The tender offer by IMA BidCo spa (100% indirectly controlled by Sofima spa) on IMA spa starts today. IMA is a Milan-listed group active in the design and production of automatic machines for the packaging of pharmaceutical, food, beverage and cosmetic products. The offer at 68 euros per share will close on 14 January 2021 (see the press release here and the Offer Document here). The complulsory takeover bid is due to the fact that last November shareholders of Sofima spa (since last November the parent company of IMA) sold some shares to paneuropean private equity firm BC Partners (see here a previous article by BeBeez) as was previously announced at the end of July (see here a previous article by BeBeez).

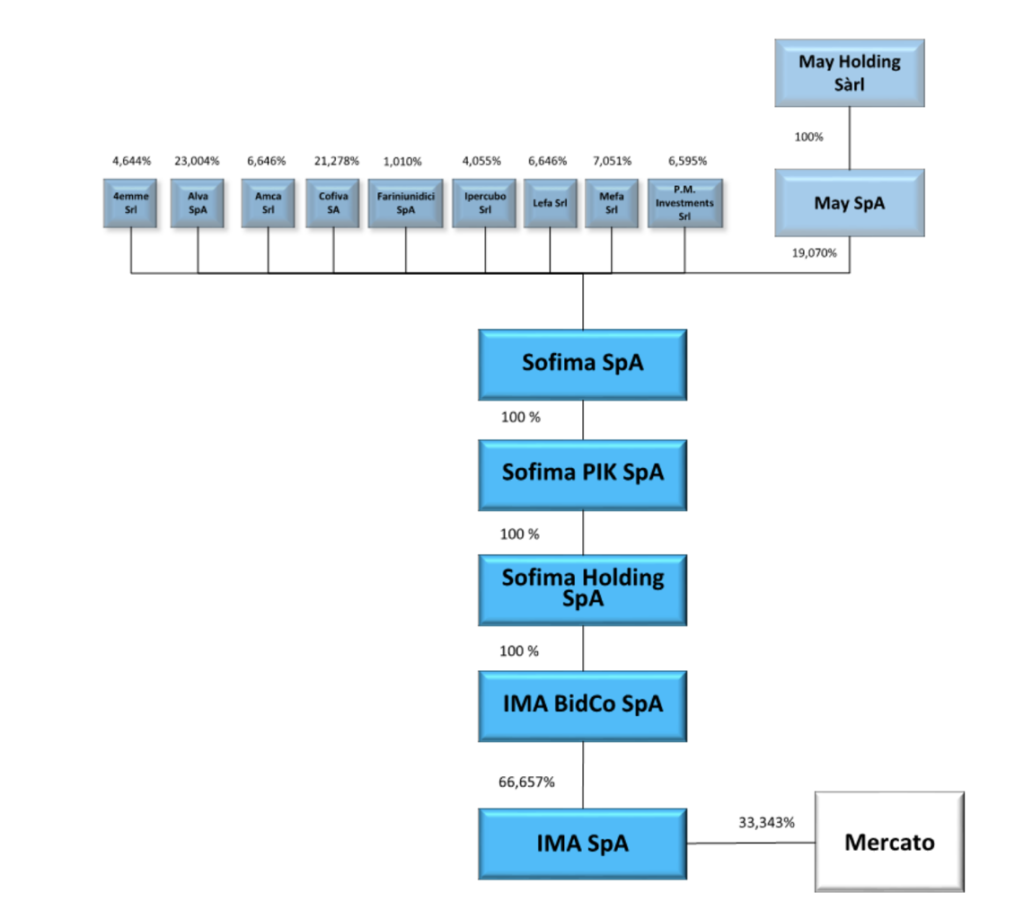

In detail, the Vacchi family, under the control of Sofima spa, which last November held 51.6% of the share capital and 67% of the voting rights of IMA, sold a 19,07% stake in Sofima and 41.414% of the related voting rights to May spa, a newco owned by BC Partners. The price was 1372.39 euros for each Sofima share, corresponding to a value of 68 euros for each IMA share (including the dividend). At the same time buyers and sellers have signed a shareholders’ agreement to share governance.

BC Partners could increase its stake in Sofima up to approximately 45%, while the current shareholders will hold 55% of the capital. The transaction is based on IMA’s equity value of 2.93 billion euros. The Offer Document shows that to date IMA BidCo already individually holds an equity investment of approximately 28.8 million ordinary IMA shares, representing 66.657% of the share capital and 76.730% of the relative voting rights. And this is because between 18 and 25 November 2020, IMA BidCo purchased additional ordinary shares on the market, corresponding to a total of 15.062% of the share capital. Meanwhile a reorganization of the control structure was made so now IMA’s parent company is IMA BidCo.

Meanwhile Sofima Holding spa (100% controlled by Sofima PIK spa, which in turn is controlled by Sofima spa) in recent days has placed bonds for a total amount of 1.280 billion euros, higher than that initially announced of 1.25 billions (see the press release here). The bonds were issued in two tranches: a senior secured bond of 450 millions, maturing in January 2028 and paying a variable coupon equal to the 3-month Euribor rate with a 0% floor plus a 400 basis point spread, and another senior secured bond of 830 millions ( more than the 800 millions expected), with maturity again in January 2028 and a fixed coupon of 3.75%. Bookrunners of the transaction were Bnp Paribas, Credit Agricole CIB, JP Morgan, Morgan Stanley, Mizuho Financial Group, Mediobanca, UniCredit, RBS. Moody’s has assigned a B2 rating, identical to the corporate rating (see Moody’s report here).

The proceeds from the issue will be used to repay the bridge loan stipulated on 17 November for the purchase of the Sofima shares and to repay the existing financial debt, together with the financing of net working capital and cash and cash equivalents. in the financial statements, as well as for the payment of commissions relating to the issue and for the deposit in escrow accounts, which may subsequently be released to make over-the-counter purchases of Ima shares and acquire shares as part of the takeover bid. The bonds will be intended for listing on the Luxembourg Stock Exchange and admitted to the Euro MTF Market multilateral trading facility.

The Offer Document also states that in November Sofima issued PIK notes for 310 million euros maturing on October 30, 2028. The interest rate at the issue date of the securities is 9.375%. From the fourth anniversary of the PIK Notes issue date and each subsequent anniversary thereafter, until 30 October 2028, the interest rate will be increased by an additional 0.5% per annum. Furthermore, the interest rate may be further increased (i) by 0.5% if the net consolidated debt ratio of the company and its subsidiaries exceeds the threshold of 7 to 1 and (ii) by 1.0% if the predicted ratio exceeds the threshold of 7.5 to 1.