Private equity funds managed by Syntegra Capital Partners and Index Ventures Growth started to sell their remaining stakes in the capital of Moleskine, after having listed the company at the Milan StockExchange in Spring 2013 (see here a previous post by BeBeez).

Private equity funds managed by Syntegra Capital Partners and Index Ventures Growth started to sell their remaining stakes in the capital of Moleskine, after having listed the company at the Milan StockExchange in Spring 2013 (see here a previous post by BeBeez).

Moleskine was created as a brand in 1997, bringing back to life the legendary notebook used by artists and thinkers over the past two centuries: among them Vincent van Gogh, Pablo Picasso, Ernest Hemingway, and Bruce Chatwin. Today, the name Moleskine encompasses a family of objects: notebooks, diaries, journals, bags, writing instruments and reading accessories.

Banca Imi, acting as bookrunner in the accelerated bookbuilding process launched yesterday evening, announced that the two private equity funds started selling 15 millions of ordinary Moleskine shares respresenting a 7.07% stake of Moleskine shareholders capital. The Moleskine shares will be placed with qualified Italian and international institutional investors.

The two private equity funds are acting through their subsidiaries Appunti sarl (owned by Syntegra and in voluntary liquidation) and Pentavest sarl (owned byIndex Ventures), which have been owning respectively a 42.249% and a 7.581% of Moleskine capital (see here Moleskine’s major shareholders as for Consob’s filings).

About 85% of the 7,07% stake on sale comes from Syntegra while the rest comes from Index Ventures, MF-Milano Finanza writes today. The latter meaning that Syntegra will retain a 36.24% stake and Index a 6.52% stake after yesterday’s sale.

In connection with the offering and in line with market practice, Appunti and Pentavest have agreed to a 90 days lock-up period with respect to sales of additional shares of Moleskine, subject to customary exceptions for transactions of this type.

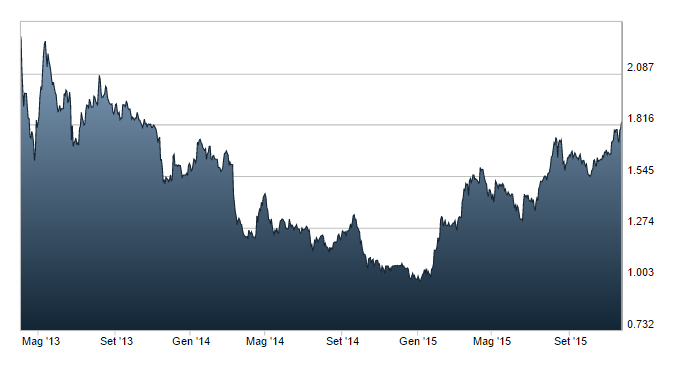

Moleskine closed with a 1.95% gain at the Milan Stock Exchange yesterday at 1.83 euro per share meaning a 388.29 million euros market capitalization. The company was priced at 2.3 euro per share in ipo (with a 490 million euros market cap), a price that never was reached by the stock on the market which instead dropped to a minimum of 1 euro per share on December 22nd 2014, From then the trend changed to positve and the stock had a very good performance this year.