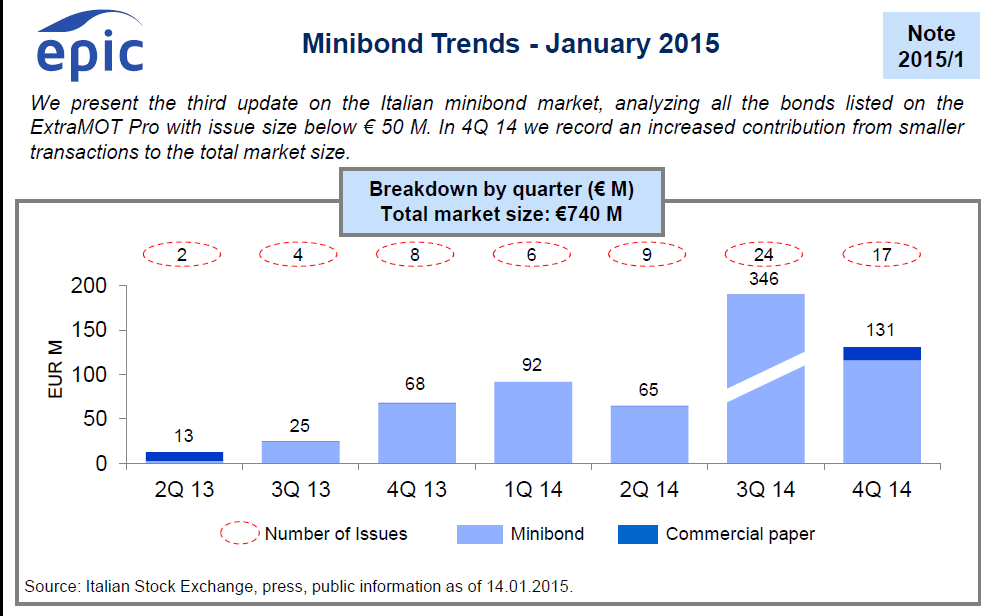

SMEs’ so-called minibond listed issues (with issue size lower than 50 million euros each) reached 131 million euros in Q4 2014 on Italy’s Stock Exchange managed market ExtraMot Pro on a total market size of 740 millions. Among Q4 issues about 15 millions were short term notes. New issues were on average of a lower size than in the previous quarters (7 millions versus 14 millions in Q3) while yields remained stable in a range between 5% and 6.5%.

SMEs’ so-called minibond listed issues (with issue size lower than 50 million euros each) reached 131 million euros in Q4 2014 on Italy’s Stock Exchange managed market ExtraMot Pro on a total market size of 740 millions. Among Q4 issues about 15 millions were short term notes. New issues were on average of a lower size than in the previous quarters (7 millions versus 14 millions in Q3) while yields remained stable in a range between 5% and 6.5%.

Figures have been calculated by Italy’s advisory company Epic sim (download here Epic’s quarterlly report), the first platform allowing qualified investors (through bonds or equity) to fund the growth projects of Italian small and medium-sized enterprises.

Other foundings were that the majority of issues are based in Northern Italy: in Q4 half of the total number of new issues came from companies with headquarters in the Milan province taking Lombardy Region to a total issued of 207 million euros just after the Veneto Region (210 millions).

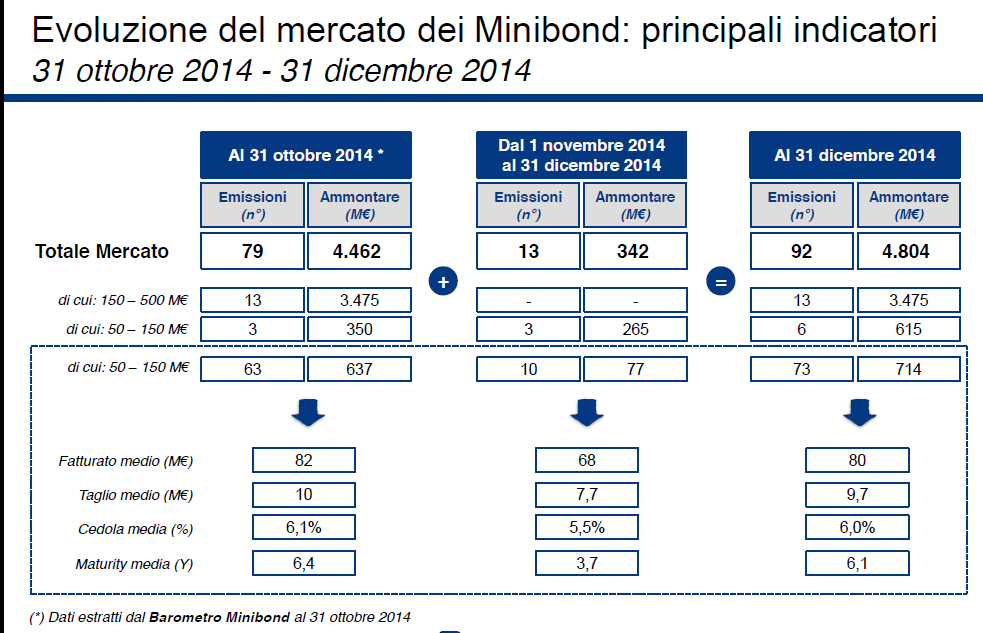

Some other foundings were published last month by minibonditaly.it, a news aggregator website about Italian minibonds managed by Italy’s advisory firm Business Support spa. At the end of november there was a total of 4.8 billion euros of bonds listed on the ExtraMot Pro market and 92 issues, among them 700 million euros or 73 issues had a size lower than 50 millions (download here the montly Barometer),

Size of issuers also has been reducing. The average issuing SME had revenues of 68 millions down from 82 millions calculated at the end of October while the issue size decreased to 7.7 millions from 10 million, with an average coupon of 5.5% down from 6.1% and an average maturity of 3.7 years down from 6.4 years.