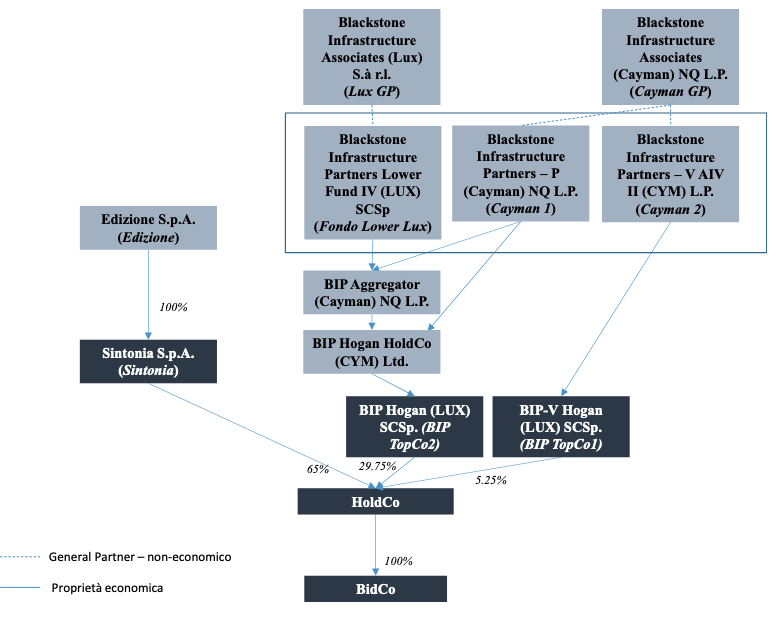

Blackstone and Edizione, the holding of the Benetton family, started to launch their public offer for delisting Atlantia, the Italian motorway company, in the week beginning on 10 October, Monday (see here a previous post by BeBeez). The bidders aim to purchase 66.9% of the company’s publicly traded capital. The deadline for tender the offer will end on 11 November, Friday. Blackstone and Edizione aim to pay 23 euros per share net of the dividend for an equity value in the region of 19 billion euros and an enterprise value of 48.7 billion or a 12.1X EV/Ebitda ratio. French-listed competitor Vinci has a 9.4X EV/Ebitda ratio.

Blackstone and Edizione, the holding of the Benetton family, started to launch their public offer for delisting Atlantia, the Italian motorway company, in the week beginning on 10 October, Monday (see here a previous post by BeBeez). The bidders aim to purchase 66.9% of the company’s publicly traded capital. The deadline for tender the offer will end on 11 November, Friday. Blackstone and Edizione aim to pay 23 euros per share net of the dividend for an equity value in the region of 19 billion euros and an enterprise value of 48.7 billion or a 12.1X EV/Ebitda ratio. French-listed competitor Vinci has a 9.4X EV/Ebitda ratio.

TIM and Open Fiber postponed the announcement of their merger from the previously scheduled date of 31 October, Monday (see here a previous post by BeBeez). Pietro Labriola, the ceo of TIM, made such announcement on 10 October, Monday and explained that CDP Equity, Macquarie and Open Fiber required for an extension of the timeline.

Fondo Fenice 190, a fund of funds that Gruppo Generali launched in February 2021, founded ten different opportunities in Italy, France and Germany worth a total of 700 million euros (see here a previous post by BeBeez). Fenice 190 already invested 50 million in Italian, Spanish and German SMEs.

Unigrains, a French holding for the agrifood sector, aims to invest up to 100 million euros in Italy in the next 5 years, ceo Maxime Vandoni said to BeBeez (see here a previous post by BeBeez). Unigrains has a portfolio of 80 companies for 1.2 billion euros.

Golden Goose, the Italian luxury fashion group that is reportedly going to list on New York Stock Exchange, announced the acquisition Italian Fashion Team – IFT, one of its suppliers, from the ceo Michele Zonno and his family (see here a previous post by BeBeez). The closing may take place by the end of 2022 upon the authorization of the Italian Antitrust authority. Golden Goose retained as advisors Italian law firms Giliberti Triscornia e Associati and Maisto e associati, and KPMG. IFT hired Ughi e Nunziante, Cacciapaglia & Liguori, Dell’Atti Liberato & Partners and Clearwater International. Zonno will keep heading the company that has sales of 36.5 million euros, an ebitda of 6.4 million and a net financial debt of 1.3 million.

TSG, an European player for the sustainable mobility that belongs to HLD Europe, acquired Ranzato Impianti (see here a previous post by BeBeez). Tsg retained Dla Piper and Pirola Corporate Finance as legal and financial advisor. Ranzato received support from Russo De Rosa Associati, a mid-market law firm. Ranzato Impianti has sales of above 30 million euros, an ebitda of 2 million and a net debt of 2.6 million. The company’s founder Antonio Ranzato will join the TSG Southern Europe unit that Fabiano Clérico heads.

Clonit, an Italian producer of molecular diagnostic reagents that belongs to Equita Smart Capital ELTIF, acquired Experteam, a company operating in the same sector, from Angelo De Bortoli (75%) and Federica Schiavon (25%) (see here a previous post by BeBeez). Experteam has sales of 3.5 million euros, an ebitda of 1.2 million and net cash of 2 million. Clonit has revenues of 8.1 million, an ebitda of 3.9 million and net cash of 1.9 million.

Assietta Private Equity sgr, a private equity management company that ceo Mauro Cornaglia heads, hired Equita and Houlihan Lokey for selling its cosmetics company Naturalia Tantum (see here a previous post by BeBeez). Sources said to BeBeez, that the asset attracted several expressions of interest and may finalise the sal by the end of this year. Assietta Private Equity owns 77% of Naturalia. Paolo Colonna, Istituto Atesino di Sviluppo and the founders of the acquired companies have the minority of the firm.

Argea, an Italian wine producer that was born on 30 September, Friday, out of the merger of Botter and Mondodelvino, two portfolio companies of Clessidra Private Equity, signed a commitment for acquiring Cantina Zaccagnini, an Italian competitor (see here a previous post by BeBeez). The target’s founder Marcello Zaccagnini will reinvest for a minority of Argea which retained as advisors LT Wine&Food Advisory, Bain & Company, E&Y, Gattai, Minoli e Partners, and Alonzo Committeri & Partners. After such an acquisition, Argea will generate 95% of its 420 million euros sales in 85 countries

Ur-Invest, an equity club deal platform, acquired Emmequattro, an Italian industrial company, from the Mori Family (see here a previous post by BeBeez). The vendors retained Banor Sim and Studio Nassini & Associati as financial and legal advisors. Merito Private Debt Fund, an ESG and PIR compliant fund, financed the transaction. Marco Bertolina is the target’s ceo, while Anna Mori kept her role of sales and marketing director. Emmequattro has sales of 7.4 million euros, an ebitda of 1 million and net profits of 0.3 million

Gruppo Eleventy, the holding that controls the sales networks of many luxury fashion firms, launched a capital increase that 51% shareholder Vei Capital will subscribe with an undisclosed investor (See here a previous post by BeBeez). The company aims to reach sales of 100 million euros by 2026 from the current 24 million, with an ebitda of minus 0.24 million and 7 million of financial debts.