Apollo Global Management is said to have delivered a binding offer for Italy’s bet and payment services Sisal Group spa, which has been controlled by funds managed by Apax (36.5%), Permira (36.5%) and Clessidra (20%) since 2006. Il Sole 24 Ore wrote.

Apollo Global Management is said to have delivered a binding offer for Italy’s bet and payment services Sisal Group spa, which has been controlled by funds managed by Apax (36.5%), Permira (36.5%) and Clessidra (20%) since 2006. Il Sole 24 Ore wrote.

Last July MF Milano Finanza had wrote about a potential interest for Sisal by Apollo, Blackstone, Carlyle and Pai (see here a previous post by BeBeez), while last April rumors about Apollo and CVC Capital Partners‘s interest were circulating (see here a previous post by BeBeez), while also Bain Capital was said to be studying the dossier.

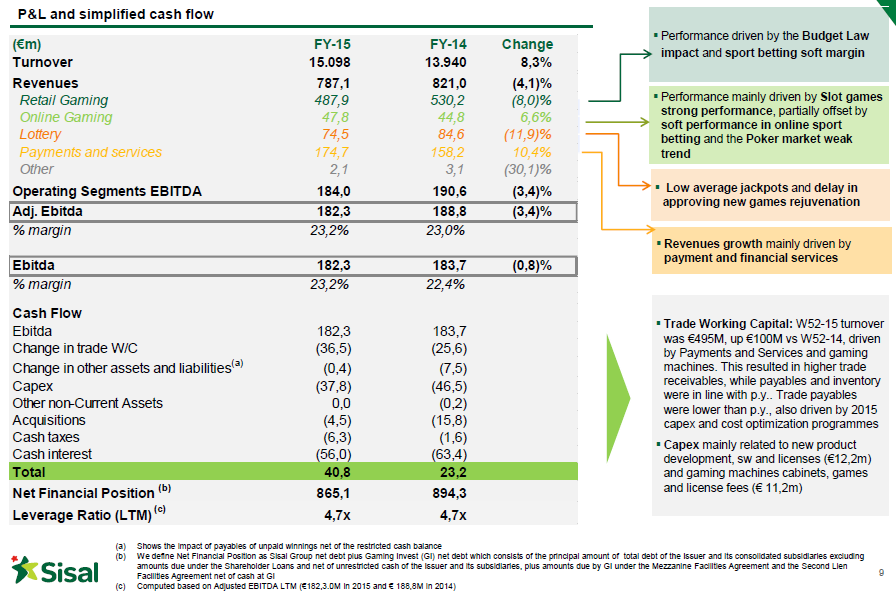

Sisal reached 787 million euros in consolidated revenues in 2015 down from 821 millions in 2014 (see here Sisal’s FY 2015 statements), due above all to a 7.2% drop (meaning a drop of more than 28 million euros) in the enbtertainment machines following a negative impact by the socalled Stability Law 2015. The adjusted ebitda dropped too to 182.3 millions (from 188.8 millions).

Among non recurrent costs are 19.5 million euros of devaluation due to the impairment test on immaterial assets. So ebit was down to 52 millions euros from 70 millions in 2014 and FY 2015 closed with a 39.7 million euros net loss (from just minus one million in 2014) and a negative of 8.5 millions.

Net financial position was better, down to 865 million euros from 894 millions in 2014 (see here Sisal’s presentation to analysts). As far as Sisal’s debt structure is concerned, “the company still has a loan secured from Gaming Invest sarl for an amount, at December 31, 2015, of euros 411.0 million subordinated to the obligations arising from the Senior Credit Agreement signed with the banks and the issuance of the Senior Secured Notes, both maturing in September 2017”. The senior secured notes have been issued for 275 million euros.