Macquarie Infrastructures is strongly interested in buying Eni‘s activities in the natural gas sector in Australia, the Australian Financial Review writes, adding that other potential buyers are the Australian-based group Santos and the South Korean-based SK Group (the latter supported by the advisor JPMorgan).

Macquarie Infrastructures is strongly interested in buying Eni‘s activities in the natural gas sector in Australia, the Australian Financial Review writes, adding that other potential buyers are the Australian-based group Santos and the South Korean-based SK Group (the latter supported by the advisor JPMorgan).

The auction has opened in recent weeks, with Citi appointed by Eni as its financial advisor and with an assessment of the assets in question that could reach one billion dollars in enterprise value (see Reuters here).

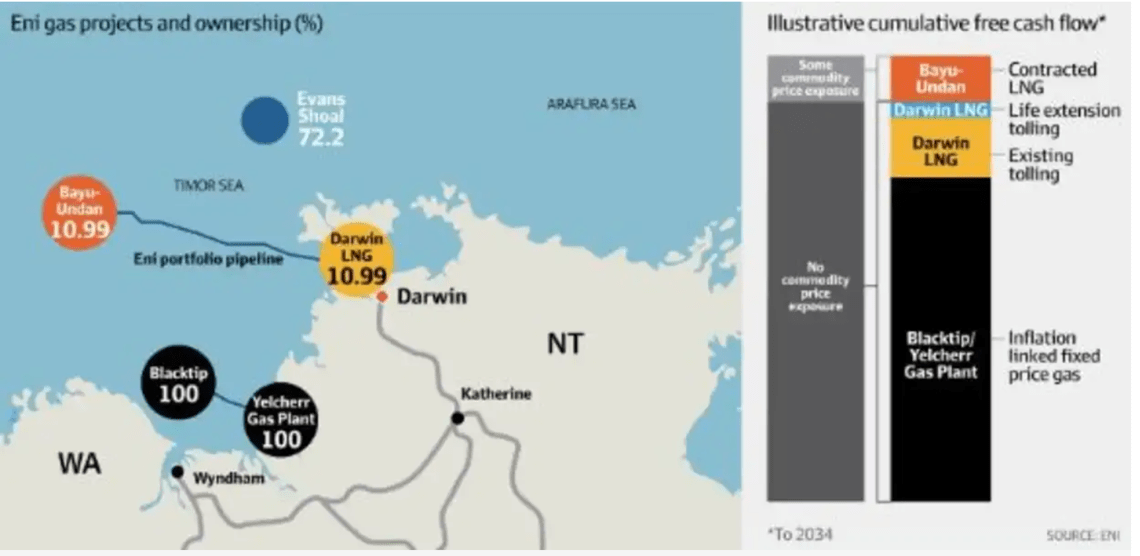

More in detail, the assets for sale are said to be the Blacktip Gas Project and the Yelcherr Gas Plant plus the 10.99% share of the Darwin LNG plant and the Bayu-Undan field and the 72.2% share in the Evans Shoal project. Last March the Australian group Santos sold 25% of Darwin LNG and Bayu-Undan to SK E&S for 390 million dollars (see the press release here).

According to AFR,, the teaser distributed by Citi reveals that the assets on sale produced a free cash flow of 165 million dollars in 2019. The most important part of that free cash flow came from contracts for the sale of gas of the Blacktip and Yelcherr plants, index-linked to inflation, followed by the share produced by the tariffs for the treatment of liquefied natural gas by Darwin LNG. Cash flows will be the same until 2034 and for the most part they are not subject to the price risk of raw materials.