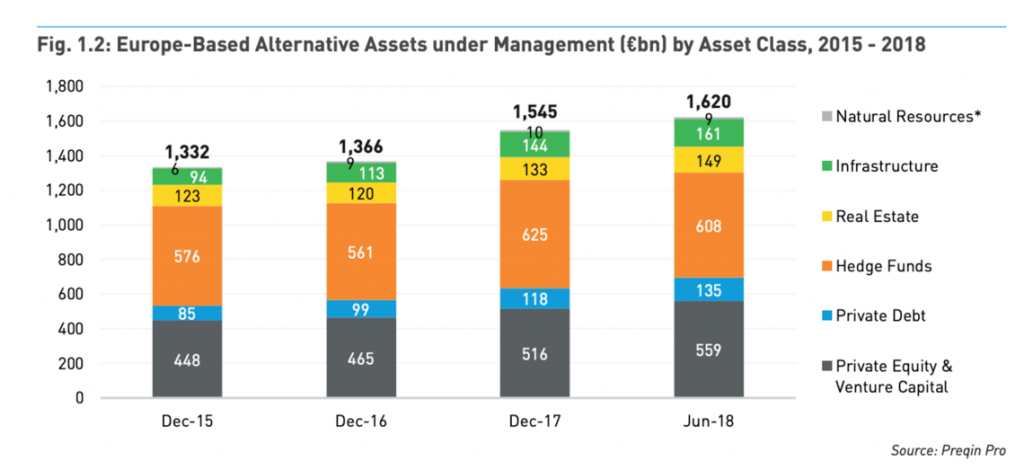

According to Preqin’s “Markets in focus: alternative assets in Europe“, in 1H18 the resources of private capital funds with a focus on Europe amounted to 1.62 billion euros (1.545 billion in 2H17) (see here a previous post by BeBeez). Private equity and venture capital firepower is of 559 billion, while private debt funds had 135 billion. In 1H18, the dry powder of private capital funds was worth 411 billion, while the powder chest of private equity and venture capital funds was of 211 billion. Private equity and venture capital hit the peak for investments in 2018 with 120 billion and 20 billion.

According to Preqin’s “Markets in focus: alternative assets in Europe“, in 1H18 the resources of private capital funds with a focus on Europe amounted to 1.62 billion euros (1.545 billion in 2H17) (see here a previous post by BeBeez). Private equity and venture capital firepower is of 559 billion, while private debt funds had 135 billion. In 1H18, the dry powder of private capital funds was worth 411 billion, while the powder chest of private equity and venture capital funds was of 211 billion. Private equity and venture capital hit the peak for investments in 2018 with 120 billion and 20 billion.

Deloitte and Legance supported AIFI, the Italian association of financial investors, for the launch of Key For Growth (K4G), a portal for companies that aim to liaise with private equity or private debt funds (see here a previous post by BeBeez). On the platform are available market data, as well as self-assessment tools for companies that are considering to start negotiating with a financial investor.

Iconic Italian stickers producer Panini is again of keen interest to private equity funds and industry peers (see here a previous post by BeBeez). The company’s ceo Aldo Hugo Sallustro, chairwoman Anna Baroni, and shareholder Maria Francesca Baroni reportedly hired Lincoln International for finding investors. An US based industrial buyer is leading the race and tabled a one billion euros bid. Painin has sales of one billion.

Giovanni Maria Paviera is the new ceo of Italian construction company Borio Mangiarotti, of which Varde Partners has 20% (see here a previous post by BeBeez). In 2017 Paviera foundedVitale Real Estate, an investment bank with a focus on real estate sector. Paviera previously worked as ceo and coo of Generali Immobiliare, ceo of CityLife, head of real estate of Cassa Depositi e Prestiti, and as ceo of Cdp Immobiliare.

Pool Service-Medavita, an Italian producer of haircare items, is of interest to Aksìa and Bluegem on the ground of an evaluation of 70 million euros (see here a previous post byBeBeez). Sources said to BeBeez that the first-round bids were in the region of 40 million euros, ie the company’s sales. Pool has an ebitda of 7 million. The sources said that the company attracted the interest of Alto Partners (that owns the same sector company Tricobiotos), Progressio, Mandarin Capital, Ergon Capital, Wise, and Argos Wityu. The club deal Accord Managementowns 76.72% of Pool, while the Cattaneo Family has 20% of the asset, and the remaining stake belongs to Stefano Banfo. The sources added that Banfo and the Cattaneo family aim to reinvest in Pool and implement a buy and build strategy. In 2016 Accord acquired Pool Service for 46 million.

Scrigno, a producer of components for manufacturing doors and windows that belongs to Clessidra, posted sales of 71.5 million euros (+2.5% yoy) and an ebitda margin of 20%, with export of 50% (see here a previous post by BeBeez). Maddalena Marchesini is the company’s ceo.

Adia, GIC, QIA, Canadian pension funds, and private equity funds General Atlantic, Warburg Pincus, Partners Group, KKR, TPG, Advent, Ardian, and Bain Capital are said to be studying an offer for 30% of Telepass, a provider of payment tools for motorways that belongs to Atlantia (see here aprevious post by BeBeez). Industry peers Nexi, Sia, Paypal, Fleetcore, Visa, Mastercard,Cerved, TomTom are also said to be interested in the deal. Telepass valuation is in the region of 2 billion euros.

Airi sold its subsidiaries Aersud Elicotteri and Helicopters Italia to Airbus Helicopters, part of aerospace giant Airbus (see here a previous post by BeBeez). Airbus Helicopters acquired a minority of Aersud in 2012. Aersud has sales of 14.9 million euros, an ebitda of 0.128 millionm and net cash of 2.5 million. Helicopters Italia has a turnover of 15.2 million, an ebitda of 0.218 million, and net cash of 9.7 million.

Filse, the financial firm of the Liguria Region, joined the AlpGip (Alpine growth investment platform) fund (see here a previous post by BeBeez). The European Investment Fund invested 20.6 million euros in AlpGIP while other resources were invested by financial arms of some other Italy’s Norhtern Regions for a total of 50.7 million euros. AlpGIP already invested in Alto Capital,Arcadia Small Cap, Gradiente, and in Programma 102.

The shareholders of Industrial Stars of Italy 3 (Indstars 3), the Milan-listed Spac that Giovanni Cavallini, Attilio Arietti, Davide Milano, and Enrico Arietti launched after having raised 150 million euros, approved the business combination with Salcef Group, an Italian railway systems and technology company (see here a previous post by BeBeez)The Spac is still having to wait for some time to be sure that shareholders representing less than 30% of the capital raised might ask to recede from the deal. If they are more, a deal won’t be signed. Indstars will invest in Salcef Group capital increase of 100 million. Salcef will list a 30% stake on AIM by November 2019. The enterprise value of Salcef is of 325 million, with an equity value of 285 million, and a net financial debt of 39.9 million.

Colorado-based Gulftech International, a producer of machinery for the food industry acquired ABL, an Italian producer of machinery for fruit processing, from Finint and the Ascari family (44.25% owner) see here a previous post by BeBeez). ABL has an ebitda of 3.3 million euros and sales of 15.3 million. Sources said to BeBeez that the target evaluation is in the region of 10-11 X ebitda.

Trevi Finanziaria Industriale (Trevifin), the troubled listed Italian oil&gas engineering company, said that in 2017 it posted sales of 949.2 million euros, an ebitda of minus 81.4 million, and net financial debts of 619.8 million (see here a previous post by BeBeez). In 2018 Trevi’s turnover has been of 618.1 million, an ebitda of 50.1 million and a net financial debt of 692.6 million. Trevi sold to Indian Megha Engineering & Infrastructures Ltd (Meil) its oil&gas division on the ground of a debt-free enterprise value of 140 million.

Astaldi received a new offer from competitor Salini Impregilo, the listed Italian construction company that is reportedly going to launch a capital increase of 600 million euros for consolidating the Italian sector through Progetto Italia together with Cdp (see here a previous post by BeBeez). Salini Impregilo said it was going to subscribe a capital increase of Astaldi of 225 million euros after which it would have 65% of the competitor. This offer is subject to the authorization of antitrust authorities and the agreement with lenders.

Alcedo is selling Exa Group, a general contractor for the sectors of luxury/fashion, hotels, restaurants, and offices (see here a previous post by BeBeez). The asset attracted bids from Trilantic, and from Fondo Italiano d’Investimento who allied with Armonia. Exa’s enterprise value is in the region of 130 million euros. Alcedo acquired 55% of the company in February for 11 million, while the three founders Giuseppe Polvani, Gianrico Specchio, and Paolo Pratesi kept a 15% stake each. Exa’s clients list includes Bulgari, Dolce&Gabbana, Aber Crombie&Fitch,and Alexander McQueen.

Giovanni Bruno, Gianluca Piredda, and Matteo Uggetti, the extraordinary administrators of troubled Italian contractor Condotte set July the 15th, Monday, as the deadline for tabling bids for the company’s core assets Società Italiana Condotte d’Acqua and Con.Cor.Su. (see here aprevious post by BeBeez). The business attracted 21 expressions of interest. The list includes Rizzani De Eccher, Pizzarotti, Icm, Cimolai, Infratech, Toto Costruzioni, Frimat Costruzioni, Vitali, De Sanctis Costruzioni, Macquarie, Hitrac Engineering, and UK Equitix. The assets for sale are worth 1.25 billion euros and have a turnover of 1.65 billion.

Alpha Private Equity signed the closing for the acquisition of 65% of Amf Snaps, a producer of components for the production of fashion items, shoes, and apparels (see here a previous post byBeBeez). The asset attracted interest also from Ergon Capital. Amf Snaps value is of 150 million euros while the turnover is of 54 million with an ebitda of 15 million. Amf chairwoman Nicole Faerber, the founder’s daughter, and her mother Carmen Toffanello, ceo, will hold 25%, andItalglobal Partners have 10%. Alpha Private Equity is is one of the investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo Version that includes the reports and the insight views of BeBeez News Premium 12 months for 110 euros per month.

EdiBeez srl