Linkem spa, an Italian provider of fixed wireless access broadband tlc services, controlled by the US investment holding Leucadia National Corporation, through Jefferies Financial Group (with the vehicle BEI Italia Wireless), by BlackRock, by the RCG Special Opportunities Fund managed by New York-based asset manager Ramius Capital (part of the Cowen Group), by the Vintage Capital fund and 2G Investimenti srl owned by the italian entrepreneur Guglielmo Tabacchi, has signed an agreement with Milan-listed tlc group Tiscali spa. The agreement is aimed at a merger into Tiscali of the newco Linkem Retail srl to which Linkem has conferred the division relating to its retail commercial activities. Linkem will obtain Tiscali shares in exchange, becoming the controlling shareholder of the group with a 62% stake (see the press release here).

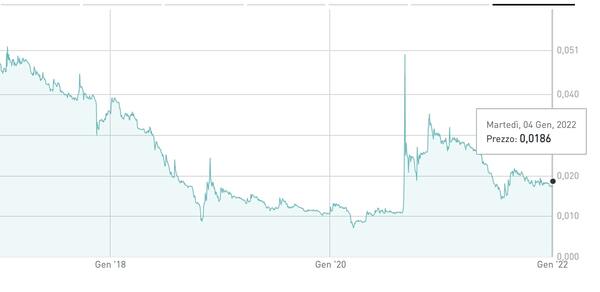

Tiscali closed yesterday at Euronext Milan down 5.1% to 0.0186 euros per share, equal to a capitalization of approximately 116 million euros. In the context of the transaction, the Tiscali Board of Directors resolved to propose to the shareholders’ meeting the grouping of Tiscali shares according to the ratio 1: 100. Where approved, the grouping will take place before the effective date of the merger.

At the end of the transaction, Tiscali will be the fifth operator in the fixed market and first in the segment of ultrabroadband accesses in FWA (fixed wireless access) and FTTH (Fiber to the Home) technologies, with an overall market share of 19.4% (data source: AGCOM), strategically positioned to make the most of the potential of FTTH and 5G FWA technologies.

The merger is expected to be subjected to the approval of the Extraordinary Shareholders’ Meeting of Tiscali and Linkem Retail which will be convened by March 2022, while the completion of the project, in the event of fulfillment of a series of conditions, is expected within the first half of 2022.

At the end of the operation, Amsicora srl, an investment company founded by Claudio Costamagna, Alberto Trondoli, Manilo Marocco and participated by other private investors too, which in May 2019 had acquired 22.059% of the company’s capital (see here the press release ), will hold a stake of approximately 3.7% of the share capital of Tiscali (of which approximately 2.67% held directly and the remaining 1.03% loaned to Nice & Green sa), while the founder and ceo of Tiscali, Renato Soru, will hold a share of approximately 2.09%.

In relation to the transaction, Tiscali is assisted by CC & Soci, as financial advisor; Equita sim, which issued a fairness opinion on the fairness of the exchange ratio from a financial point of view; BDO which carried out the accounting due diligence; and Chiomenti for legal and tax aspects. Linkem and Linkem Retail are assisted by Banca Akros as financial advisor, which issued a fairness opinion on the fairness of the exchange ratio from a financial point of view; Studio Spada Partners for tax and accounting due diligence, and Gianni & Origoni for the legal aspects. Finally, Deloitte & Touche was appointed as independent expert for the preparation of the report on the fairness of the exchange ratio.

BlackRock had entered into Linkem’s capital in January 2017 by underwriting for 50 million euros half of the 100 million euros capital increase launched by the company and that was subscribed for the other half by its previous shareholders (see here a previous article by BeBeez). That investment had brought the total capital raised from investors by Linkem since the start of the business to a total of 500 million euros.

Led by the ceo Davide Rota, due to continuous large investments, Linkem’s balance sheet is still at a loss. The company closed 2020 with 140.6 million euros of consolidated revenues, 56.1 million ebitda and a net loss of 69.6 million (on top of the 59.3 million euros of net loss in 2019 and to 36.3 million in 2018), versus a net financial debt of 147.8 millions (see the Leanus report here, after registering for free).

The agreement with Tiscali was plan B for Linkem, after the decision to postpone the listing on the stock exchange, which had been talked about since last Spring. Linkem had already mandated the advisors Morgan Stanley, Jefferies and Banca Akros to raise 250 million euros of capital on the basis of a valuation of just under one billion euros, corresponding to a multiple in line with the latest transactions on the Fwa networks, equal to 18-19 times the ebitda expected for 2021, which should be around 52 million (see La Repubblica here).

However, an interest in Tiscali from Linkem had already been discussed at the beginning of 2018, when talks began on a restructuring of the medium-long term financial debt of the Milan-listed group (see here a previous article by BeBeez), an operation that was concluded in March 2019 (see here the press release of the time).

Tiscali then announced at the beginning of October 2021 the signing of a new debt restructuring agreement with lenders Intesa San Paolo and Banco BPM relating to the group’s senior medium-long term debt providing for an extension of the maturity of the debt to 31 March 2026, with an initial grace period up to March 2023 and consequent improvement of the financial structure. The agreement also provided for a new repayment plan with half-yearly installments, in March and September of each year (see the press release here). Non-current financial debt at the end of June 2021 was 87 million euros and the total net financial debt was 88.8 millions.

Last May, moreover, Tiscali signed with Nice & Green sa, a professional investor based in Nyon, Switzerland, an agreement for a financing program consisting in a convertible and mandatory convertible bond (POC) into ordinary Tiscali shares to be issued in a maximum of 7 tranches of 3 million euros each, for a total maximum amount of 21 millions (with the option of an extension by Tiscali for a further maximum of 21 millions) reserved to Nice & Green (see the press release here). The Investment Agreement provides for an overall period of issue of the POC equal to 21 months upon expiry of which all outstanding bonds not yet converted will be irrevocably converted into Tiscali shares. To date, Tiscali has issued 5 tranches of the POC of 3 million euros each, the last of which in mid-December (see the press release here). The first four tranches have been converted to capital already and the same is reasonable to think it will happen for the fifth tranche just subscribed.

The new loan agreement, together with the capital increase deriving from the implementation of the bond loan, will allow Tiscali to find resources to be allocated to meet short / medium-term liquidity needs, guaranteeing a profitable management of financial flows at the service of the business. during the 2021-2024 strategic plan, approved last September.

Precisely among the conditions necessary for the transaction with Linkem to be closed are both the full issue and conversion of the first 7 tranches of the POC reserved for Nice & Green and the procurement by Tiscali of the financial resources (in the form of equity or quasi-equity) necessary to fully cover the financial requirements envisaged by the industrial plan for at least 12 months following the effective date of the merger of Linkem retail into Tiscali.

Once the Linkem-Tiscali transaction is concluded, Linkem will indirectly be a shareholder in FiberCop, together with Italy’s tlc giant TIM, Italy’s fiber company Fastweb and US private equity giant KKR.

Actually we recall that in August 2020 Tiscali was the first telecommunications operator to sign an agreement with TIM for a strategic partnership relating to the development of the ultra-broadband market through the commercial participation of Tiscali in the FiberCop co-investment project (see here a previous article by BeBeez), the new company into which TIM’s FTTH secondary network and the fiber network developed by FlashFiber (the joint-venture of TIM, with 80%, and Fastweb, with 20%) converged and which is now controlled by TIM at 58% and owned by KKR (37.5%) and by Fastweb (4.5%) (see here a previous article by BeBeez). But that’s not all, because last August TIM and Tiscali also said that they would subsequently verify the possibility of an entry of Tiscali into the FiberCop shareholders structure, through the contribution of a specific business branch, according to procedures to be agree.

In November 2020, the definitive agreements relating to the commercial partnership were signed (see the press release here), while on the front of Tiscali’s investment in FiberCop, things turned out to be longer than expected. In fact, at the end of 2020, the Antitrust opened an investigation into the operation (see here the announcement) and the process has not yet been completed. In fact, last August 2021, Telecom Italia, Fastweb, Teemo Bidco (a vehicle of KKR), FiberCop, Tiscali Italia and KKR presented a series of commitments aimed at facilitating the operation from an Antitrust point of view and the Authority launched a public consultation on those commitments at the beginning of September. Last November 2021, then, Telecom Italia, Fastweb, Teemo Bidco, FiberCop, Tiscali Italia and KKR presented their observations on the results of the public consultation and the accessory changes to the commitments presented. At that point, in mid-December, the Authority decided to postpone the deadline for concluding the procedure to February 15, 2022, previously set at December 31, 2021, “in order to fully assess the suitability of these commitments to resolve the concerns competition highlighted in the provision to initiate the procedure “(see here the Antitrust Bulletin of 3 January).

Once the Tiscali transaction on FiberCop is concluded, Linkem and its shareholder funds will therefore indirectly find themselves shareholders of Fibercop as said together with TIM, Fastweb and KKR.