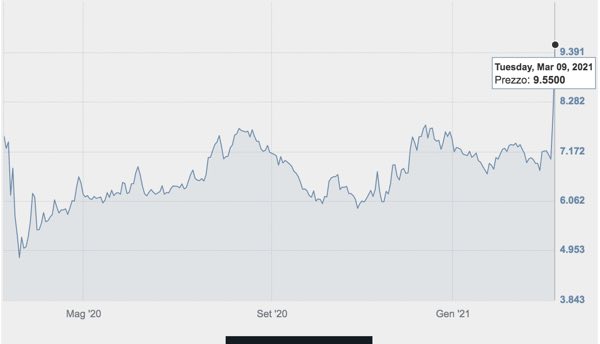

On 8 March, Monday, ION Investment Group, FSI and GIC launched a 1.855 billion euros public offer on Milan-listed business information group Cerved (see here a previous post by BeBeez). ION Investment Group is the global technology provider serving the financial sector, founded more than 20 years ago by the Italian entrepreneur Andrea Pignataro. Advent previously tried to acquire Cerved on the ground of an equity value of 1.8-1.85 billion euros back in early 2019 and an enterprise value of 2.3 billions. The bidders set a 90% (below 95%) treshold for the offer on Cerved. ION, FSI and GIC could keep only the business division for integrating it with Cedacri and sell Cerved Credit Management.

Actually the dossier about the sale of Cerved Credit Management was back to heat in the last few days, after it had been frozen since last July when talks with Intrum didn’t bring any result (see here a previous post by BeBeez). This was confirmed by the Cerved group itself with a note released on Sunday 7th March in which “it confirms that, as part of the assessments relating to the enhancement of the Credit Management division, negotiations are underway, without exclusivity constraints, with private equity funds for the sale of the subsidiary Cerved Credit Management Group srl “. The dossier is said to be on the table of the Italian asset manager and servicer Prelios and of international private equity firms such as Apollo, Lonestar and Centerbridge. Among them, Prelios is said to be in pole position as it intends to increase its size in view of the exit of the US fund Davidson Kemper Capital Management, which could take place through a listing or a sale of Prelios itself In early 2020, Intrum reportedly had tabled a bid of 450-500 million. Now the division is said to be valued around 400 million euros.

ION Investment Group had just announced a deal to buy control of Cedacri, a company specializing in the outsourcing of IT and back office services to banks. The seller was the FSI fund, which ended his adventure in Cedacri with a return of about 3x the capital invested in just over three years. However, FSI will not completely leave the scene because it will reinvest directly in the buyer’s capital for a minority (see here a previous article by BeBeez). The deal will be on the basis of a 1.5 billion euros enterprise value. And that’s not all, because a completely new European chapter is now opening for Cedacri, in which FSI will continue to play a key role, reinvesting, according to BeBeez about double what it had invested in 2018 or around 200 million euros. Instead, banks shareholders of Cedacri will completely divest.

Exor, the holding of the Agnelli-Elkann, acquired 24% of luxury shoe maker Christian Louboutin for 541 million euros (see here a previous post by BeBeez). Exor will appoint two out of seven directors and be part of the company together with its founders Christian Louboutin, Bruno Chamberlain, Henri Seydoux, and Faheema Moosa.

Italian Football team Inter Milan attracted the interest of Public Investment Fund (PIF) of Saudi Arabia, a sovereign fund with assets under management in the region of 400 billion US Dollars which also tabled a 350 million GBP bid for acquiring Newcastle Football Club from Mike Ashley (see here a previous post by BeBeez). PIF is holding talks for acquiring around a 30% stake in FC Inter, equal to the one owned by Chinese Lion Rock (but it’s not clear it the selle will be Suing or Lion Rock) on the ground of an enterprise value of 850 million GBP or 990 million euros. BC Partners reportedly tabled a lower offer for the Italian team which hired Goldman Sachs as it is looking for resources for strengthening its working capital and refinancing its 375 million euros bond due to mature at the end of 2022.

The 20 football clubs of Italy’s Lega Calcio Serie A have not yet made a decision about the sale of the tv rights for their matches of 2021-2024 (see here a previous post by BeBeez). During this past week the clubs were expected to discuss the bid of CVC – Advent – FSI for a minority of a media company that will own the tv rights as well as the offer of pay-tv operators DAZN and Sky (910 million – 830 million euros). However no decision has been made yet.

Ruffini Partecipazioni, the holding company that previously owned 22.5% of Milan-listed Moncler, the manufacturer of down jackets, placed 3.2% of the Moncler shares at 4.80 euro per share for a total of 400.16 million euro in an accelerated bookbuilding (abb) procedure (see here a previous post by BeBeez). Following the conclusion of this transaction and after the contribution of newly issued Moncler shares to Ruffini Partecipazioni envisaged in the context of the combination of Sportswear Company (the company that owns the Stone Island brand, previously controlled by the Rivetti family and the Singapore sovereign fund Temasek ), Ruffini Partecipazioni will individually own a 24.2% stake in the fully diluted Moncler share capital.

Italcer, the holding that Mandarin Capital Partners (MCP) created for investing in the high-end tiles sector, acquired Spain’s Equipe Ceràmicas from Miura Private Equity (see here a previous post by BeBeez). Miura has more than one billion euros of assets under management and will reinvest for a minority of Equipe Ceràmicas of which acquired the majority in 2018. Italcer expects to generate a turnover of 220 million with an ebitda of 50 million.

Riello Investimenti Partners (RIP) acquired 65% of Garmont International, a producer of sport shoe, from ceo Pierangelo Bressan, that now will own 30%, and Luigi Rossi Luciani, 28% owner (see here a previous post by BeBeez). Terry Urio, cfo, will have 5% of the business.

Aksìa acquired 75% of Mir, an Italian provider of medical diagnostic services and products, on the ground of an enterprise value of 36 million euros or 9X ebitda 2020 (see here a previous post by BeBeez). Mediobanca advised the vendors and founders Paolo Boschetti and Siro Brugnoli who kept a 25% stake of the business. Mir has sales of 15 million.

Rolando Benedick (chairman) and Domenico Sibilio (ceo) launched WindeX Investment Club (WIC), a club deal platform with resources of 30 million euros (see here a previous post by BeBeez). WindeX will target Italian SMEs with a turnover of 20 – 80 million and will receive the support of Swiss club deal Helvetica Capital.

OTB (Only the Brave), the holding of Renzo Rosso that owns the brands Diesel, Maison Margiela, Marni, Viktor&Rolf, Amiri, and Brave Kid acquired Jil Sander from Tokyo-listed Onward Holdings, who hired Nomura as advisor (see here a previous post by BeBeez). Onward is also selling Iris, an Italian shoe-maker that acquired in 2005 from Giuseppe Baiardo. Change Capital Partners sold Jil Sander to Onward Holdings in 2008 for 167 million euros after having acquired it from Prada for 50 million in 2006.

Gowan Company, an Arizona-based agrifood company, launched a public offer of 2.76 euros per share on Milan-listed Isagro, an Italian agropharmaceuticals firm (see here a previous post by BeBeez). Gowan signed a binding agreement for acquiring the stakes of Giorgio Basile and the minority shareholders. Gowan invested in Isagro in 2013 and now aims to delist the company on the ground of an equity value of 106.9 million euros. Isagro has sales of 105.4 million, an ebitda of minus 2.6 million and net losses of 13.9 million.

DIstressed Piaggio Aero Industries and Piaggio Aviation, the subsidiaries of Piaggio Aerospace, which belongs to Mubadala attracted four non-binding offers (see here a previous post by BeBeez). Piaggio has debts of 618.8 million euros and sales of 100 millions.

FT System, a provider of inspection systems and services for the beverage industry that belongs to Milan-listed Antares Vision, acquired Pen-Tec and Tecnel from the founder Roberto Allegri (see here a previous post by BeBeez). Antares Vision listed in April 2019 after the business combination with the spac ALP.I.Davide Allegri and Anna Maria Trombini sold their holdings in Tecnel. Antares has sales of 149.5 million euros, an ebitda of 103.1 million and net profits of 25.3 million.

Comat Servizi Energetici (Cse), an asset of Fondo Italiano per l’Efficienza Energetica (FIEE) and Comat, signed a partnership with Intesa SanPaolo for allowing its clients to receive the Superbonus 110%, a Government incentive for implementing energy saving technologies in condominiums (see here a previous post by BeBeez). Cse already received orders worth 100 million euros of which Intesa will acquire the tax credits. FIEE is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

Consilium acquired the majority of Music Center, a producer of components and accessories for musical instruments, from the Pisoni Family (see here a previous post by BeBeez). The vendors will keep a minority of the business, while Cassa Centrale e Cassa di Trento financed the acquisition. Consilium is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

MBE Worldwide, a logistic company that belongs to Graziano Fiorelli and Oaktree Capital Management (40% since January 2020), acquired Australian competitor Pack & Send (P&S), from the ceo and founder Michael Paul (see here a previous post by BeBeez). Mbe has sales of 858 million euros.

TEN Food & Beverage (TFB), the owner of the brands TEN Restaurant, Al Mare by TEN and Pasticceria Svizzera 1910, acquired the troubled competitor California Bakery, a bankrupted company that Marco D’Arrigo and his wife Caroline founded (see here a previous post by BeBeez). In April 2020, TFB tabled a 2 million euros offer for California Bakery.

Ilwaddi WLL acquired a minority of Fueguia 1833, an Italian producer of vegan perfumes (See here a previous post by BeBeez). Fueguia has sales of 2.3 million euros, an ebitda of 0.318 million and net cash of 49,000 euros.