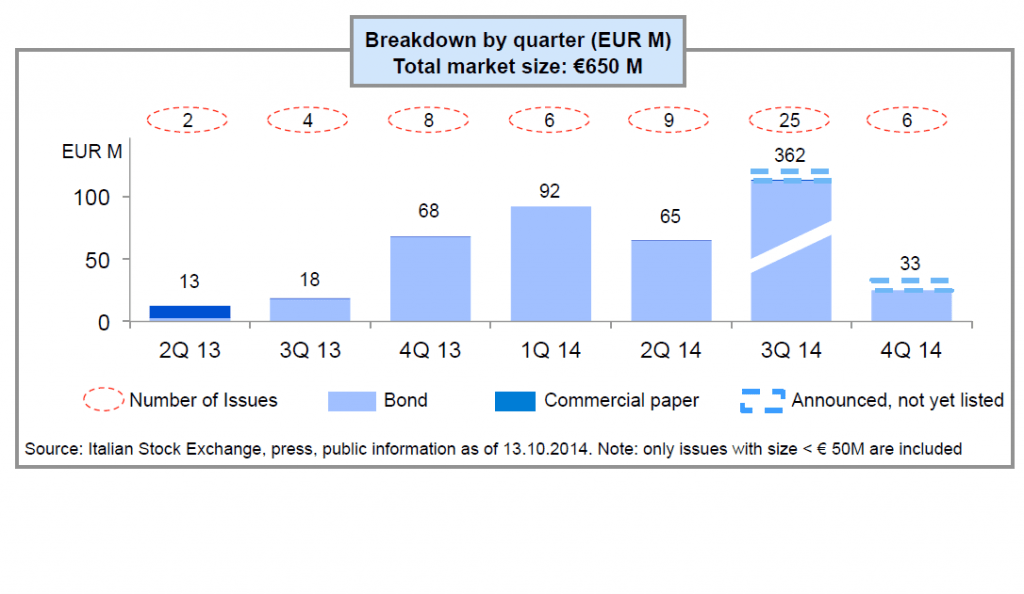

Italian SMEs’s debt (so called minibond) issues listed at the ExtraMot Pro market by Borsa Italiana reached 650 million euros in mid-October up from 331 millions in mid-July thanks to an explosive third quarter (25 issues and 362 millions), Epic sim calculated, including issues with size lower than 50 million euros (see here announcements of the last issues on the ExtraMot Pro market).

Italian SMEs’s debt (so called minibond) issues listed at the ExtraMot Pro market by Borsa Italiana reached 650 million euros in mid-October up from 331 millions in mid-July thanks to an explosive third quarter (25 issues and 362 millions), Epic sim calculated, including issues with size lower than 50 million euros (see here announcements of the last issues on the ExtraMot Pro market).

Founded by former Italian well-known banker Andrea Crovetto and other partners, Epic sim is the first platform allowing qualified investors (through bonds or equity) to fund the growth projects of Italian small and medium-sized enterprises.

The minibond market, with 33 new announced issues, is growing and maturing, with yields that are becoming more consistent among each other (see a previous post by BeBeez). Yield are actually all in a range between 4% and 7%, while few months ago it was possible to see issues paying rather higher yields.

Moreover if more and more evident a direct relationship between yield and leverage: companies with a leverage of 4x or lower pay spread yields of less than 500 basis points while higher leverage mean spread of 700 bps or above. Utility minibonds moreover pay generally less than minibonds issued by companies in other sectors.

Finally, the majority of the issues come from small and medium enterprises with headquarter in Milan of in the Region of Veneto, for a total of 47% of the issued value, And that percentage is 67% if you count issues from Emila Romagna and Tuscany Regions.