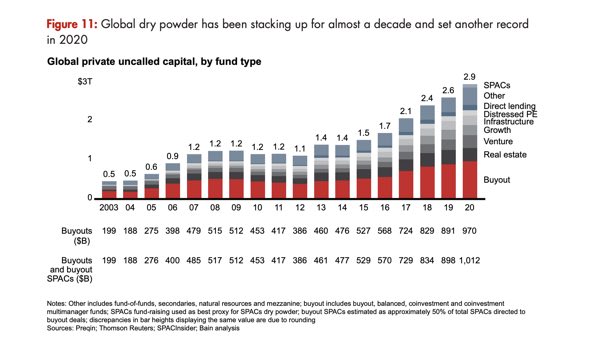

At the end of 2020, the global dry powder of private capital funds amounted to 2,9 trillion US Dollars, Roberto Fiorello, the head of the Italian private equity practice of Bain&Company (Bain), said (see here a previous post by BeBeez). Mr. Fiorello quoted the data of a Private Equity report of top tier consulting Bain that combined the resources of the funds with those of the SPACs. Preqin, Thomson Reuters and SPACInsider provided such figures. For a focus on the state of the private equity sector in Europe in 2020, please refer to this article by BeBeez, while on the Italian activity of private capital investors in 2020, we refer to the various reports by BeBeez, available for subscribers to BeBeez News Premium and BeBeez Private Data (see here how to subscribe): here the Private Equity 2020 Report, here the Venture Capital 2020 Report and here the Private Debt 2020 Report.

At the end of 2020, the global dry powder of private capital funds amounted to 2,9 trillion US Dollars, Roberto Fiorello, the head of the Italian private equity practice of Bain&Company (Bain), said (see here a previous post by BeBeez). Mr. Fiorello quoted the data of a Private Equity report of top tier consulting Bain that combined the resources of the funds with those of the SPACs. Preqin, Thomson Reuters and SPACInsider provided such figures. For a focus on the state of the private equity sector in Europe in 2020, please refer to this article by BeBeez, while on the Italian activity of private capital investors in 2020, we refer to the various reports by BeBeez, available for subscribers to BeBeez News Premium and BeBeez Private Data (see here how to subscribe): here the Private Equity 2020 Report, here the Venture Capital 2020 Report and here the Private Debt 2020 Report.

Milan-listed motorway manager Atlantia turned down the binding offer that Cdp Equity-Blackstone-Macquarie tabled on 24 February, Wednesday, for 88% of ASPI-Autostrade per l’Italia (see here a previous post by BeBeez) However, Atlantia said that it is ready to re-open talks if the funds are willing to sweeten their offer for ASPI which is of 9.1 billion euros, press reports say, while the vendors aim to fetch 11-12 billion on the ground of a RAB-based evaluation. In 2017, ASPI sold a stake of 11.94% to Allianz Capital Partners, EDF Invest, DIF, and Silk Road Fund on the ground of a value of 14.8 billion.

The Italian Football Clubs that are part of Lega Calcio Serie A took no decision on the TV rights of the Italian championship and on the offer by private equity funds for a media company were those rights might be transferred at their meeting on March 4th (see here a previous article by BeBeez). The offer by CVC – Advent – FSI for the creation of a media company that would manage the tv rights and the offers of pay-TV broadcasters Sky and DAZN for the tv rights were a topic of discussion at the meeting as expected (see here a previous article by BeBeez).

Seco, an Italian producer of miniature computers and IT systems for industrial use that is part of the portfolio of FII,aims to list by 1H21 (see here a previous post by BeBeez). The company will launch an IPO through the sale of shares and the launch of a capital increase and will invest the raised proceeds in its development. Seco has sales of 76 million (+16.4% yoy), a 21% adjusted ebitda or 15.9 million (+35%) and an adjusted net financial debt of 11.4 million (7.3 million). The company invested 13.5 million, 4.9 million of these in the acquisition of InHand Electronics, Ispirata and Hopenly.

Alberto Castelli is the new ceo of Italian asset manager Kairos and replaced Fabrizio Rindi, who became chairman and subscribed a capital increase of the firm for holding a 5% stake together with the sales director Caterina Giuggioli (see here a previous post by BeBeez). Swiss private bank Julius Baer is the controlling shareholder of Kairos. Guido Brera (cio) Rocco Bove (Head of Fixed Income) and Massimo Trabattoni (Head of Italian Equity) have 30% of Kairos. In September 2020, Kairos launched Renaissance Eltif, whose subscription period ends on 31 March,Wednesday

Italian Infrastructure Funds F2i acquired 80% of Geasar the company that manages the airport of Olbia Costa Smeralda based in Sardinia (see here a previous post by BeBeez). Alisarda hired Houlihan Lokey for selling this stake. The Chambers of Commerce of Sassari and Nuoro and the Sardinia Region have 20% of OCS.

The Chinese Government now has 23% of Shenzeng-listed Suning.com, the retailer that owns Italian Football team Inter Milan (see here a previous post by BeBeez). Shenzhen International Holdings, a Government’s motorway management company, acquired 8% of Suning.com. Shenzhen Kunpeng Equity Investment Management purchased 15% for 14.8 billion yuan (2.28 billion US Dollars or 1.9 billion euros). Zhang Jindong, the founder of Suning, is still the company’s main shareholder.

Ceme, an Italian producer of electropumps and of electrovalves that belongs to Investindustrial, acquired competitor Ode from Hong Kong-based Defond (see here a previous post by BeBeez). Banca Finint acted as financial advisor for Ode which has sales of above 80 million euros. Roberto Zecchi is the ceo of Ceme whose turnover amounts to 170 million. Investindustrial acquired 97% of CEME from Investcorp in December 2017 for 285 million. In 2008, Investcorp acquired Ceme from Barclays Private Equity. Investindustrial is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

Alberto Minali, the former ceo of Cattolica Assicurazioni and previous coo of Generali, is considering the launch of a Spac for the insurance sector (See here a previous post by BeBeez). Intesa Sanpaolo and Ubs will be the sponsor of the Spac. In October 2019, Minali left Cattolica and asked the insurer’s chairman Paolo Bedoni to refund 9.6 million euros.

A club deal that Akos Finance launched acquired 25% of CDM Soluzioni Logistiche from the founders Michele, Alberto and Laura Franceschin who kept a controlling stake in the business (see here a previous post by BeBeez). CDM has sales of 3 million euros with a 15 ebitda margin.

Lucart, an Italian producer of paper for cleaning that owns the brands Tenderly and Tutto, acquired UK competitor ESP (Essential Supply Products) from the founder Carl Theakston (see here a previous post by BeBeez). The target has sales of 24 million GBP (30 million euros). Lucart has a turnover of 510 million euros and belongs to the Pasquini family. The sector is growing and consolidating. Sofidel, an Italian competitor of Lucart generated sales of above 2 billion in 2020 (1.91 billion in 2019) with an ebitda of 418 million (259 million) (see here a previous post by BeBeez).

Ambienta appointed William Kitchin and Michele Romualdi as head of business development and head of sales (see here a previous post by BeBeez). The managers will report to Ambienta’s managing partner and founder Nino Tronchetti Provera and will support the growth of Ambienta X, an absolute return fund that has more than 500 million US Dollars of assets under management. Kitchin previously worked for Titan Capital Management, Morgan Stanley, Russell Investments, and Tremont Capital Management. Romualdi previously worked for Fidelity International, Kairos Partners and UBS. Ambienta is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

Marco Boglione, the chairman and founder of Milan-listed fashion firm BasicNet (the owner of brands Kappa, Robe di Kappa, Jesus Jeans, K-Way, Superga, Sabelt, Briko, and Sebago) withdrew its bid for troubled competitor Corneliani (see here a previous post by BeBeez). BasicNet has sales of 260 million euros and an ebitda of 20 millions.

On 1 March, Monday, BFF closed the acquisition of 76% of DEPOBank while on 5 March, Friday, Equinova (the vehicle of Advent International, Bain Capital and Clessidra) will hold 7.6% of the merged Milan-listed entity (see here a previous post by BeBeez). BFF will rebrand as BFF Banking Group. Amélie Scaramozzino will represent Equinova in the board of directors.

On 1 March, Monday, Stefanel, the troubled Milan-listed fashion retailer, sold 23 of its 27 shops to Milan-listed competitor OVS (see here a previous post by BeBeez). Milan-listed Tamburi Investments Partners (TIP) is a shareholder of OVS which pais 3.2 million euros for acquiring the brand Stefanel, 23 shops and other activities. OVS will finance such an acquisition with its own resources and the proceeds of a capital increase of up to 80 million.

Bio-On, a bioplastic producer that is no longer Milan-listed since October 2019, started a sale auction for a least price of 95 million euros (see here a previous post by BeBeez). Marco Astorri and Guy Cicognani founded the company in 2007. The company bankrupted after a report of Quintessential Capital Management, an active shareholder that questioned the company’s financials.

Unece (United Nations Economic Commission for Europe) and Università Carlo Cattaneo di Castellanza LIUC will create an excellence centre for green finance for infrastructures and smart cities (see here a previous post by BeBeez). This think tank aims to support local and national governments for creating sustainable smart cities.

At the closure of trading of 3 March, Wednesday, Milan-listed biotech Philogen’s share price has been of 16.69 euros below the ipo price of 17 euros, for an initial market capitalization of 690 million euros (see here a previous post by BeBeez). In May 2019, The Equity Club (TEC), the club deal of private investors that Mediobanca launched and Roberto Ferraresi heads, acquired a 17% of Philogen after having subscribed part of a 62 million capital increase of the company on the ground of an equity value of 355 million. Philogen listed 10% of its equity in ipo (69 million) through a capital increase and allowed to exercise the overallottment option for a further 1% (7 million) as Nerbio and Dompé Holdings sold part of their shares. The company totally raised 76 million. After the listing the company’s shareholders are the Neri Family (41%), Dompé Holdings (30.18%) TEC (1.47%). The company will invest the raised proceeds in its organic development.

Fondo Italiano d’Investimento (FII) aims to launch Agritech & Food, a sector fund that aims to raise 700 million euros (see here a previous post by BeBeez). Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Stevanato Group, an Italian company that procuces packaging for the pharmaceutical sector, aims to list on NYSE on the ground of an enterprise value of 4 – 5 billion US Dollars (see here a previous post by BeBeez). The company hired Houlihan Lokey, Jefferies, Morgan Stanley, and Bofa Merrill Lynch as advisor for the IPO. The Stevanato Family is the owner of the company, Franco Stevanato is the ceo. The company has sales of 570.3 million euros (+10.9% yoy) and an ebitda of 111.1 million. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Sviluppo Imprese Centro Italia (Sici) and Next Holding (the family office of Andrea Manganelli) acquired a minority of 3M, an Italian foundry (see here a previous post by BeBeez). Deloitte acted as legal and financial advisor to 3M. In 2017, Sici subscribed a minibond of 3M, sottoscrivendo un suo minibond. SICI has resources of 146 million euros.