New Italian Special Purpose Acquisition Company (Spac) IdeaMi, promoted by Banca Imi (Intesa Sanpaolo group) and DeA Capital (De Agostini group) debuted yesterday on the Aim Italian market closing at a 9.785 euro per share price (down 2.15% from 10 euros initial price) while the warrant remained flat a 1.235 euro (investors have been assigned 2 warrants every 10 shares and will receive other 3 warrants every 10 shares at the business combination).

New Italian Special Purpose Acquisition Company (Spac) IdeaMi, promoted by Banca Imi (Intesa Sanpaolo group) and DeA Capital (De Agostini group) debuted yesterday on the Aim Italian market closing at a 9.785 euro per share price (down 2.15% from 10 euros initial price) while the warrant remained flat a 1.235 euro (investors have been assigned 2 warrants every 10 shares and will receive other 3 warrants every 10 shares at the business combination).

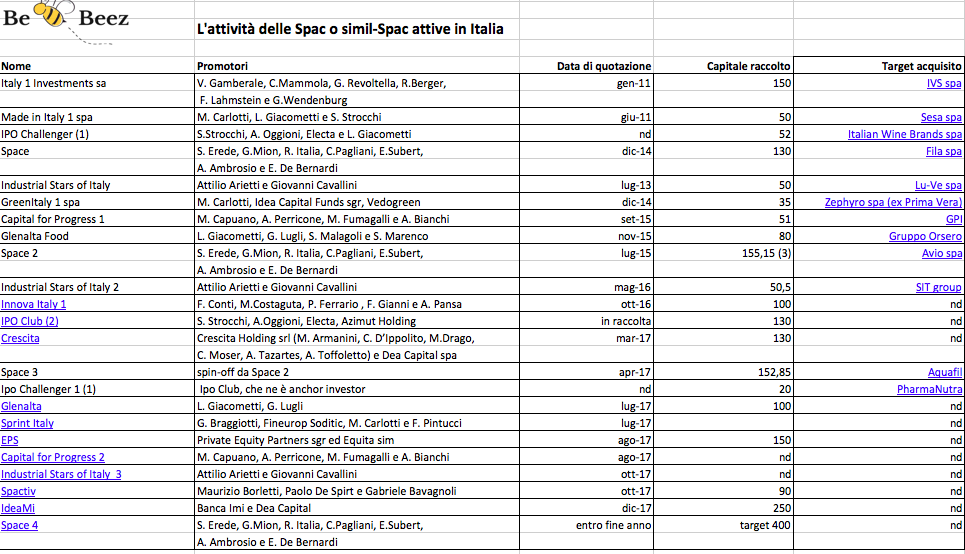

The Spac had raised 250 million euros from investors (see here the press release and here a list of all Spacs awhich have been or are still active on the Italian market).

As announcd last week (see here a previous post by BeBeez) the two IdeaMi’s promoters invested a significant stake of their money in the deal as they jointly subscribed a total of 41.25 million euros for a 16.50% stake of IdeaMi ordinary shares and 8.75 million euros in special shares equal to an other 3.75% stake of the Spac.

Banca IMI and Banca Akros are joint global coordinators and Banca Akros is also Nomad and Specialist. IDeaMI and its promoters have been supported by Gatti Pavesi Bianchi law firm while the joint global coordinators have been supported by Gianni, Origoni, Grippo, Cappelli & Partners law firm.

This is the second Italian Spac promoted by instititutional financial players after EPS Equita Pep Spac, lwhich was launched last July by Equita group and Private Equity Partners and listed at the Aim Italia market, after having raised 150 million euros (see here a previous post by BeBeez).

Before that the Italian market had seen the launch of Ipo Club, a closed-end fund launched and sponsored in May 2016 by Azimut Group and Electa Group raising 120 million euros in a first closing and targeting 150 million euros (see here a previous post by BeBeez) aiming at investing in Italian SMEs in a pre-ipo phase. More in detail, Ipo Club is to invest in financialinstruments which are to be issued by pre-booking companies promoted by Ipo Club itself and targeting Italian SMEs. Ipo Club is to sibscribe at least 30% of the value of the financial instruments that each pre-booking company will issue while the remaining 70% will be raised among third party investors so that Ipo Club will have dry powder for more than 400 million euros to accelerate ipos on the Italian market. A first pre-booking company was launched (Ipo Challenger 1) and closed its business combination last July acquiring a minority stake in Pharmanutra, which eas then listed at the Aim Italia (seea here a previous post by BeBeez).

Click here forhere a list of all Spacs which have been or are still active on the Italian market.