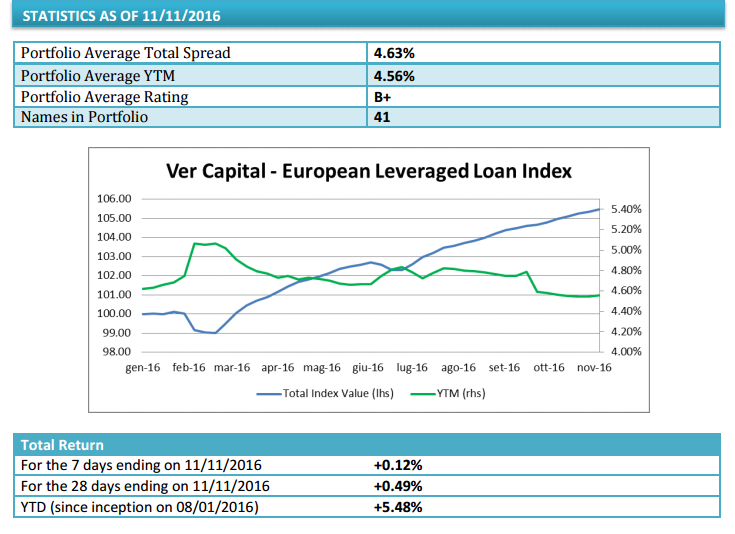

A euro-denominated leveraged loan issued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturity pays a 4.56% yield and a 5.48% year-to-date total return. These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The launch of the index has been anticipated by MF Milano Finanza last Saturday Nov. 19th.

The Ver Capital Leveraged Loan Index has 41 member loans (all performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum. Most weighted loans are the one relating to Douglas perfumeries chain (controlled by CVC Capital Partners) and to Verallia, the world leader of glass packaging (controlled by Apollo Global Management).

Ver Capital stresses that the euro leveraged loan market is attracting many investors and since September spreads on the primary markets have been narrowing as a re-pricing trend has been showing up and issuers have been coming back to the market in order to refinance at better conditions. This trend has been going on in October and November with good corporates’ fundamentals and realtive low default and recovery rates. On the contrary Q1 and Q2 saw some volatility and spread widening, especially due to Brexit in June and to market instability in China and drop in oil prices at the beginning of the year.