Eni Norge as (Eni Group) announced yesterday a merger with Point Resources as, giving birth to a new company named Vår Energi as, a leader in the hydrocarbons exploration & production sector in Norway (see here the press release).

Eni Norge as (Eni Group) announced yesterday a merger with Point Resources as, giving birth to a new company named Vår Energi as, a leader in the hydrocarbons exploration & production sector in Norway (see here the press release).

Point Resources is controlled by HitecVision private equity fund, fouded by Ole Ertvaag and focused on the oil & gas sector. Point Resources was born in 2016 from the merger of Core Energy, Spike Exploration and Pure E&P, all in HitecVision’s portfolio. In 2017 Point acquired the Norwegian operative assets of ExxonMobil, including the majority of employees, and now holds all the assets that ExxonMobil has been piling up on the Norwegian continental platform in 50 years. Vår Energi will be owned by Eni with a 69.6% stake and by HitecVision with a 30.4% stake. The closing of the deal is expected by the end of 2018.

The new company will count about 800 employees. Kristin F. Kragseth, now vice president production of Point Resources, will be ceo of the new entity, while Philip D. Hemmens, now managing director of Eni Norge, will be chairman. Both Mr. Hemmens and Mr. Morten Mauritzen, now ceo of Point Resources, will remain in their actual roles in Eni Norge and Point Resources till the completion of the merger.

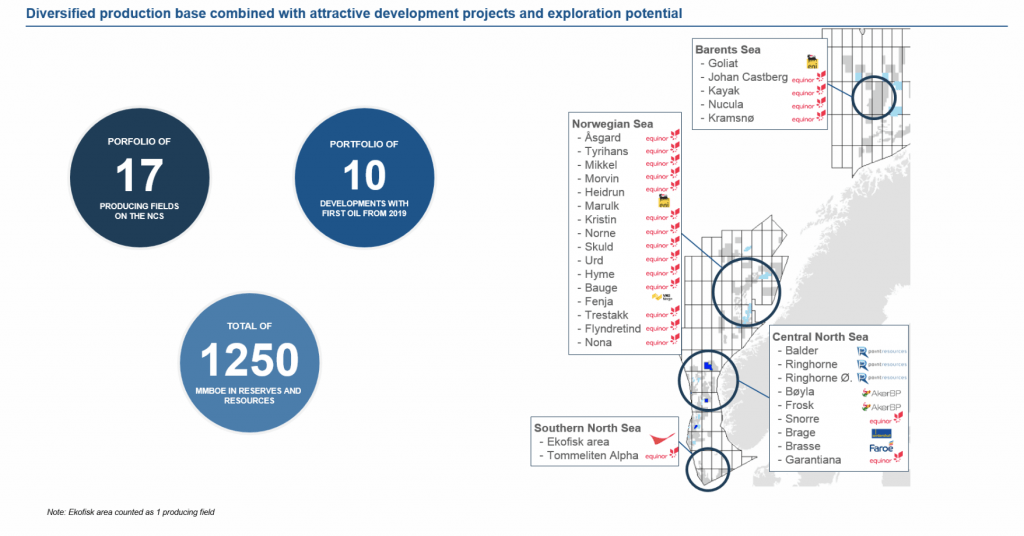

The portfolio of the combined company will have a wide geographical coverage, from the Barents Sea to the North Sea, producing around 180,000 barrels of oil equivalent per day (boepd) this year from a portfolio of 17 producing oil and gas fields. The company will have reserves and resources of more than 1,250 million barrels of oil equivalent (Mboe).

Production is expected to reach 250,000 boepd by 2023 after developing more than 500 Mboe in ten existing assets, with a breakeven price of less than 30 USD per barrel. In total, the company plans to invest more than NOK 65 billion (USD 8 billion) over the next five years to bring these projects on stream, revitalize older fields and explore for new resources. The extended presence in the Norwegian waters will allow the company also to expand further its portfolio through both future exploration bid rounds and m&a transactions.