Lvmh is to buy a 10% stake of Italy’s eyewear maker Marcolin, which had been delisted from the Italian Stock Exchange in 2012 following a tender offer by funds managed by Pai Partners, Bloomberg wrote yesterday.

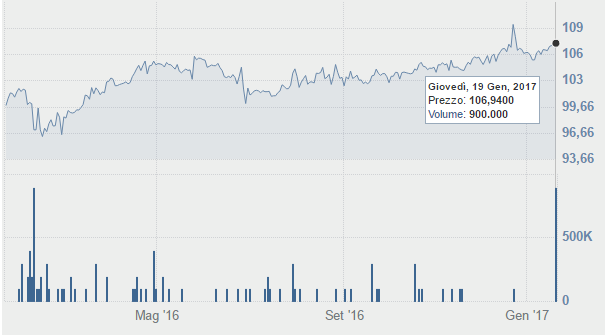

The news made Marcolin’s competitor Safilo quotes to plunge by 13.91% at 6.84 euros on the Milan Stock Exchange, while also Luxottica‘s quotes closed 2.75% down to 51.25 euros per share. On the other hand, Marcolin’s bond quotes on the ExtraMot pro market were up to 106.94 from 106.86 on January 18th.

The deal is said to be build on a 500 million euros enterprise value basis for Marcolin. Pai Partners, a paneuropean privat equity operator whose Italian activities are managed by the managing partner Raffaele Vitale, had bought an 80% stake in Marcolin’s capital in 2012 on a 282 million euros enterprise value basis from the Marcolin family, and Italian entrepreneurs Andrea and Diego Della Valle and Antonio Abete who partly reinvested in the company thereafter. In 2013 Marcolin listed on ExtraMot Pro market 200 million euros of senior bonds maturing in November 2019 and paying an 8.5% fixed coupon. Proceeds from the bond were to be used to refinance Marcolin’s existing debt and finance the acquisition of US eyewear maker Viva Optique.

Lvmh would get more control over the production process at the company, which currently manufactures its Emilio Pucci line of glasses, and may ultimately make Marcolin a production hub for its other brands, including Celine. Celine has an agreement to manufacture its glasses with Safilo, which is due to terminate at the end of this year. But Safilo today also manufactures other Lvmh’s glasses lines such as Marc Jacobs, Fendi and Givenchy brands.

The deal could also involve the creation of a new company that could eventually absorb all of Lvmh’s eyewear licenses. Today Marcolin manufacturs glasses for other wellknown brands such as Moncler, Tod’s e Diesel.

The deal could also involve the creation of a new company that could eventually absorb all of Lvmh’s eyewear licenses. Today Marcolin manufacturs glasses for other wellknown brands such as Moncler, Tod’s e Diesel.

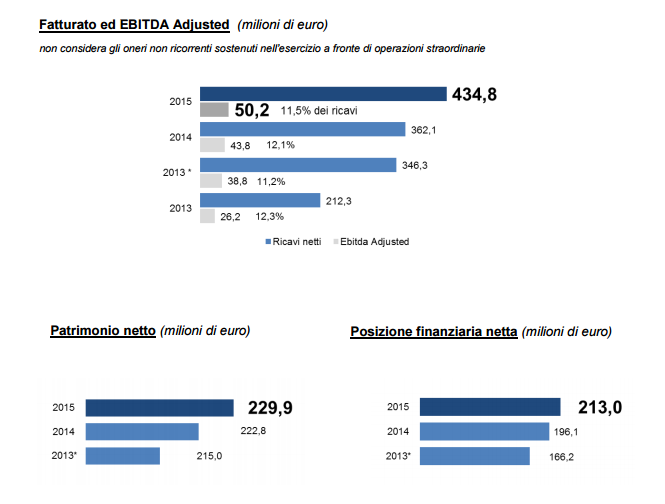

Marcolin’s FY 2015 consolidated statements say that the Italian glasses maker sold about 15 million glasses in 2105 reaching 434.8 million euros in revenues (from 382.1 millions in 2014), with a 50.2 million euros djusted ebitda (from 43.8 millions) and a 213.9 million euros net financial debt (from 196.1 millions).

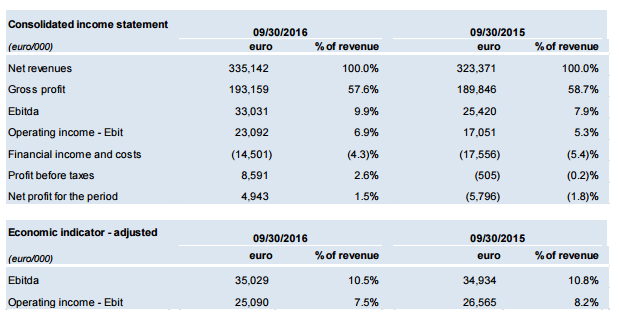

In the 9 months closing on Sept. 30th 2016 the company reached 335.1 million euros in revenues and a 35 million euros ebitda with 215 million euros of net financial debt.