Guala Closures, a leading producer of security closures for spirits, wine, oil, vinegar, water and pharma products, announced yesterday the acquisition of the screw caps activity of ICSA (Industria Corchera sa), the Chilean company specialised in promoting and selling packaging products for the wine Industry in South-America (see here the press release).

Guala Closures, a leading producer of security closures for spirits, wine, oil, vinegar, water and pharma products, announced yesterday the acquisition of the screw caps activity of ICSA (Industria Corchera sa), the Chilean company specialised in promoting and selling packaging products for the wine Industry in South-America (see here the press release).

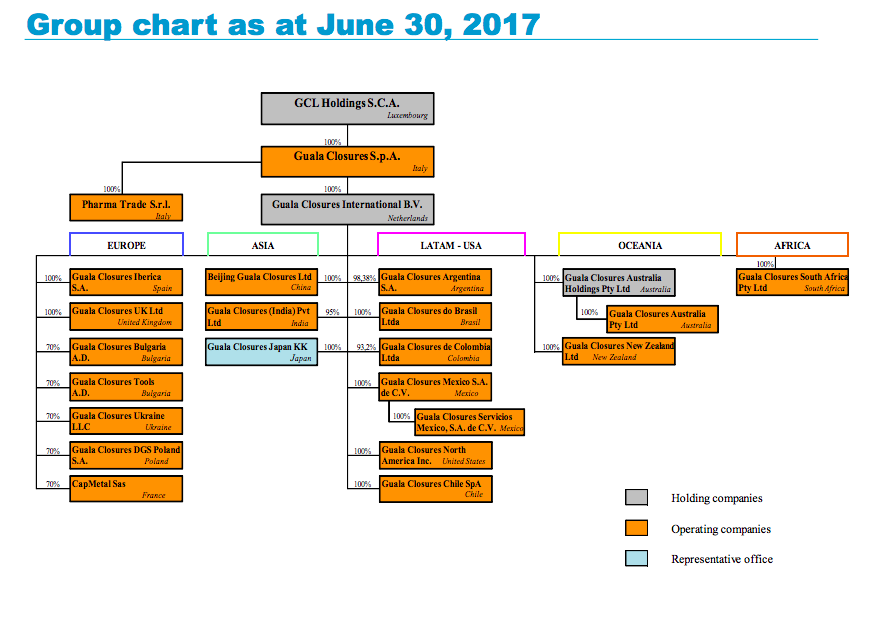

The acquired activity of ICSA, based in Santiago de Chile, recorded a turnover of approximately 4 million dollars in 2016. This deal increases Guala Closures Group local production capacity to face the growing demands of South American wines, after the company had announced last July the acquisition of LIMAT sa de CV, a Mexican company specialised in the manufacturing of wood overcaps for top-range spirit bottles. The activity of Limat is based in Mexico City and in 2016 recorded a turnover of approximately 1 million dollars (see here the press release). And this is on top of the fact that Guala finalized last week in Mumbai the purchase of 100% of shares of Axiom Propack Pvt Ltd, the Indian company active in the production of safety closures for spirits, in a deal announced last July too.

All that happens while an auction for the sale of Guala Closure’s control is ongoing. The Benetton family’s investment group Edizione Holding and Goldman Sachs private equity are said to have delivered a joint binding offer for Guala Closures Group, while also French private equity form Astorg and industrial subjects Amcor Corporation and Onex Corporation are said to have been selected for a short list. In a first phase of the auction also Blackstone, Clayton Dubilier & Rice, Advent, Kkr, Apollo and Tpg private equity funds were said to have studied the dossier(see here a previous post by BeBeez).

Guala Closures’ major shareholders are aPriori Capital Partners and NB Renaissance Partners while Guala’s management led by ceo Marco Giovannini are owning a minority stake.

Guala’s shareholders are said to assign an enterprise value of more than one billion euros to the company or 9-11x 2017 expected ebitda, which is seen at 110 million euros (see here a previous post by BeBeez).

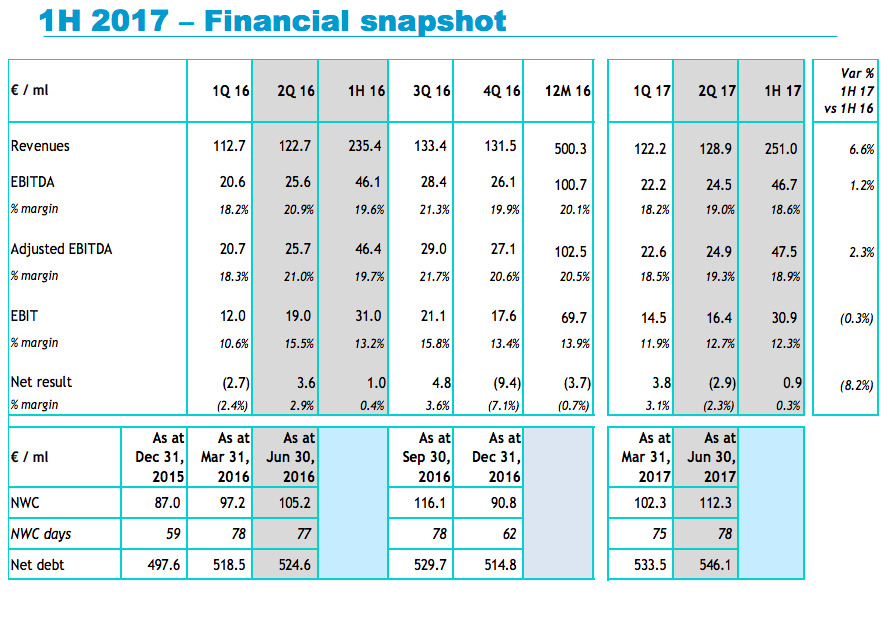

Guala reached 251 million euros in revenues in H1 2017, a 47.5 million euros in adjusted ebitda and a 0.9 millions net profit with a 546.1 millions in net financial debt (see here H1 2017 Results). That was after the company had closed FY 2016 with 520.5 million euros in consolidated revenues (from 550.3 millions in 2015), 103.3 millions in ebitda (from 100.7 millions), a 4.7 million euros net loss (from -3.7 millions) and 497.6 million euros in net financial debt (from 514.8 millions) (see here FY 2016 Financial Statements).