Italy’s tlc and energy giant Enel spa announced yesterday that it has signed an agreement with Cinven private equity group in order to buy a 21% stake in Ufinet International, a wholesale leading operator in optical fiber in Latin America, where it manages more than 49,000 km in fiber, 17,000 km of which in urban areas, copunting on long term contracts with big industrial customers for a total value of about 700 million euros. The closing of the deal is expected by the end of July (see here the press release).

Ufinet Internationl is today entirely owned by Cinven, through its Sixth Cinven Fund. The private equity firm reinvested in Ufinet last May (see here a previous post by BeBeez), when its sixth fund bought the internationakl activities of Ufinet Group from Cinven’s fifth fund, while Antin Infrastructure Partners bought Ufinet Spain (see here the press release). Cinven had in turn bought Ufinet Group in January 2014 from Spanish group Gas Natural Fenosa.

More in detail, Enel’s subsidiary Enel X International spa will invest 150 million euros for the 21% stake of a newco which will buy 100% of Ufinet International, of which Sixth Cinven Fund will own a 79% stake. Enel X International and Sixth Cinven Fund will however exercise a joint governance on the company, owning 50% each of the voting rights in the newco.

Enel X International will also have a call option to buy the entire stake of Cinven in the newco between Dec 31st 2020 and Dec 31st 2021 a price in the range of 1.31-2.1 billion euros, depending on specific preformance indicators. If the option is not exercised by the end of 2021, Enel X International will lose its joint control on the newco, Sixth Cinven Fund will be able to sell its stake with a drag along right on Enel’s stake, while Enel will have a tag along right on Cinven’s stake if Cinven reduce its stake under 50%.

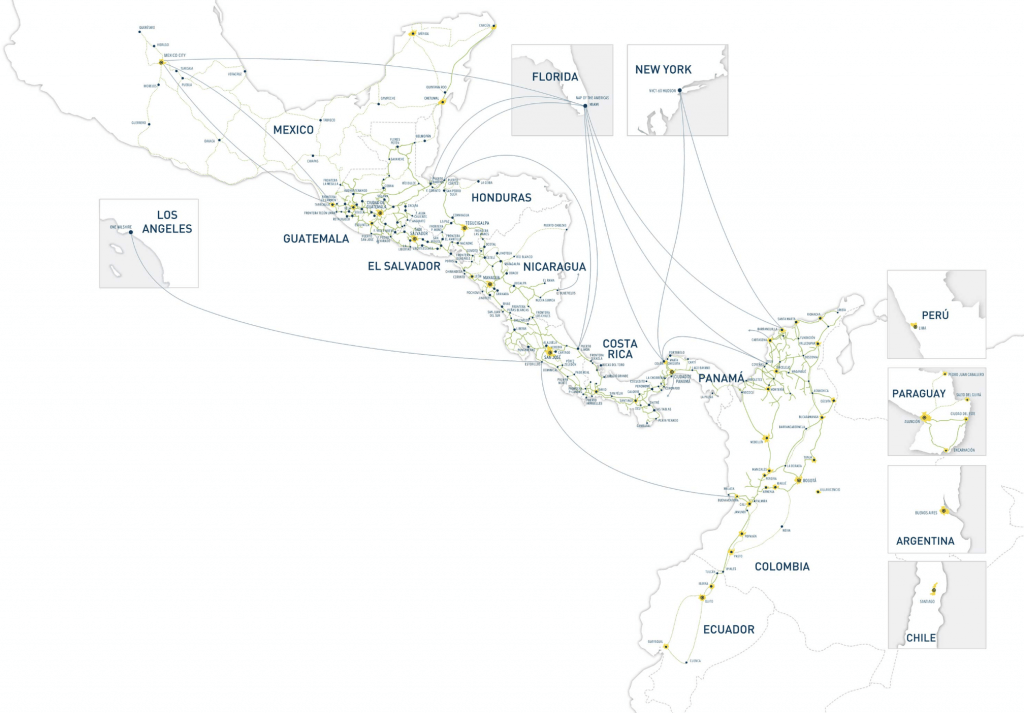

In 2017 Ufinet International reached 159 million euros in revenues. The company employs approximately 1,000 people in total. Ufinet International builds telecommunications infrastructure and provides value-added ICT services, such as cloud services, through its subsidiary IFX.

In South America, Enel is one of the main private operators in the energy sector, with a consolidated presence in the generation, distribution and transmission sectors through Enel Américas and its subsidiaries in Argentina, Brazil, Colombia and Peru, and through Enel Chile and its subsidiaries in Chile. The Enel Group is also one of the main operators in the region in the green energy sector, through its renewable energy division, Enel Green Power. In South America, the group has a total installed capacity of around 21 GW and supplies electricity to over 26 million customers.