Even though the Italian GDP shrank by 9% in 2020, Italian companies with a turnover of above 500k euros proven to be more resilient than expected, said a report of Leanus and BeBeez (see here a previous post by BeBeez). On 7 July, Wednesday, Leanus and BeBeez held a webinar on this topic and offer to the joiners a 20% discount on the annual subscription to BeBeez Private Data, the private capital database of BeBeez in collaboration with FSI Fund.

Even though the Italian GDP shrank by 9% in 2020, Italian companies with a turnover of above 500k euros proven to be more resilient than expected, said a report of Leanus and BeBeez (see here a previous post by BeBeez). On 7 July, Wednesday, Leanus and BeBeez held a webinar on this topic and offer to the joiners a 20% discount on the annual subscription to BeBeez Private Data, the private capital database of BeBeez in collaboration with FSI Fund.

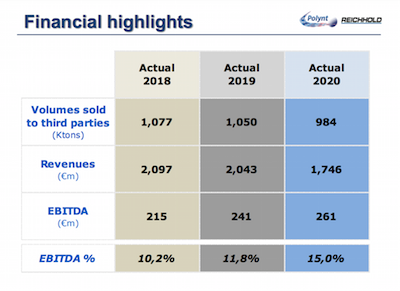

Investindustrial said it will exit from Polynt-Reichold, the group born thanks to the merger of two portfolio companies previously owned respectively by Investindustrial itself and the US private equity firm Black Diamond Capital Management (see here a previous post by BeBeez). Polynt Reychold has sales of 1.74 billion, an ebitda of 261 million and a net financial debt of 317 million. Investindustrial will sell its 50% stake to Polynt-Reichold itself on the ground of an enterprise value of 2.6 billion euros of in the region of 10x ebitda. JPMorgan and Apollo Capital Management will provide secured and unsecured senior credit lines for financing the transaction, while Black Diamond will also pour a portion of equity and will come unique shareholder.

Apollo Impact, the platform for ESG investments of Nyse-listed Apollo Global Management, signed an agreement for the acquisition of Milan-listed recycled paper producer Reno de Medici, ahead of delisting the company (see here a previous post by BeBeez). Apollo acquired the stakes of Canada’s Cascades (57.6%) and Caisse de Depot et Placement du Quebec (9.1%) for 365 million euros (1.45 euros per share) on the ground of an enterprise value in the region of 543 million or 7.8x ebitda. Apollo will launch a public offer at 1.45 euros per share.

The closing of the sale of a 50% stake in Open Fiber delayed from the previous schedule of 30 June, Wednesday, as the vendor Cdp is replacing Fabrizio Palermo with Dario Scannapieco as head of the company (see here a previous post by BeBeez). Milan-listed Enel agreed to sell 10% of Open Fiber to Cdp and 40% to Macquarie Infrastructure. The closing could now take place by mid July 2021, but Enel may charge the buyers with a 9% annual rate on the agreed price of 2.12 billion euros which amounts to 16 million.

Eurizon ITEᴙ and Eurizon ITEᴙ ELTIF, two vehicles of Eurizon Capital (part of Intesa SanPaolo), acquired 70% of GSA, an Italian company for fire prevention (see here a previous post by BeBeez). Armonia and the ceo Alessandro Pedone sold the asset and reinvested for a 12% and 18% stake. Mediobanca and Dc Advisory, part of Japan’s Daiwa Securities, handled the auction that attracted the interest of FSI, Investcorp, Alvarez & Marsal Private Equity, and Chequers Capital. GSA has sales of 165 million euros and an ebitda of above 35 million.

Armonia-Fondo Italiano d’Investimento, Charterhouse and Ardian are frontrunning for the acquisition of Induplast, an Italian packaging company that belongs to Europe Capital Partners since June 2018 (see here a previous post by BeBeez). Houlihan Lokey is handling the sale process on the ground of an enterprise value of Induplast of 140-150 million euros of 10X ebitda. The company’s turnover is of 40 million.

NB Renaissance improved its public offer on Milan-listed Sicit Group from 15.45 to 16.8 euros per share and extended the deadline for subscribing from 7 to 9 July, Wednesday and Friday (see here a previous post by BeBeez). Intesa Holding already sold its 40.47% stake and will hold an even stake in the business with NB Renaissance. Raymond Totah and Matteo Carlotti the company’s directors that the Spac SprintItaly appointed (8.46% owner of Sicit) after having carried on the business combination with the firm, reportedly asked NB to improve its bid.

Rino Mastrotto, an Italian tannery that belongs to NB Renaissance Partners, NB Aurora and the Mastrotto family, acquired Carroll Leather from US-based Carroll Companies (see here a previous post by BeBeez). Rino Mastrotto has sales of 309 million euros, an ebitda of 60 million and net debt of 22 million.

Dierre, an Italian provider of protection systems for industrial authomation that belongs to NB Aurora and other family offices, acquired IN.Ecosistemi, an Italian competitor (see here a previous post by BeBeez). In.Ecosistemi has sales of 2.9 million euros, an ebitda of 0.431 million and a net financial debt of 0.307 million. Dierre turnover is in the region of 45.8 million euros, an ebitda of 6.4 million and a net financial debt of 0.98 million. In July 2019, NB Aurora poured 27 million for acquiring 49.9% of Dierre together with Italian family offices for 30.2 million.

European infrastructure fund Marguerite acquired 25% of GTS (General Transport Service), an Italian transport company (see here a previous post by BeBeez). The fund purchased shares from the Muciaccia family and subscribed a capital increase. GTS has sales of 111.1 million euros (50% export) and an ebitda of 22.3 million.

Financial holdings Smart Capital and PFH Palladio Holding will act as cornerstone investors with a 12 months lock-up agreement and a total of 4.2 million euros for the listing of Ala (Advanced Logistics for Aerospace) on Milan market (see here a previous post by BeBeez). Ala belongs to AIP Italia, a holding operating in the sector of integrated logistics for aeronautical and aerospace components that chairman Fulvio Scannapieco owns with the vicechairman Vittorio Genna. Ala plans to grow through acquisitions. In December 2020, the Cerved improved the company’s rating from B1.2 to B1.1 (si veda qui il comunicato stampa). Ala has sales of 136.8 million with a 13 million ebitda and an ebit of 10.5 million.

Made in Italy Fund, a vehicle of Quadrivio and Pambianco, acquired Xtrawine, an online distributor of wine (see here a previous post by BeBeez). The founders Alessandro Pazienza, Stefano Pezzi, Francesco Rattin, and Massimo Pompinetti sold the business. Xtrawine was born in 2009 and has sales of 10.8 million euros with an ebitda of 0.5 million.

DGS, a cybersecurity company that belongs to Hig Europe, acquired LumIT, an Italian competitor, from the ceo and founder Paolo Ferrari (see here a previous post by BeBeez). LumIT has sales of 8.8 million euros, an ebitda of 0.355 million and net cash of 1.46 million. DGS has sales of above 115 million.

Hig Europe is also holding exclusive talks for acquiring Acqua e Sapone (fka Cedas), a chain fo shops for personal hygiene and house cleaning products (See here a previous post by BeBeez). Mediobanca is handling the auction. Acqua e Sapone has sales of 800 million euros. Raffaele Legnani is the managing director of Hig Europe in Milan. HIG Capital is one of the private capital investors that BeBeez Private Data monitors (find out how to subscribe for only 110 euros a month).

Plixxent Holding, a provider of innovative technologies based on polyurethanes that belongs to HIG Capital since 2019, acquired Italian competitor Tagos (see here a previous post by BeBeez). Marco and Daniele Monzeglio sold Tagos with the assistance of Equity Factory. Tagos has sales of 9.6 million euros, an ebitda of 0.322 million and a net financial debt of 2.6 million.

Gianetti Ruote said to its workers that it will terminate its activities in one of its two plants (see here a previous post by BeBeez). In August 2018, Quantum Capital Partners acquired the company from Accuride. Giannetti has sales of 56.3 million euros, an ebitda of minus 5.26 million, net losses of 4.6 million and net cash of 0.26 million.

Green Arrow Energy Fund (GAEF), an investor in renewable energy, refinanced its 20 million euros worth portfolio of photovoltaic plants (See here a previous post by BeBeez). The fund created Green Arrow Solar Holding to whom belong the company that own the plants. GAEF paid earlier than scheduled its banking debt and received from Banca Mps a project finance facility of 14 million.

Edra, an Italian publisher for the pharmaceutical and medical sector that is part of LSWR Group, acquired 51% of Spanish Luzán 5 Health Consulting, a consultancy form for communication and training for the health sector (See here a previous post by BeBeez). LSWR has sales of 42.5 million euros, an ebitda of 4.5 million and net profits of 0.9 million.

Milan Spac Industrial Stars of Italy 4 (Indstars 4) started trading on 8 July, Thursday, after having raised 138 million euros in its placement (See here a previous post by BeBeez). As BeBeez previously reported, Indstars 4 achieved the 100-150 million fundraising target, but started to publicly trade later than the previous schedule for the end of June 2021. See here the Insight View of BeBeez of 10 May 2021, available for the subscribers to BeBeez News Premium. Indstars may raise up to 500 million in the next five years through a capital increase. Giovanni Cavallini, Attilio Arietti, Enrico Arietti, Davide Milano, Marco Croci, and Piero Vitali launched IndStars4.

IMA, an Italian producer of machinery for the packaging sector that belongs to BC Partners and the Vacchi family, acquired 80% of Italian competitor FASP from the Folco Family who hired Translink Corporate Finance as advisor (see here a previous post by BeBeez). FASP has sales of 10.5 million euros, an ebitda of 0.64 million and net cash of 50,000 euros. In 3Q20, IMA generated a turnover of 1.015 billion, an adjusted ebitda of 146.6 million and a net financial debt of 700.9 million.

Specchiasol, an Italian producer of natural cosmetics that since July 2020 belongs to White Bridge Investments, acquired Phyto Garda, an Italian competitor for which Ethica Corporate Finance acted as financial advisor (see here a previous post by BeBeez). In 2003, Alessandro Moglia founded Phyto Garda which has sales of 14.5 million euros, an ebitda of 3.9 million and net cash of 0.4 million. After such an acquisition, Specchiasol’s turnover will be in the region of 100 million.

Asobi Ventures, the family office of US businessman Victor Luis, acquired from Antonio Colombo the majority of Gruppo, the owner of bicycles producer Cinelli and of Columbus, a manufacturer of frame pipes (see here a previous post by BeBeez). Asobi appointed Marcello Segato as the new ceo of Gruppo which has sales of 8.6 million and an ebitda of 0.896 million.

HAT sold its 43% of Advice Group, an Italian martech and behavioral loyalty company, to Metrika Tech and club deal Aegida (see here a previous post by BeBeez). HAT generated an IRR of above 20% and a return on invested capital in the region of 2X. The fund acquired 43% of Advice in February 2019, while the ceo and founder Fulvio Furbatto held the remaining stake. Advice has sales of 4.8 million euros, an ebitda of 1.9 millions. HAT is one of the private capital investors that BeBeez Private Data monitors (find out how to subscribe for only 110 euros a month)

Obton Italy, a partnership company that Arrow Global signed with Denmark’s renewable energy player Obton, acquired 21 Italian photovoltaic plants with a power of 20.75 MW (see here a previous post by BeBeez). Natixis, Unicredit and Intesa Sanpaolo financed the transaction with a project financing credit line of up to 185 million euros.