are over 22% for top quartile funds and 9% for the lowest quartile.

In Italy direct lending has just been completely admitted by the law. The country has recently introduced a new legislation that opens up the acquisition finance market to alternative and international lenders, effectively aligning the country with most other major European countries. The legislation is in place although a small number of implementation regulations still need to be enacted.

More in detail, with the introduction of Law Decree 24 June 2014 no. 91, Italian companies have now access to an additional source of financing. The decree allows Italian securitisation special purpose vehicles (SPVs), insurance companies and closed-end investment funds to provide finance directly to borrowers provided certain conditions are met (see here a previous post buy BeBeez).

However that practice was limited to funds that did not use leverage so that the majority of international private debt operators weren’t able to benefit from that law. Last January Italy’s Government led by Premier Matteo Renzi approved the so called “Investment Compact” bill last January 20th which introduces some impacting measures facilitating investments in Italy’s SMEs. Among those measures there is one that opens up direct lending activity to all kind of funds, including the leveraged ones (see here a previous post by BeBeez).

A few deals have been already closed by itnernational funds with mid-market companies in Italy. At the end of 2013 Blackrock subscribed a 60 million euros bond issued by Sit Technologies spa, the parent company of Sit La Precisa spa, a Padua-based group producing heating plants and components in order to support a shareholders’ riorganization (see aprevious post by BeBeez).

In January 2014, invece US private equity giant firm Kkr invested 100 milioni euros in bonds and shares of Argenta, a leading group active in thefood&beverage vending machine management sector. Kkr became so a minority shareholder of the Italian group which is controlled by Motion Equity Partners and allowed Argenta to repay its junior debts to Italian banks Unicredit and Mediobanca which was part of a financing facility the banks prepared in 2009 in support of a capital increase of the group (si veda altro articolo di BeBeez).

Morte recently, it was disclosed that US hedge fund manager Och- Ziff Capital Managementi s holding exclusive talks with Italian shipowner Vincenzo Onorato in order to support him with a 100 million euro financing in the shareholding reorganization of Moby and Tirrenia ferry operators (see a previous post by BeBeez).