Investindustrial will put on sale at the beginning of 2021 Polynt-Reichhold, the Italian-American group active in the field of coating and composite resins, as well as a global operator in the field of specialized chemistry, vertically integrated and with a significant presence in Europe and North America, Reuters reports, adding that the group should be worth 1.5-2 billion euros.

Investindustrial will put on sale at the beginning of 2021 Polynt-Reichhold, the Italian-American group active in the field of coating and composite resins, as well as a global operator in the field of specialized chemistry, vertically integrated and with a significant presence in Europe and North America, Reuters reports, adding that the group should be worth 1.5-2 billion euros.

The group actually closed FY 2019 with 2 billion euros in revenues, an ebitda of 241 millions and a net financial debt of 300 millions (see the presentation here). Last February the group refinanced its 506 million euros gross medium-long term debt with a new medium-long term senior secured loan that was issued to Specialty Chemicals Holding I bv for 475 million euros (JPMorgan was the only bookrunner and administrative agent) and with a 100 million euros new revolving credit facility; and with a new 60 million euro senior secured medium / long-term loan granted to Polynt Composites USA (see Moody’s report here). The operation also allowed the payment of an extraordinary dividend to shareholders for 125 million euros.

At the same time, Investindustrial is said to be monitoring the ongoing sales process of the Specialty Ingredients division of the listed Swiss chemical group Lonza (see Reuters here). The division is said to be valued 3-3.5 billion Swiss francs, based on a EV multiple of 10-12x the 300 million francs expected 2020 ebitda. The same potential bidders for Lonza Specialty Ingredients, in fact, may be interested in purchasing Polynt-Reichhold at the same time.

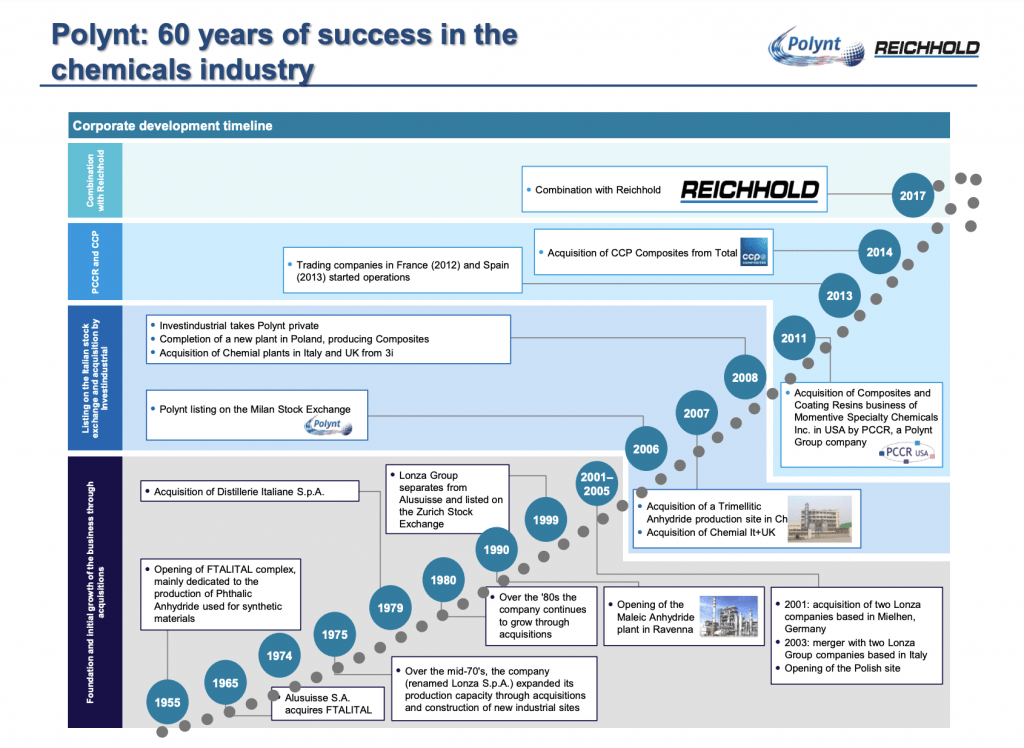

Polynt-Reichhold was born in 2017 following the merger between Polynt spa, a leading Italian company in the production of intermediate polymers and composite materials, controlled by Investindustrial since 2008 through Polimeri Speciali Holding spa, and Reichhold Industries. The latter was a US chemical group specializing in the production of resins, in turn controlled by a group of private equity funds led by Black Diamond Capital Management and which also included JP Morgan Investment Management, Third Avenue Management and Simplon Partners. The latter funds had invested in Reichold’s senior bonds which then defaulted in 2014 and had therefore taken control of the group by converting their credit into equity, supporting the relaunch of the business (see here a previous article by BeBeez). Today Polynt-Reichhold operates 41 factories around the world and has a strong presence in Europe and North America.

We recall that last September Investindustrial and Black Diamond jointly acquired Hexion PSR, a company active on a global scale in the production of special phenolic resins, engineering thermosetting molding compounds and formaldehyde, and has a strong positioning in both Europe and North America. The seller of the group was NY-listed Hexion Inc group. The company changed hands for 425 million dollars, of which 335 million paid at closing and including some liabilities assumed by the buyer and the remainder relating to future income based on the performance of the company for the remainder. The closing of the transaction is scheduled for the first quarter of 2021 (see here a previous article by BeBeez). The acquisition of Hexion was not made through Polynt-Reichnold, but considering that it is operates in the same sector, in the future it cannot be excluded that the two companies may merge and form a single group, perhaps in view of a future sale, which could thus become even more attractive.