A binding offer by the Australian infrastructure fund Macquarie for a 50% stake in OpenFiber spa owned by Italy’s electricity giant Enel is expected in early September, Il Sole 24 Ore wrote.

Enel had confirmed last June press rumors about an offer by the Macquarie Infrastructure Real Asset fund for its stake in the broadband telecommunications operator (see here a previous article by BeBeez). It was a non-binding offer and concerned all or part of the 50% stake in Open Fiber owned by Enel.

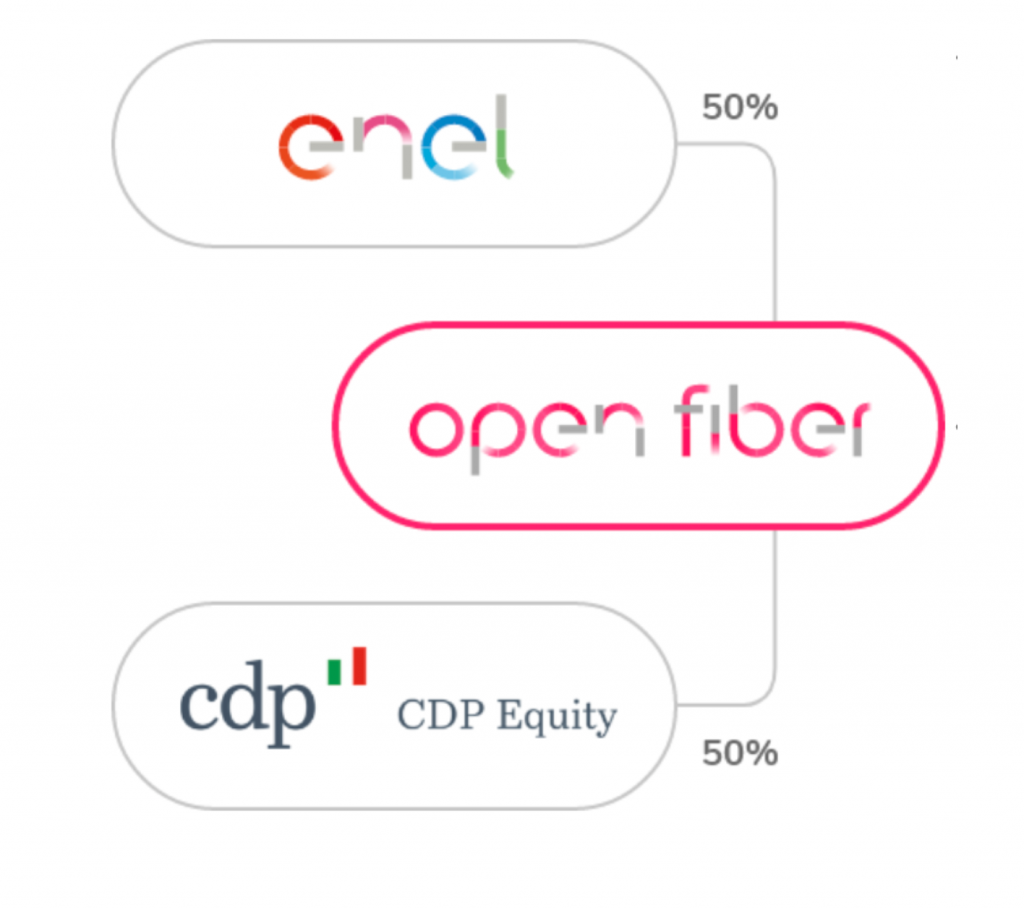

OpenFiber is now jointly controlled by Enel and Cdp Equity (Cassa Depositi e Prestiti’s private equity investment arm) and last November it was rumored that various international infrastructure funds had delivered expressions of interest not only for Open Fiber, but also for Flash Fiber (a joint venture between TIM, which controls it at 80 % and Fastweb, which holds the remaining 20%) and for TIM’s FTTH (Fiber to the Home) assets (see here a previous article by BeBeez). All in the context of a complex operation with the aim of creating a single major Italian player in the optical fiber sector.

As is known, on August 27 in a meeting between the Italian Government and the Italian political majority’s representatives it was given green light to the path for the creation of a single company to manage the ultra-broadband network, supporting the path identified in the meantime by Cdp and TIM for the establishment of the company that will manage the infrastructure of the single network with ultra-fast fiber.

Today the TIM Board of Directors is expected to give the green light to KKR’s offer as part of the FiberCop Project relating to TIM’s secondary network (from street closets to homes), which, in addition to involving KKR and Fastweb, could also expand to Tiscali and also include OperFiber (see here a previous article by BeBeez).

FiberCop is the newly established vehicle, in which the transfer of TIM’s secondary network, the participation of the KKR Infrastructure fund and the activities of FlashFiber, now 80% controlled by TIM and 20% by Fastweb, are planned. On the occasion of the presentation of the half-year report, last August 4, TIM had explained that the transaction provides for the purchase by KKR Infrastructure for 1.8 billion euros of 37.5% of FiberCop on the basis of an enterprise value of approximately 7.7 billion euros (equity value 4.7 billion euros with Fastweb which would instead have 4.5% of the capital of FiberCop (see here a previous article by BeBeez).

TIM and Tiscali announced, again on August 27, that they had signed a Memorandum of Understanding to define the terms of a strategic partnership concerning the development of the ultra-broadband market through Tiscali’s commercial participation in the FiberCop co-investment project. Furthermore, TIM and Tiscali will subsequently verify the possibility of a possible entry of Tiscali into the FiberCop shareholding through the transfer of a specific business unit, according to procedures to be agreed.

That said, it must now be understood how FiberCop and OpenFiber will integrate and if KKR will increase its weight in the deal, taking over 50% of OpenFiber in the hands of Enel, or if it will be Macquarie. As for the figure, initially there was talk of a value of Open Fiber’s assets of at least 3 billion euros, but even as early as June a Mediobanca study, commissioned by Enel, provided an evaluation of 8 billion for Open Fiber, of which 2 billion of synergies. As for TIM, according to Reuters, it would have valued the asset at 5-6 billion.

EdiBeez srl