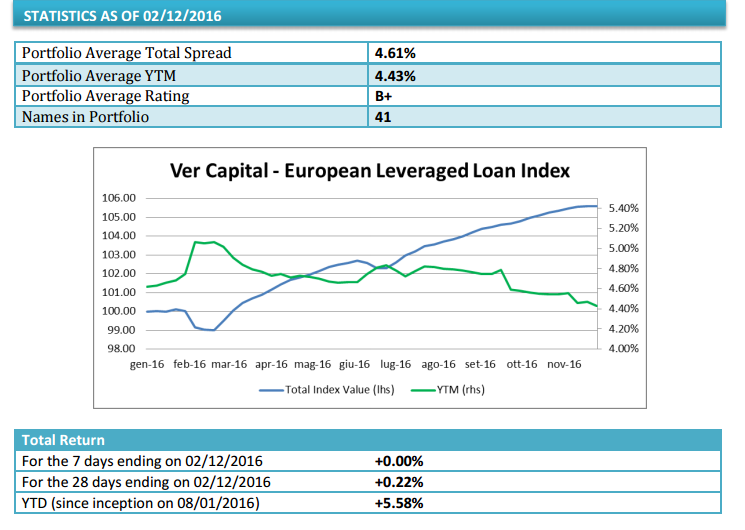

A euro-denominated leveraged loanissued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturitypays a 4.43% yield (from 4.47% last week) and a 5.58% year-to-date total return (flat performance). These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 41 member loans (all senior secured performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum.

The best performer loan on a weekly total return basis was the one relating to Spanish ceramic glaze maker Esmalglass (+0.46%) controlled by Investcorp. The company refinanced its debt in 2016 to support the acquisition of Spanish competitor Fritta from Nazca Private Equity. The wrost weekly performance was instead the one relating to Angus Chemical (-0.97%), a chemical group which was sold by Dow Chemical to Golden Gate Capital in August 2015 . All that when the entire portfolio had a flat performance last week.