A lot of potential pretenders are lining up to buy Quadrivio Capital sgr, one of the major alternative asset maangers in Italy with about 1.3 billion euros of assets under management, which has been put on sale after last April Bank of Italy ordered to remove chairman Alessandro Binello and ceo Walter Ricciotti from their seats due to some irregular practices in cash managment of the the company (see here a previous post by BeBeez).

A lot of potential pretenders are lining up to buy Quadrivio Capital sgr, one of the major alternative asset maangers in Italy with about 1.3 billion euros of assets under management, which has been put on sale after last April Bank of Italy ordered to remove chairman Alessandro Binello and ceo Walter Ricciotti from their seats due to some irregular practices in cash managment of the the company (see here a previous post by BeBeez).

Non binding offers are due by next week, MF Milano Finanza, writes today, after financial advisor Lazard asked about 30 different potential buyers to sign a confidentiality agreement.

The dossier is on the desk of some major international asset managers such as Eurazeo, Tikehau Capital Partners, Muzinich, Adam Smith Capital and Advanced Capital (a UK asset manager, not the same named Italian one) and Chinese Fosun, while another Chinese group, Haitong, who was said to have asked for information then decided not to proceed in the deal. Among potential Italian buyers, Idea Capital Funds sgr, Clessidra sgr and Tages Holding are said to be interested in the deal.

The management company generated about 12 million euros in fees each year and has an expected adjusted ebitda for 2017 of about 2.4 million euros while the parent company values 20 million euros its 100% stake in Quadrivio sgr, so that shareholders are looking for something more than that figure.

Actual shareholders are Mr. Alessandro Binello and Mr. Walter Ricciotti with a 70% stake, while the remaining 30% stake is hold by Futura Invest, in turn controlled by Fondazione Cariplo, a powerful banking foundation in Italy, having a major stake in Intesa Sanpaolo bank. In the deal Quadrivo sgr’s shareholders are supported by Pedersoli law firm.

Binello e Ricciotti had suddenly resigned last April and Adalberto Alberici (a professor at the Milan State University and Bocconi University) and Francesco Ceci (former cfo of Cassa Depositi e Prestiti) took their seats. Back then Quadrivio funds’ investors were told that the decision was due to the fact that Bank of Italy does not like management companies were managers are the same people as the shareholders, at least in cases of management companies having billions of euros under management. But even if this is actually true, that was not the real point, MF Milano Finanza writes today.

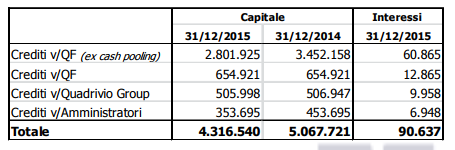

The real story is that in Quadrivio’s FY 2015 financial statement there were 4.3 million euros recorded as credits versus the two managers’ holding company following a cash pooling agreement and other credits versus that company and the managers directly due to a sale of some Quadrivio funds’ stakes to that holding company and the managers. The sale however originated from the fact that an international family office, one of Quadrivio funds’ LPs, was no more able to follow its committements in the funds. A buyer on the secondary market for that stake was not found so Mr. Binello and Mr. Ricciotti decided to by themselves those stakes in the funds to solve the problem and asked Quadrivio sgr a bridge loan to finance the acquisition and follow committements. A move that Bank of Italy disliked. In the meantime however Quadrivio’s 2016 FY statement no more show those figures so the situation has been risolved.

Just one other new to complete the picture. Lat June 20th Bank of Italy nominated Alessandro Zanotti as liquidator of the Pegaso Real Estate fund (managed by Quadrivio sgr and herited in 2012 when Quadrivio sgr bought Fondamenta sgr, see here MF Milano Finanza), whose real estate assets were put on sale at the end of last December in a public auction (see here the documents and the auction announcement). The Pegaso Re fund however is not in the Quadrivio sgr’s sale perimeter.