“We are targeting a doubling in our assets under management to 2.6 billion euros by year 2024 from actual 1.3 billions”, Green Arrow Capital sgr‘s ceo Eugenio de Blasio told Milano Finanza yesterday after the presentation of the new industrial plan of the Italian alternative asset management firm (see here the press release and Green Arrow’s presentation).

“We are targeting a doubling in our assets under management to 2.6 billion euros by year 2024 from actual 1.3 billions”, Green Arrow Capital sgr‘s ceo Eugenio de Blasio told Milano Finanza yesterday after the presentation of the new industrial plan of the Italian alternative asset management firm (see here the press release and Green Arrow’s presentation).

Green Arrow Capital sgr is a new firm born from the integration of the activities of previous Green Arrow Capital’s Luxembourg asset managementt platform, with a focus on renewable energy investments, and Italy’s Quadrivio sgr, which Green Arrow bought last May after an auction that saw bids from many private capital firms. Sellers were previous Quadrivio’s founders and managers Alessandro Binello and Walter Ricciotti and investment veichle Futura Invest (see here a previous post by BeBeez).

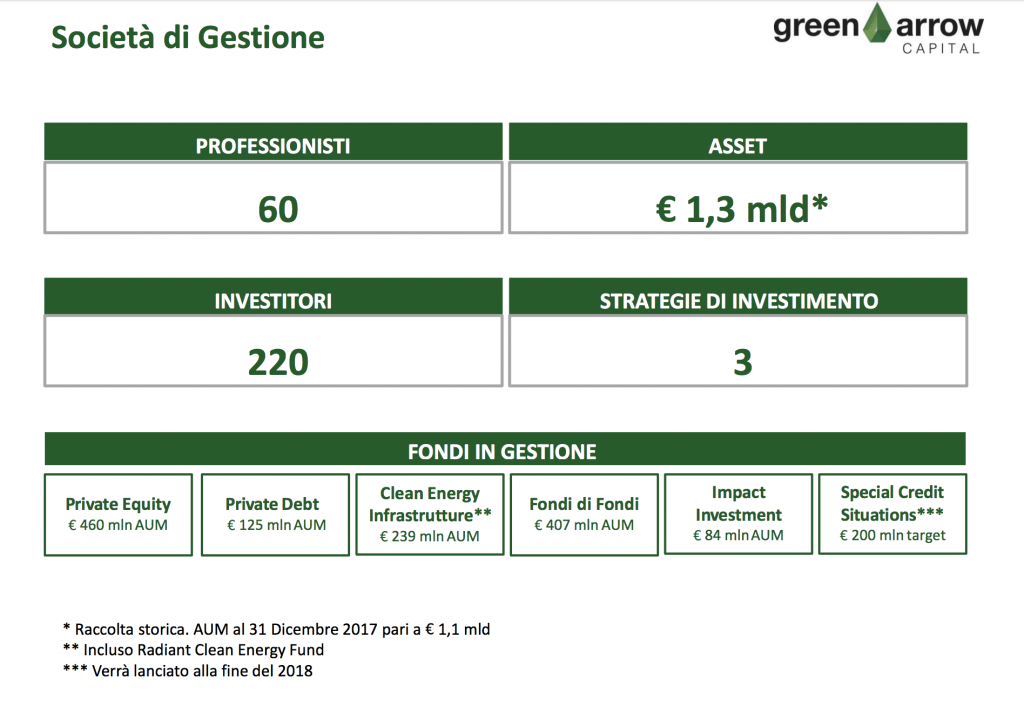

The new firm is led by Mr. de Blasio together with other partners Luisa Todini and Stefano Russo and other 5 partners, counts a team of about 60 professionals and manages the two separated asset management platform in Italy, with a focus on private equity and private debt, and Luxembourg, with a focus on infrastructures and energy,

As for the private equity sector, Mr. de Blasio said that “the firm is investing its third fund (previously managed by Quadrivio) which is now invested for about sa 30% but is seen to be invested for a 70% of its total dry powder by one year from now. That’s why we think to be launching a new private equity fund at the end of 2019”.

As for the private debt sector, instead, a new private debt and direct lending fund is still in fundraising. The fund announced a first closing at 120 million euros in 2016 and is seen to announce a final closing at around 150 million euros by next September, Mr. de Blasio said adding that “next November we will launch the fundraising of a new Special Credit Situations fund targeting a total of 200 million euros. The fund will acquire distressed loans from banks and loans deriving from leasing contracts and will be able to inject new cash in order to relaunch the business of the distressed debtors”.

At the beginning of 2019, Green Arrow will also launch a new fund with a focus on energy infrastructures with a 500-700 million euros target and focus on Italy but also on the rest of Europe (30%).

Finally the company will still be active in the impact investing sector where it actually manages a 115 million dollars micro-credit fund which is recording a 15% Irr.