Last April 3rd a delegation from Aifi, the Italian Association for Private Equity and Venture Capital, met in Zurich a group of family offices interested in investing in Italian private equity funds.

Last April 3rd a delegation from Aifi, the Italian Association for Private Equity and Venture Capital, met in Zurich a group of family offices interested in investing in Italian private equity funds.

Aifi Chairman Innocenzo Cipolletta opened the meeting drawing the actual Italian macroeconomic scenario (download here the data presentation).

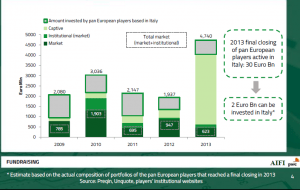

Aifi General Manager Anna Gervasoni showed instead last private equity figures in Italy (download here the data presentation) and stressed the fact that fundraising had been rather though in the last few years.

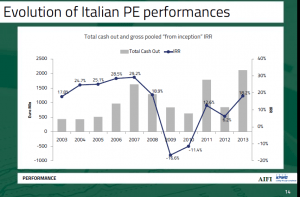

However now perspectives are quite good in terms of funds performances. Irr from inception (that is Internal rate of return for divestments made in 2013 whenever they entered in funds’ portfolio) was 18.2% at the end of 2013 from 6.2% in 2012, thanks to a good market situation for divestments.

However now perspectives are quite good in terms of funds performances. Irr from inception (that is Internal rate of return for divestments made in 2013 whenever they entered in funds’ portfolio) was 18.2% at the end of 2013 from 6.2% in 2012, thanks to a good market situation for divestments.

And performance is quite good also from a “by horizon” perspective (that is gross pooled Irr on all investments, taking into account all investment made in a specific time period, both divested and still in funds’ portfolio). In a 10 years’ horizon, total cash out (that is equity invested by funds) was 4.5 billion euros in 1994-2003 and became 19.7 billions in 2004-2013, while total cash in (that is equity paid back to funds from their portfolio companies) was 6.3 billions in the first decade and became 26.7 billions in the last decade, with a cash multiple ranging from 1.2x to 1.5x.

Finally, as for net Irr, which might be estimated as 50-65 pct of gross Irr, an aggregated figure might be around 6.6% in 10 years’ horizon at he end of 2013 up from 4.6% in 2012. European average figure is not available yet, but in 2012 that was 8,1%. In 2011 however, Italian net Irr was 8% while the European avegare one was 5.6%.

EdiBeez srl