More than a year after the last rumors about possible new shareholders for Kedrion spa, the leading group in the plasma-derived sector, controlled by the Marcucci family and 25.7% participated by Cdp Equity (see here a previous post by BeBeez), saw the price of its 350 million euro 2022 coupon 3% bond placed in July 2017 (see here a previous post by BeBeez) collapse below 80 cents.

At the same time new rumors are spreading about a potential share reorganization which, according to Il Sole 24 Ore reports, give the dossier to the examination of Italmobiliare, Edizione Holding, the Canadian fund PSP, the family office of the US Koch family, but also of Chinese conglomerates.

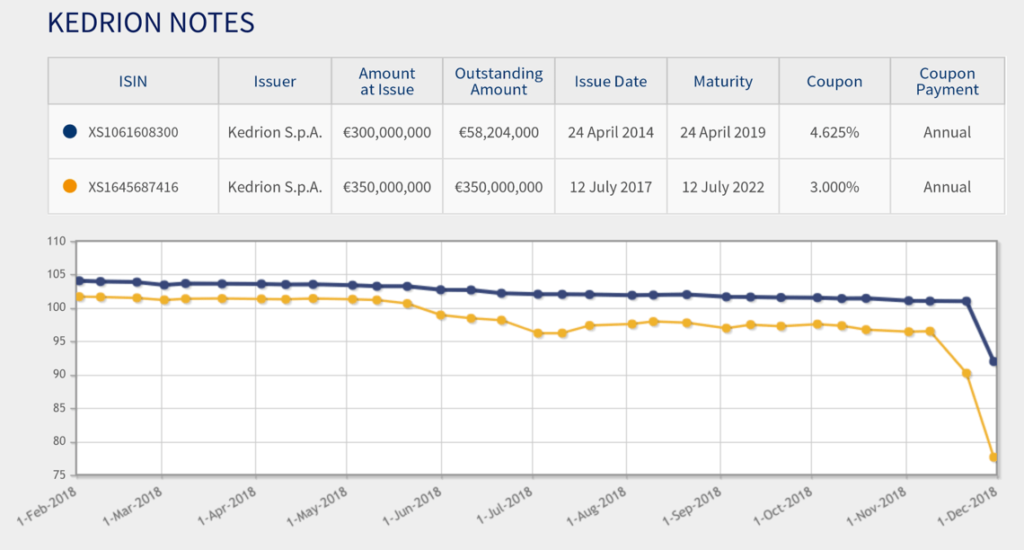

In recent days, Kedrion has issued a note to clarify that the reason for the collapse of the bond prices is not explained, emphasizing the fact that the business is booming. The nine months of 2018, in fact, closed with revenues of € 438.6 million (+ 7% from the nine months of 2017), with an adjusted ebitda of € 104.8 million (+ 7.9%) and a net financial position of 520.1 million euro, up from 507 million at the end of June, following an increase in net working capital and investments for the acquisition of plasma collection centers (see here the press release). The debt includes two bonds, both listed on the Irish Stock Exchange: the one with an amount of € 350 million and another bond (initially issued for € 300 million but today outstanding only for € 58 million following a repurchase offer) at maturity. April 2019 and coupon 4.625%, and whose prices fell less than those of the other bond, up to just above 90 cents.

The group had closed the FY 2017 with revenues of € 602.5 million, an adjusted EBIT of € 139.9 million and a net financial debt of € 444.6 million.

In the spring of 2013, the company had studied the IPO project, but then nothing had been done (see here a previous post by BeBeez). Earlier, in July 2008, Kedrion also came to define a price range for an ipo for newly issued shares of 9-12 euros for a total enterprise value of 557-703.4 million. But in that case the hypo had been canceled at the last moment because the price was eventually judged too high by institutional investors.