A secondary buyout deal, a new investment firm, the opening of a new auction and news from three private equity portfolio companies were announced last week in italy.

A secondary buyout deal, a new investment firm, the opening of a new auction and news from three private equity portfolio companies were announced last week in italy.

Apax Partners bought a majority stake in Business integration partners (Bip), an Italian consultancy for technology development (Industry 4.0) (see here a previous post by BeBeez). Apax aims to bring Bip to compete internationally with McKinsey, Boston Consulting and Accenture. According to rumours, the transaction is worth in the region of 200 million euros and Apax will invest a further 100 million for Bip’s organic and M&A growth. Apax has substantial experience in the tech&telco sectors. Apax owns together with NB Renaissance Partners Italian IT company Engineering. In May 2014 Argos Soditicsupported for a management buyout twelve executives of BIP led by the founders Nino Lo Bianco (chairman) and the two ceos Carlo Capè and Fabio Troian. Lo Bianco, Cape’ and Troiani will keep managing the company as well as being shareholders. Bip has 1800 employees in Italy, UK, Spain, Turkey, Brazil, Belgium, Switzerland, USA, Uae, Chile and Colombia. In 2016, the company posted revenues of 114.9 million, with an ebitda of 18.6 million and a net financial debt of 6.7 million. After it acquired Italy’s Artax Consulting, BIP posted revenues of 180 million.

Italy’s private equity firm 21 Partners signs a partnership of equals with Aberdeen Standard Investments to launch 21 Aberdeen Standard Investments Limited an investment firm with a fundraising target of one billion euros (see here a previous post by BeBeez). The London-based fund will initially have a management team of 6 professionals and invest in minority and majority stakes of European businesses. The fund will also target opportunistic transactions or special opportunities which are time sensitive and with a shorter term investment horizon. Alessandro Benetton, 21 Partners’ managing partner, will lead the Board of the JV. The Italian fund announced its first fundraising closing at 200 million ahead of a 300 million target (down from initial 400 millions target), while it is starting a sale auction for Nadella, an Italian manufacturer of components for the mechanic industry that the 21 acquired in 2014 from Mid Industry Capital. Rw Baird and Ethica Corporate Finance are auctioning the asset, which attracted the interest of Equistone, Icg private equity, and further undisclosed industrial and financial buyers. Nadella recently acquired Chiavette, a Bologna-based company with revenues of about 10 million, which will take Nadella’s 2018 sales to over 70 million. Aberdeen Standard Investments is the long term investment division of Scotland-based and London-listed investment group Standard Life Aberdeen plc.

Potential bidders for RTR Rete Rinnovabile, one of the leading solar photovoltaic operators in Italy and among the largest in Europe, are lining up (see here a previous post by BeBeez). The business has 330 MW of installed capacity across 130 production sites in Italy, is controlled by Terra Firma private equity fund and has been on sale since the end of 2016 The sale process, which is managed by Terra Firma’s financial advisors Unicredit, JPMorgan and Jefferies, seems finally to have accelerated. Ready to study a deal on RTR are Italy’s utilities A2A and Enel (together with Italy’s infrastructure asset manager F2i sgr), oil&energy company Erg and funds Tages Helios and Quercus Investment Partners.

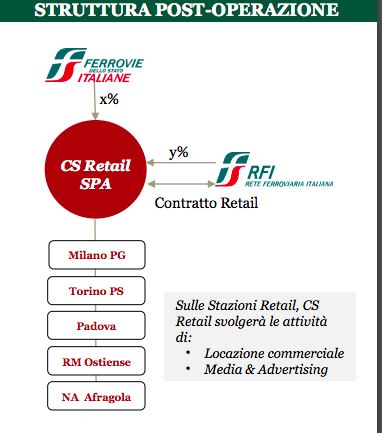

Ferrovie dello Stato started sale auction for the commercial exploitation of the real estate complexes belonging to some medium-sized railway stations with a distinctly retail nature, some of which (Milano Porta Garibaldi, Roma Ostiense, and Padova) are currently managed by Centostazioni spa and others (Torino Porta Susa e Napoli Afragola) by Rete Ferroviaria Italiana spa (see here a previous post by BeBeez). Among potential investors is for sure Grandi Stazioni Retail (Gs Retail), the group which owns the long term license for the commercial exploitation of the real estate complexes belonging to 14 big-sized railway stations in Italy (and other two stations in the Czech Republic) which was bought in June 2016 by a consortium made by Antin Infrastructure, Icamap and BG Asset Management (Borletti Group). CS Retail might be of interest to other investors too such as Altarea, Lone Star and Deutsche Bank’s infrastructure fund. All the latter arrived at the last phase of GS Retail auction in 2016 but lost the race.

Sirti, the Italian player in the field of tlc and energy infrastructures that entirely belongs to turnaround firm Pillarstone Italy, aims to generate sales of 743 million of euros with an ebitda margin of 7.8% by 2020. The company’s current sales are of 673 million with a 5.1% ebitda margin, chief executive officer Roberto Loiola said (see here a previous post by BeBeez). John Davison, ceo of Pillarstone and chairman of Sirti, said that the financial firm is not yet considering any exit plan. Loiola and Davison pointed out that the group may carry on acquisitions in the sectors of energy, utilities, and ict. In 2016 Sirti acquired Foi & Vitali Elettrodotti. The Ict sector is Sirti’s priority for M&A, even though Loiola said that the company’s client Retelit is not a target. Sirti’s primary clients are Tim the leading telcos, Enel and several utilities, and Italian railway operator Ferrovie dello stato.

Equita sim will buy for 0.9 million euros Nexi’s units for brokerage & primary market and market making (see here a previous post by BeBeez). Nexi belongs to private equity firms Advent International, Bain Capital and Clessidra. After such a transaction, Equita will acquire 80 banking clients and strengthen its position in the brokerage segment and generate a further 5 million in revenues. On the other side, Nexi is splitting its securities services that need a depository banking licence from Mercury Payment Services. Once completed this process, Nexi may launch an IPO in 2020.