Fundraising and divestments reached new highs for private equity and venture capital firms in Italy in 2017, with good gross returns. Investment activity however dropped down to less than 5 bn euros.

Fundraising and divestments reached new highs for private equity and venture capital firms in Italy in 2017, with good gross returns. Investment activity however dropped down to less than 5 bn euros.

Data for the Italian market were published yesterday by Aifi in partnership with PwC (while private debt data were reported by Aifi itself some weeks ago, see here a previous post by BeBeez and here BeBeez‘s 2017 Private Debt Report).

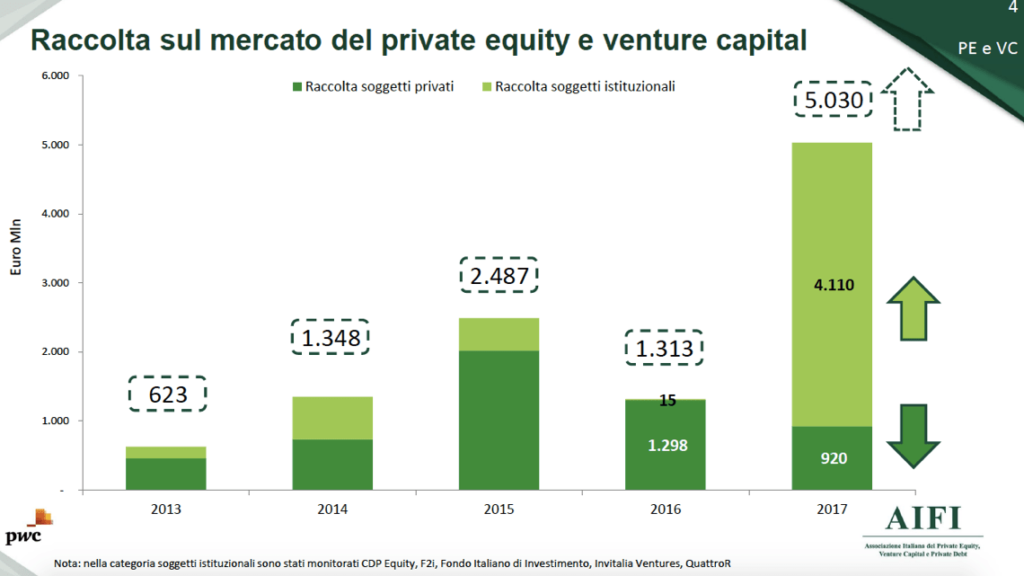

As for the fundraising activity, Aifi’s managing director Anna Gervasoni stressed that 5.03 billion euros were reached from just 1,3 billion euros in 2016. However this was just thanks to capital raised by some big private equity firms such as F2i sgr, QuattroR sgr and Fondo Italiano d’Investimento sgr, who raised 4.11 bn euros alone. Italian investors were responsabile of the major part of funds raised (72%) with international investors laying behind (28%).

As for fundraising, Fabio Innocenzi, chairman of the Italian Private Banking Association, proposed that investments might be increased if the minimum investment ticket is lowered and if a new investors category between retail and professionals is introduced (see here Mr. Innocenzi’s presentation).

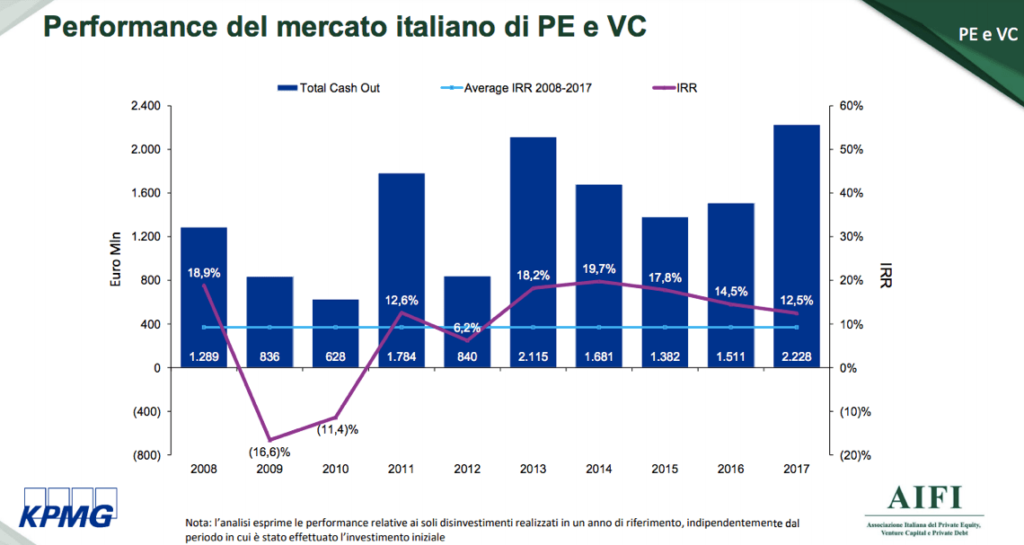

IInvesting in private equity and venture capital in Italy still gives good returs. Kpmg calculated for Aifi that average gross Irr for divestments in 2017 was 12.5%, which was above the 10% 10-year average, even if lower than the 14.5% Irr for 2016 and 19.7% in 2014. To find a lower figure, you need to look at 2012 Irr which was 6.2%.

IInvesting in private equity and venture capital in Italy still gives good returs. Kpmg calculated for Aifi that average gross Irr for divestments in 2017 was 12.5%, which was above the 10% 10-year average, even if lower than the 14.5% Irr for 2016 and 19.7% in 2014. To find a lower figure, you need to look at 2012 Irr which was 6.2%.

Divestments are now easier: Italian funds divested a total of 3.752 billion euros last year spread on 202 deals, which was the highest figure in the Italian market history. While write-offs were just a 6% of the total number of deals.

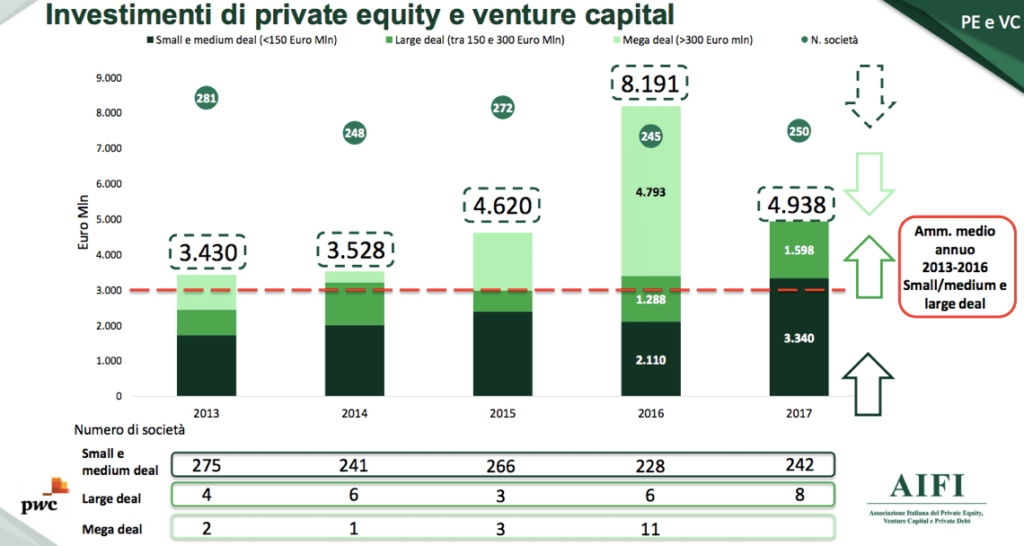

Bad news come instead from the investment activity as fund invested just 4.938 billion euros in 2017 (in 250 companies) which was a figure 40% lower than the 8.191 billion euros invested in 2016 (in 245 companies).

Bad news come instead from the investment activity as fund invested just 4.938 billion euros in 2017 (in 250 companies) which was a figure 40% lower than the 8.191 billion euros invested in 2016 (in 245 companies).

However, if you do not count megadeals (or deals above 300 million euros of invested equity), which were not announced in 2017 while were 4.793 billion euros in 2016, you see that year 2016 (with 3.398 billion euros) was just above year 2017 (for an analysis of all the deals made by the private equity firms in Italy last year download here BeBeez‘s 2017 Private Equity Report).

As for different strategies, in 2017 expansion deals dropped both as for number (-33%) and for value (-52%). On the contrary early stage deals were more both as for number (+4%) and for value (+29%). As for portfolio companies sector, industrial goods and services represents the most common sector for 2017 deals (16%) followed by Ict (just less than 16%).

“Innovation is crucial for economic growth in the industrial countries and Italy is no exception”, Aifi’s chairman Innocenzo Cipolletta said adding that “innovation allows us to be competitive and is an incentive to new investments and new consumes. This is why private equity and venture capital funds which invests in our SMEs give them enormous opportunities allowing them to grow and develop” (see here Mr. Cipolletta’s presentation).

However Italy still need more finance for innovation. Carlo Ferro, vicepresident of Assolombarda (the Milan’s entrepreneurs association) and STMicroelectronics’ s cfo, said at the Aifi conference that “there is a gap for accessing credit for new initiatives depending on wether you are a big player or a startup. In 2017 I led an equity linked bond issue for STM and raised 1.5 billion dollars at zero cost and with zero dilution. But this happens if you have an investment grade rating and a consolidated equity story. This is not so easy for a startup or a tech SME. But if this is the case, the Italian innovation ecosystem cannot grow or cannot grow at the same pace of other European countries such as France” (see here Mr. Ferro’s opening speech).

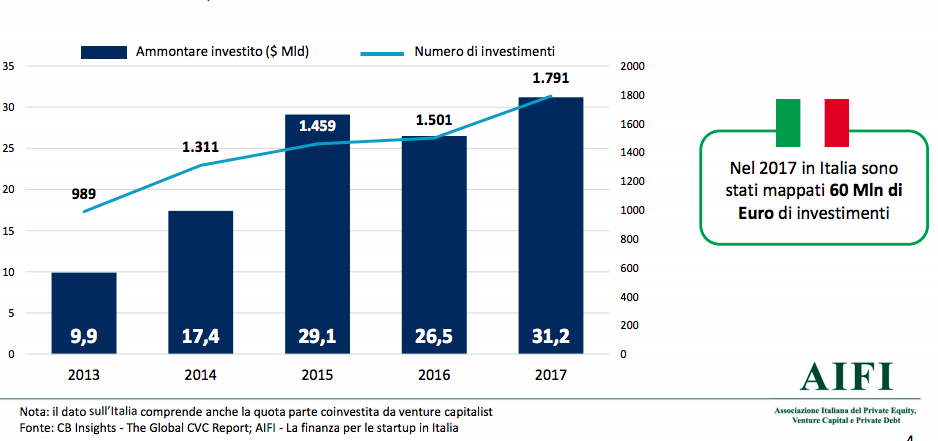

On of the problems is that in Italy there is still a lack of corporate venture capital activity. Aifi counts that CVC’s investments were just about 60 million euros in 2017 versus a total of 31.2 billion euros in the world.