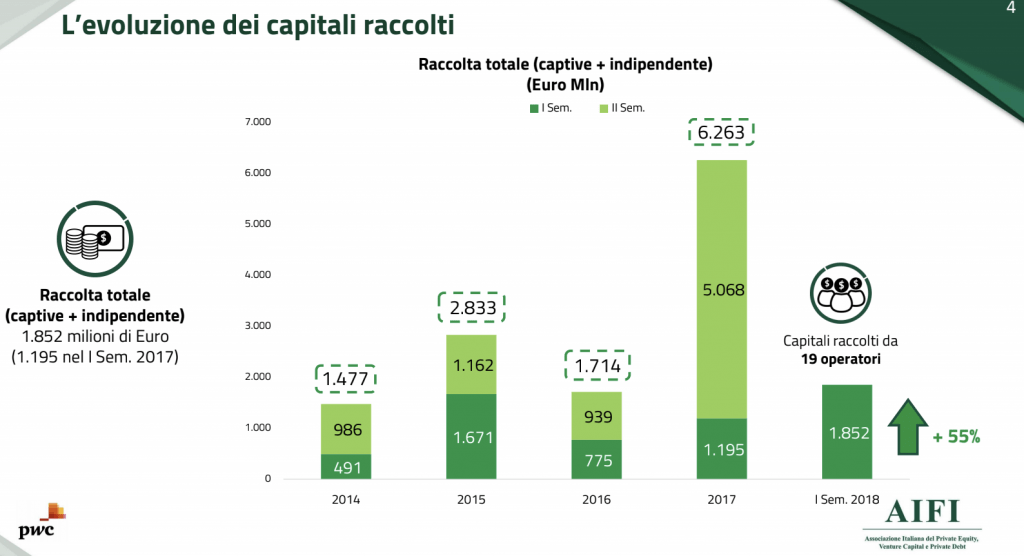

Private equity and venture capital market in Italy reported a booming H1 2018, the Italian priavte equity and venture capital association (AIFI) said yesterday presenting data elaborated by PwC (download here the presentation), adding that between January an June this year Italian firms have been investing about 2.9 billion euros (from 1.9 billions in H1 2017), closing 160 deals (from 139) and that 19 firms have been raising about 1.9 billion euros in total from investors (from 1.2 billions in H1 2017), thanks to a strong contribute by foreign investors (see here the press release).

Private equity and venture capital market in Italy reported a booming H1 2018, the Italian priavte equity and venture capital association (AIFI) said yesterday presenting data elaborated by PwC (download here the presentation), adding that between January an June this year Italian firms have been investing about 2.9 billion euros (from 1.9 billions in H1 2017), closing 160 deals (from 139) and that 19 firms have been raising about 1.9 billion euros in total from investors (from 1.2 billions in H1 2017), thanks to a strong contribute by foreign investors (see here the press release).

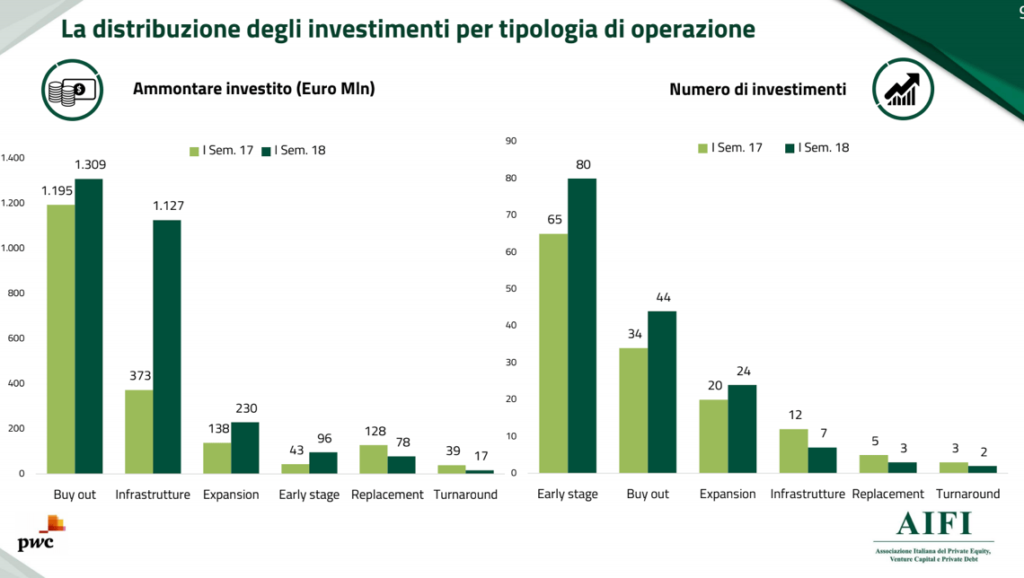

As for investments, large and mega deal came back (for a total of 1.462 billion euros). This is a trend that already emerged from BeBeez 2018 8 months’ Private equity report published a few days ago.

As for investments, large and mega deal came back (for a total of 1.462 billion euros). This is a trend that already emerged from BeBeez 2018 8 months’ Private equity report published a few days ago.

Another significant result was posted by venture capital firms who have been increasing their activity by far with 80 deals (from 65 deals in H1 2017) for a total 96 million euros of equity invested (from 43 millions).

Always in terms of investments, companies with a turnover of less than 50 million (75% of the total) prevail as targets. At the sector level, the ICT sector dominate (31 deals, equal to 19% of the total), industrial goods and services (28 deals, equal to 18% of the total) and medical (20 deals, equal to 12% of the total). Finally, the disinvestments in H1 2018 were 59 (-24% compared to the first half of 2017), for a value of 1.1 billion euros (-10%).

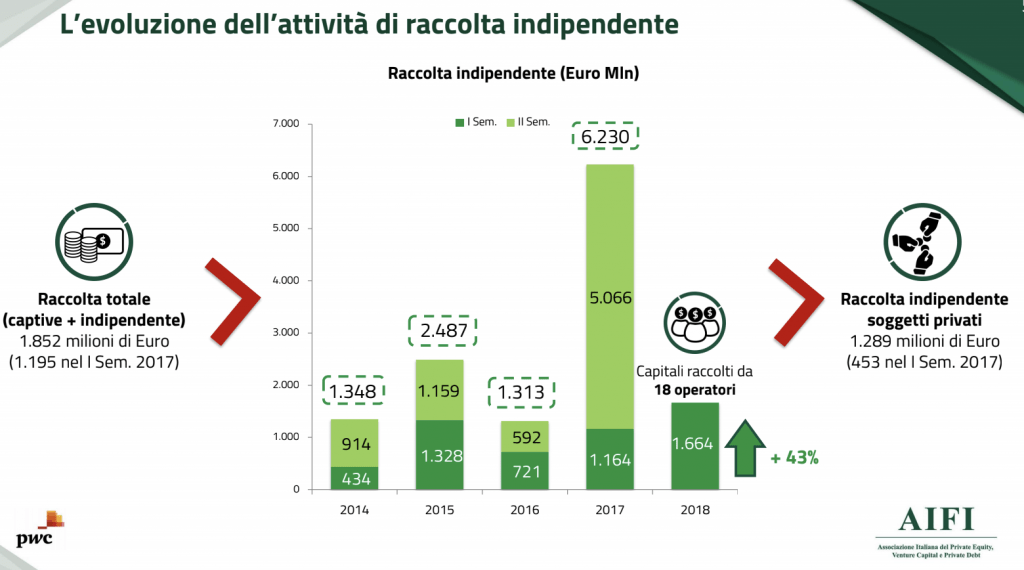

As for the fundraising, 1.3 billion euros out of the total of 1.9 billions were raised by independent firms (i.e. not Government backed or captive) and there was a significant contribute by foreign invesdtors who invested 607 million euros (+535% from 96 millions in H1 2017) or almost half of the total independent fundraising.

As for the fundraising, 1.3 billion euros out of the total of 1.9 billions were raised by independent firms (i.e. not Government backed or captive) and there was a significant contribute by foreign invesdtors who invested 607 million euros (+535% from 96 millions in H1 2017) or almost half of the total independent fundraising.

As for the investors classification, the first contributors were private individuals and family offices (17%), followed by pension funds (16%), banks (14.4%) and insurance companies (14,2%). Both banks and insurance companies are lowering their investments in private equity and venture capital due higher capital provisions that they are asked to make for keeping that kind of assets in their portfolios. Finally funds of funds just contributed for an 11.1% to the total fundraising in H1 2018.