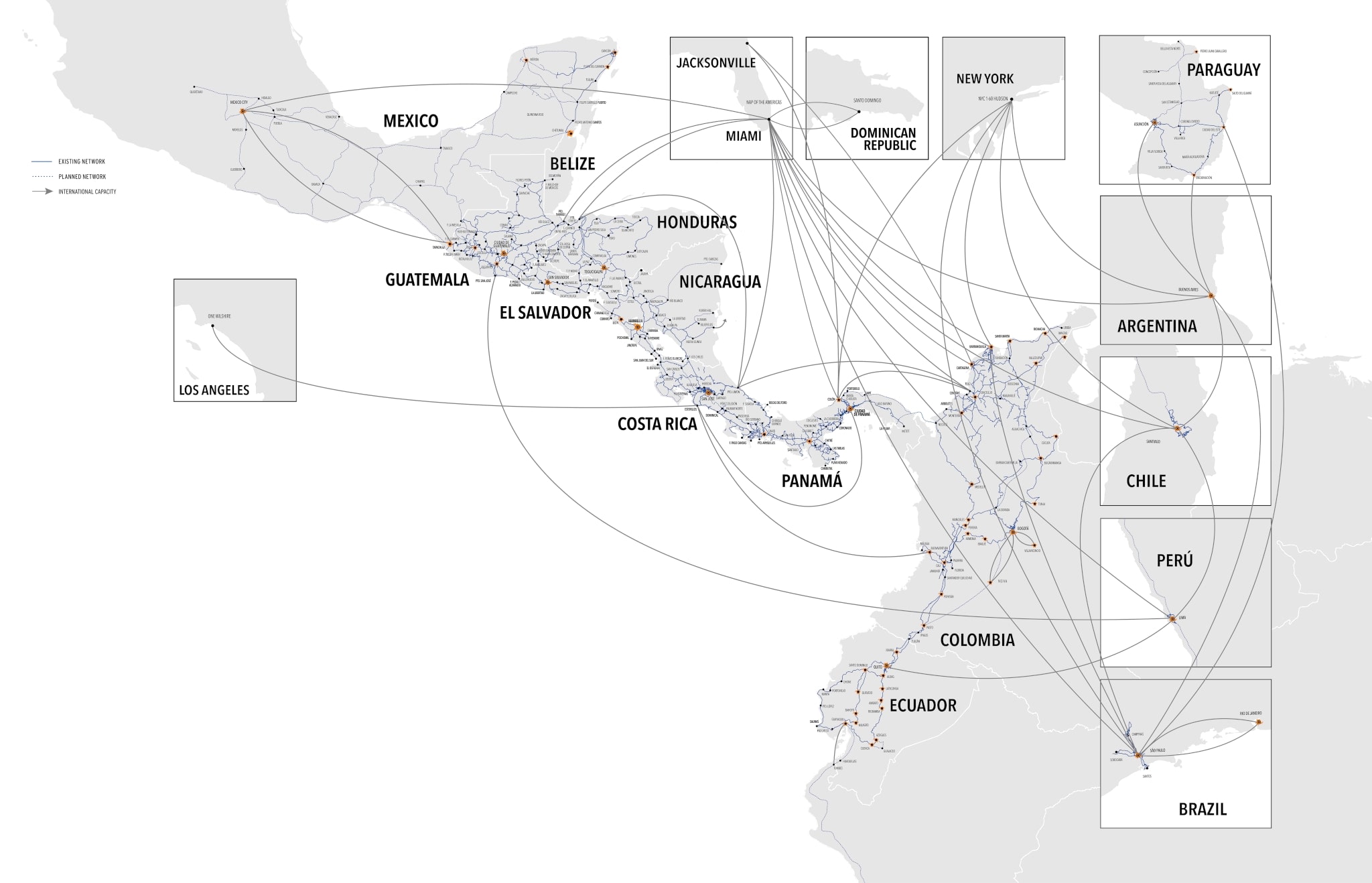

Italy’s energy and tlc giant Enel has been thinking in recent weeks whether or not to exercise its call option to buy from private equity firm Cinven the 79% stake it does not control yet in Ufinet International, the leading wholesale operator of fiber optic networks in Latin America, where it manages over 75,000 kilometers of fiber in 17 countries. The Spanish economic newspaper Cinco Dias writes.

The opportunity to exercise the option was envisaged at the time of Enel’s purchase of the first 21% stake at the end of June 2018 for 150 million euros and it was then clarified that the option would be exercisable between 31 December 2020 and 31 December 2021 versus an additional investment of between 1.31 and 2.1 billion euros to be defined on the basis of certain performance indicators (see here a previous article by BeBeez).

Until June 2018 Ufinet International was fully controlled by Cinven, through its sixth fund (Sixth Cinven Fund). Cinven had reinvested in Ufinet in May 2018 (see here a previous article by BeBeez) when the sixth fund had acquired the international assets of Ufinet Group from the fifth fund, while Antin Infrastructure Partners had instead bought Ufinet Spain (see here the press release of the time). Cinven had acquired Ufinet Group in January 2014 from Gas Natural Fenosa.

Enel acquired its stake in Ufinet through the subsidiary Enel X International spa, the company for advanced energy solutions of the Enel Group, which had signed an agreement to purchase 21% of the capital of a vehicle company in which 100% of Ufinet International was transferred. However, Enel X International and Sixth Cinven Fund have joint control of Ufinet International, each exercising 50% of the voting rights in the newco’s shareholders’ meeting. However, according to the agreements made in 2018, in the event that Enel X International does not exercise the call option by December 31, 2021, its joint control over the newco will cease. In this case, the Sixth Cinven Fund will be able to sell its holding with the right to drag along on the stake of Enel X International, while the latter will have a right to tag along in the event that Sixth Cinven Fund reduces its holding stake below 50% of the capital of the newco

In 2019 Ufinet International generated revenues of around 233 million euros and an ebitda of 114 millions, according to what Moody’s wrote in July 2020 in its report in which it confirmed the B2 rating to Zapata sarl, the parent company of Ufinet, and to two existing credit lines (one medium-long term of 600 million dollars and the other 93.5 million revolving lines).