The dry powder of European private equity and venture capital funds is now up to 265 billion dollars. This is the fresh figure calculated by Preqin for BeBeez, and show an increase of about 2 billion euros since December 2019 and about 20 billions since the end of 2017. This is money that could be vital to support European companies in this difficult moment due to the coronavirus epidemic.

We asked for the updated data, because we were curious to have the most recent possible comparison data on the dry powder of all private capital in the world, while we were preparing the latest BeBeez Report on the fundraising of Italian private capital funds, published yesterday (available for subscribers to BeBeez News Premium and BeBeez Private Data Combo, find out how to subscribe here), which calculated that from 2018 to today at least 14.2 billion euros of capital have been raised, many of which still to be invested.

The Mc Kinsey & Co. study we reported about in recent days, which puts together the data provided by the main providers in the sector, in fact, indicated a dry powder of 2.3 trillion dollars as for June 2019 and assets under managementat 6.5 trillion dollars (see here a previous article by BeBeez).

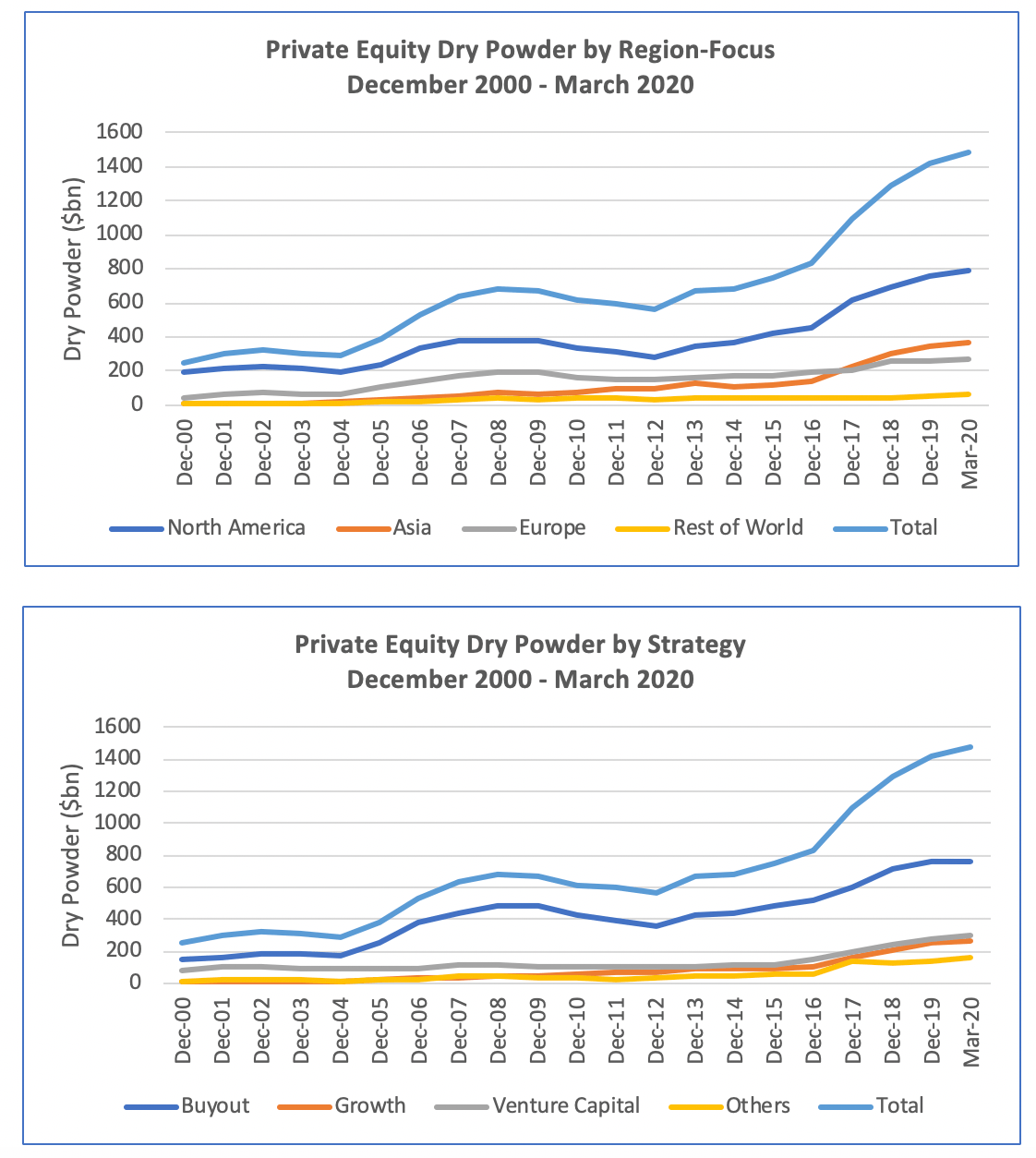

Well, the latest Preqin data indicate that the total dry powder has so far risen to over 2.570 billion dollars, of which approximately 1.480 billions are the cartridges of private equity and venture capital funds, 276 billions are those of private debt funds. 327 billions those of real estate funds, 222 billions of infrastructure funds and 266 billions is the dry powder of funds specializing in natural resources.

As for European funds, it was said, private equity funds still have capital raised but not yet invested for a total of about 265 billion dollars, private debt funds for 84.1 billions, real estate funds for 83.2 millions, infrastructure funds 82.2 billions and finally funds dedicated to natural resources 68.2 billions. All capital ready to be invested despite the coronavirus.